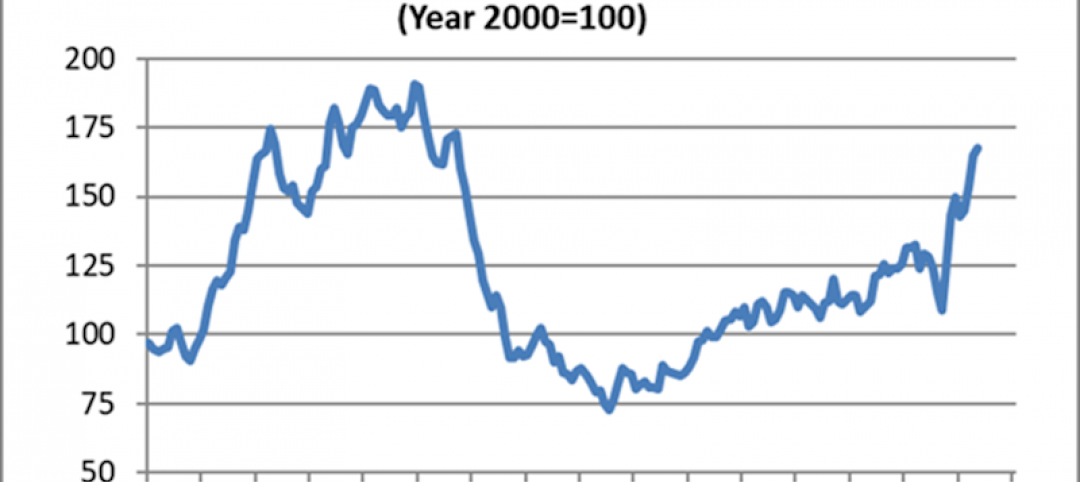

Despite what it describes as a “chaotic” year saddled with labor shortages and interest-rate creep, the American Institute of Architects (AIA) estimates that spending for nonresidential construction increased by nearly 8% in 2016. That growth is expected to continue for “another couple of years,” albeit somewhat more modestly.

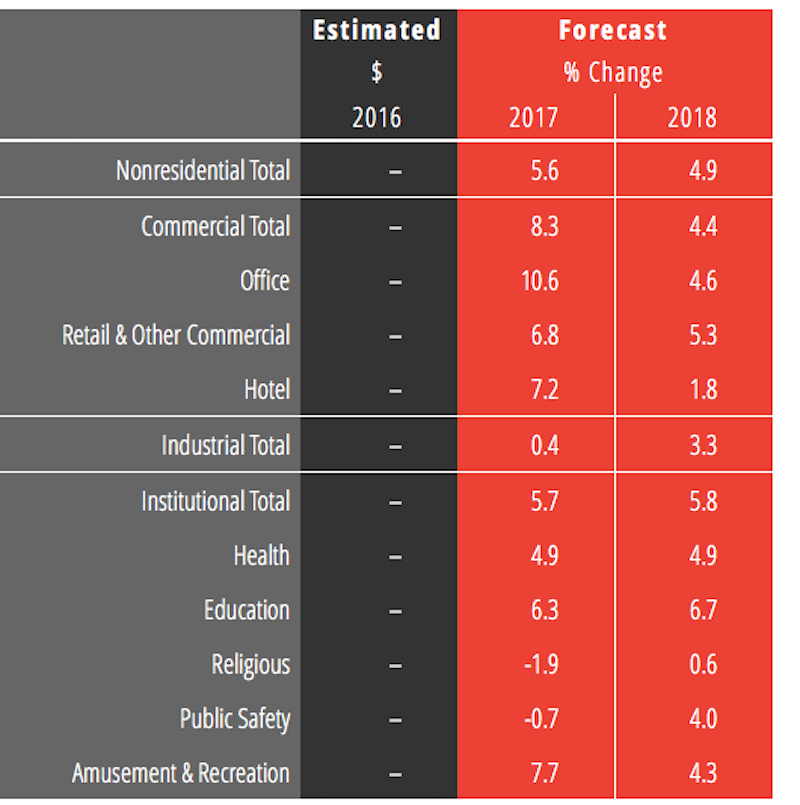

The AIA Consensus Forecast projects a 5.6% increase in nonres construction spending this year, and 4.8% in 2018, with commercial and industrial sectors growing at slower rates. (AIA did not include dollar amounts with its forecast.) And certain sectors, such as offices and hotels, are expected to cool considerably.

