Based on data from over *11,000 tracked large-scale country wide construction projects, GlobalData, a leading data and analytics company, finds that 10 major US states account for nearly 60% of the total US construction project pipeline value (US$3.7 trillion).

GlobalData’s latest report: ‘Project Insight - Construction in Key US States’ reveals that, California, Texas and New York are among the states with the highest value of construction projects in the pipeline. With a total of 1,302 projects worth US$524.6bn, California, for example, has both the largest number and value of projects in the US construction project pipeline, with infrastructure projects and mixed-use developments, representing a combined 56% of California’s total pipeline value.

Dariana Tani, Economist at GlobalData explains: “The construction of mixed-use developments is booming across many US states, with the building of American city centers and suburbs coming to resemble one another due to changing demands from consumers and homebuyers. This is particularly the case for states such as Florida, California and New York. In Florida, the construction of mixed-use properties is growing faster than any other US state, with five of the top 10 largest construction projects in Florida being mixed-use construction projects, according to GlobalData.”

The desire to live, work, shop and play within walkable distances is not only unique to millennials and baby boomers, but also older generations who want to live in well-connected urban communities.

Tani adds: “The tech industry is also creating new demand to build more residential and commercial buildings, as well as transport infrastructure to accommodate the influx of workers. Big tech companies such as Google, Apple, Facebook, Microsoft and Amazon are encouraging significant investment. Among the most notable projects in the pipeline are Facebook’s US$850m Willow Campus Mixed-Use Development in San Francisco, Google’s US$800m Residential Development in Mountain View and Microsoft’s US$1bn Redmond Headquarters Redevelopment.”

*These projects are at all stages of development from announcement to execution.

Related Stories

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

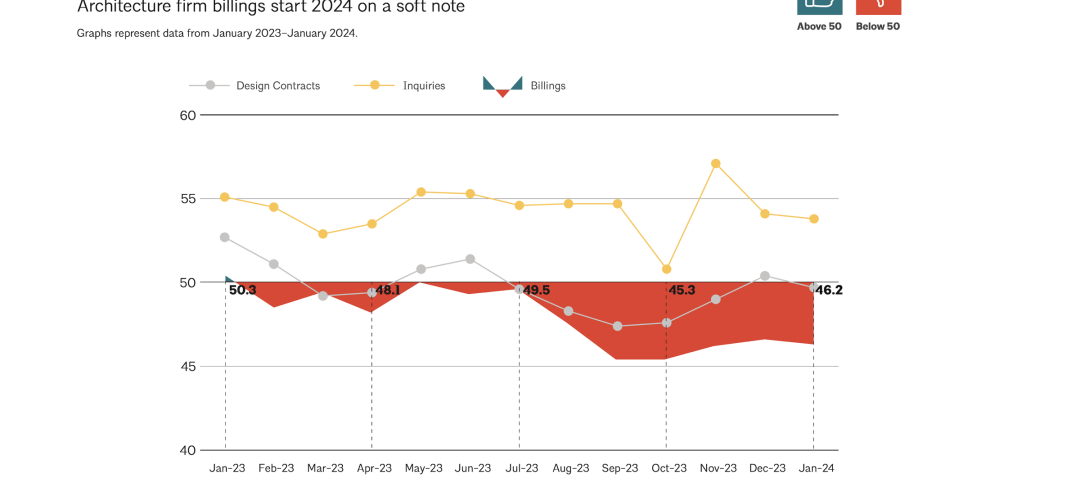

Architects | Feb 21, 2024

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.