A new Hoyt Advisory Services Study commissioned by the National Apartment Association (NAA) and National Multifamily Housing Council (NMHC) reveals that the apartment/multifamily industry and its residents annually contribute more than $3.4 trillion to the national economy. The new report, available at WeAreApartments.org, provides a detailed breakout of the economic impact nationally, by state, and in 50 metro areas.

New data show how different aspects of the apartment industry positively impact national, state and local economies. Resident spending contributes $3.0 trillion to the U.S. economy, while operations adds $175.2 billion. New construction contributes $150.1 billion and renovation and repair adds $68.8 billion.

Highlights from the report include:

— All four sectors of the industry have posted very strong growth, punctuated by the construction industry ramping up to meet the unprecedented demand for apartments this cycle – reaching a height of 346,900 completions in 2017, up from 129,900 in 2011.

— Previous research by Hoyt Advisory Services found that we need to build an average of 328,000 apartments per year at a variety of price points to meet existing demand, which would bring continued economic activity. This number of multifamily completions has only been surpassed twice since 1989.

— Hoyt research also found that a significant portion of the existing apartment stock will need to be renovated in the coming years, boosting spending in the renovation and repair sector.

— The combined contribution of apartment construction, operations, renovation, and resident spending equals $3.4 trillion per year, or more than $9.3 billion daily.

“The apartment industry’s contribution is one that has grown in recent years, fueled by increased rental demand overall as population and employment growth continue and renting becomes a preferred tenure choice for millions of Americans,” said Eileen Marrinan, Managing Director of Eigen 10 Advisors, which partnered with Hoyt.

“Construction is still moving ahead, as there’s a need for additional apartments in many states. And, due to an abundance of aging stock, there’s a growing need for renovations and improvements on existing apartment buildings. Construction and renovation/repair will provide a sizable boost in jobs – and the economy – nationwide, and will continue to be a hefty contribution to the country’s economy for decades,” said NMHC President Douglas M. Bibby.

“The multifamily industry is an economic engine powering the economy very significantly at the national, state and local levels,” said NAA President Robert Pinnegar. “This clearly illustrates the tremendous positive impact our apartments have on the communities they serve.”

This study provides data to back up the assertion that the apartment industry contributes to national, state and local tax economies. Tax payments associated with apartment operations, as well as tax payments by apartment residents, contributed $408.9 billion to the national economy. These taxes support schools, improvements to local infrastructure, and other critical services in communities across the country.

Related Stories

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

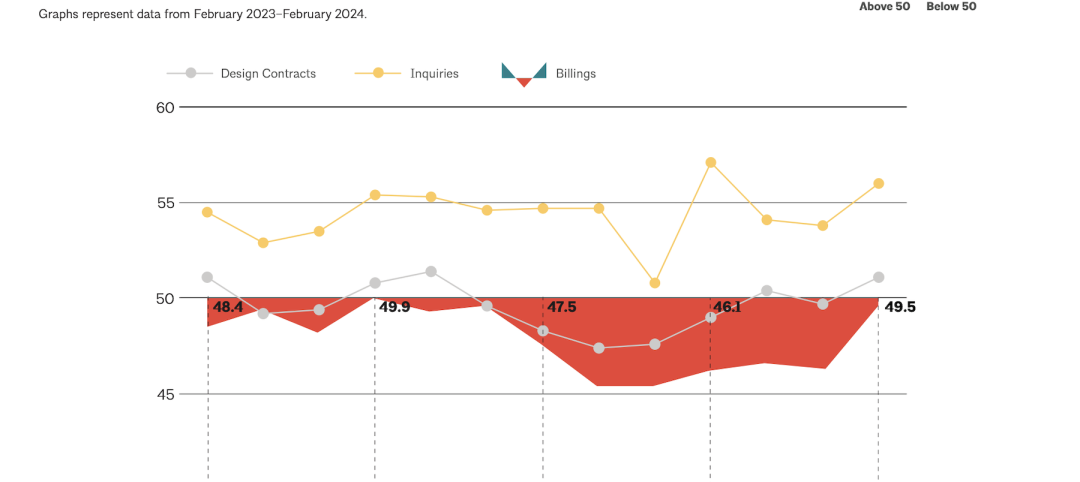

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.