Offices, which increased by more than 20% in 2016, will grow 10.6% this year and by 4.6% in 2018, by AIA’s reckoning. Hotel spending, up 25% last year, should rise by 7.2% in 2017, but only by 1.8% the following year, according to AIA projections. Spending on healthcare building is expected to stay at nearly 5% growth this year and next.

Office construction spending is expected to stay relatively strong this year, with some fading in 2018. But hotel construction is expected to experience a significant decline. Image: AIA Consensus Construction Forecast.

AIA’s forecast is in line with other industry watchers, with the notable exception of a rosier portrait painted by Dodge Data and Analytics, which estimates that nonres spending, at $406.9 billion last year, will increase by 8.2% this year and by 7.3% in 2018. Dodge is far more bullish than AIA on office construction. But it also sees negative growth in the hotel sector in 2018.

On the flip side, FMI expects growth this year to be only 4.4%, and 4.1% in 2018, and foresees a weaker industrial sector than some of the other prognosticators.

Kermit Baker, Hon. AIA, AIA’s chief economist, addressed several issues affecting construction spending that could be impacted by the new Trump administration. For example, infrastructure spending, which is currently at about $1.2 trillion a year, could get a big boost if proposals to spend another $1 trillion over the next decade are realized.

The proposed repeal of the Affordable Care Act, and what would replace it are serious concerns for a construction industry where healthcare accounts for about 10% of total spending.

Trump has also promised “massive” regulatory rollbacks, especially on the environment front. Baker cites an NAHB study posted last May that attributes 24.3% of the price of a single-family home to government regulations. (Three-fifths of this is due to higher finished lot costs resulting from regulations.)

Baker also touches immigration restrictions that could “exacerbate an already serious labor problem” in a construction industry that is “most reliant on immigration for its workforce.”

On the whole, though, AIA is “quite positive” about the prospects for the construction sector, which it expects to outperform the broader economy over the next two years. However, AIA also see an industry “on the down side of this construction cycle.” The commercial sector is expected to show signs of slowing first, and AIA foresees its growth rate dropping from 17% in 2017, to 8% this year and just over 4% in 2018.

“Being this late in the cycle, the industry is more vulnerable to external disruptions, and the list of possibilities in this category is very long at present,” Baker writes.

Related Stories

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.

Market Data | Jun 22, 2018

Multifamily market remains healthy – Can it be sustained?

New report says strong economic fundamentals outweigh headwinds.

Market Data | Jun 21, 2018

Architecture firm billings strengthen in May

Architecture Billings Index enters eighth straight month of solid growth.

Market Data | Jun 20, 2018

7% year-over-year growth in the global construction pipeline

There are 5,952 projects/1,115,288 rooms under construction, up 8% by projects YOY.

Market Data | Jun 19, 2018

ABC’s Construction Backlog Indicator remains elevated in first quarter of 2018

The CBI shows highlights by region, industry, and company size.

Market Data | Jun 19, 2018

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

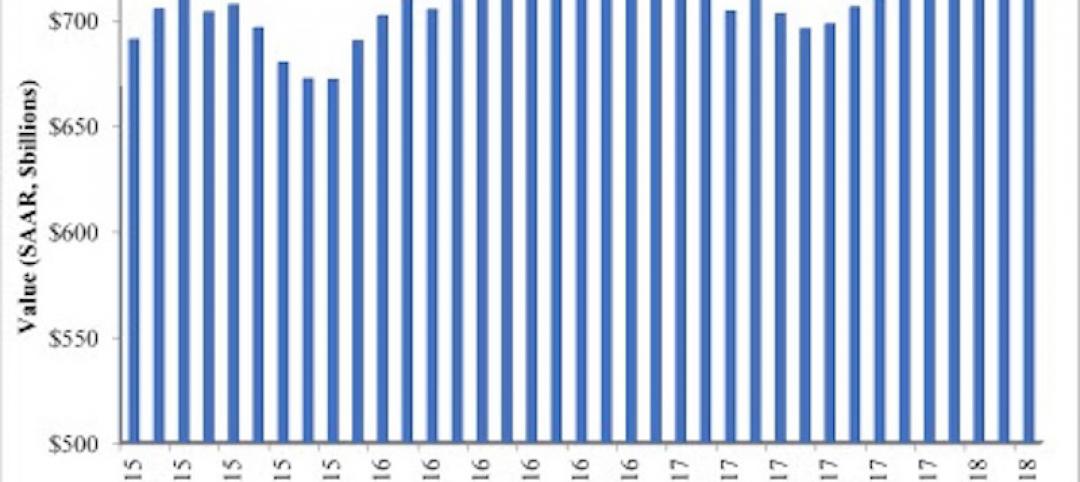

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.