Despite what it describes as a “chaotic” year saddled with labor shortages and interest-rate creep, the American Institute of Architects (AIA) estimates that spending for nonresidential construction increased by nearly 8% in 2016. That growth is expected to continue for “another couple of years,” albeit somewhat more modestly.

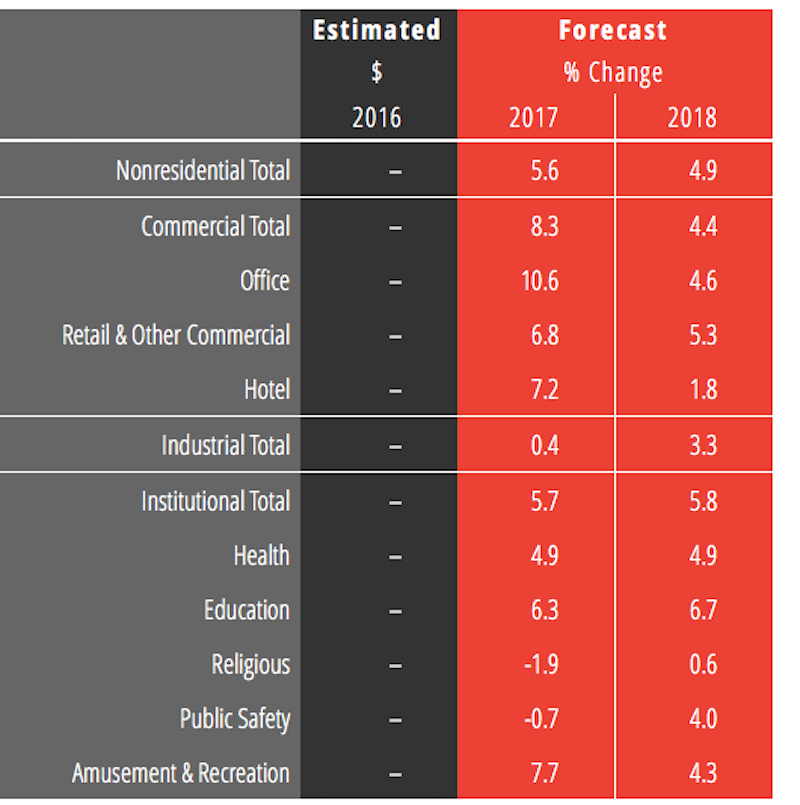

The AIA Consensus Forecast projects a 5.6% increase in nonres construction spending this year, and 4.8% in 2018, with commercial and industrial sectors growing at slower rates. (AIA did not include dollar amounts with its forecast.) And certain sectors, such as offices and hotels, are expected to cool considerably.

Offices, which increased by more than 20% in 2016, will grow 10.6% this year and by 4.6% in 2018, by AIA’s reckoning. Hotel spending, up 25% last year, should rise by 7.2% in 2017, but only by 1.8% the following year, according to AIA projections. Spending on healthcare building is expected to stay at nearly 5% growth this year and next.

Office construction spending is expected to stay relatively strong this year, with some fading in 2018. But hotel construction is expected to experience a significant decline. Image: AIA Consensus Construction Forecast.

AIA’s forecast is in line with other industry watchers, with the notable exception of a rosier portrait painted by Dodge Data and Analytics, which estimates that nonres spending, at $406.9 billion last year, will increase by 8.2% this year and by 7.3% in 2018. Dodge is far more bullish than AIA on office construction. But it also sees negative growth in the hotel sector in 2018.

On the flip side, FMI expects growth this year to be only 4.4%, and 4.1% in 2018, and foresees a weaker industrial sector than some of the other prognosticators.

Kermit Baker, Hon. AIA, AIA’s chief economist, addressed several issues affecting construction spending that could be impacted by the new Trump administration. For example, infrastructure spending, which is currently at about $1.2 trillion a year, could get a big boost if proposals to spend another $1 trillion over the next decade are realized.

The proposed repeal of the Affordable Care Act, and what would replace it are serious concerns for a construction industry where healthcare accounts for about 10% of total spending.

Trump has also promised “massive” regulatory rollbacks, especially on the environment front. Baker cites an NAHB study posted last May that attributes 24.3% of the price of a single-family home to government regulations. (Three-fifths of this is due to higher finished lot costs resulting from regulations.)

Baker also touches immigration restrictions that could “exacerbate an already serious labor problem” in a construction industry that is “most reliant on immigration for its workforce.”

On the whole, though, AIA is “quite positive” about the prospects for the construction sector, which it expects to outperform the broader economy over the next two years. However, AIA also see an industry “on the down side of this construction cycle.” The commercial sector is expected to show signs of slowing first, and AIA foresees its growth rate dropping from 17% in 2017, to 8% this year and just over 4% in 2018.

“Being this late in the cycle, the industry is more vulnerable to external disruptions, and the list of possibilities in this category is very long at present,” Baker writes.

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.