There are over 1,400 large-scale rental apartment projects under construction in the biggest metros in the U.S. In buildings that will have 50 or more apartments, 321,177 units are projected to be completed by year’s end, representing a 50% increase over the 214,108 completions in 50-plus-unit structures in 2015, according to RENTCafé, a nationwide apartment search website.

This is the highest point for apartment construction in the past five years.

Apartment construction in the country's 50 largest metros is the highest it's been in five years. But with so much new inventory coming on line, rent appreciation has slowed in several of these markets. Image: RENTCafe

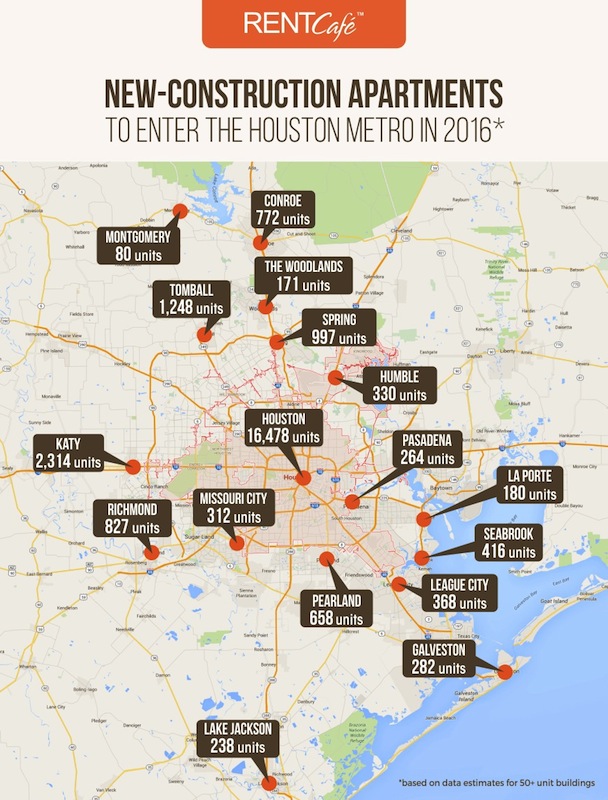

Drawing from data captured by its sister company, Yardi Matrix, RENTCafé examined the construction pipelines in the country’s 50 largest U.S. markets. It found that two Texas cities—Houston and Dallas—rank first and second among the top 20 hottest metros for apartment construction. Houston expects to deliver 25,935 apartment units in 95 developments this year. That total includes Tate at Tanglewood, which will add 417 units to Houston’s Galleria/Uptown submarket.

Greater Houston is expected to have nearly 26,000 new apartment deliveries this year. Texas's four largest metros combined should add 69,000 units. Image: RENTCafe

RENTCafé estimates that more than 69,000 new apartments will be delivered in Texas’s four largest cities, Houston, Dallas, Austin, and San Antonio, representing 22% of the total estimated increase in inventory within the 50 largest metros that include New York (21,177 deliveries), Los Angeles (20,205), and Washington D.C. (18,027).

One-bedroom apartments will account for more than half (51%) of the new rental stock that comes online this year. RENTCafé indicates that studio apartments rank lowest on developers’ preferences for bedroom distribution, whereas two-bedroom apartments are expected to account for 37.5% of new deliveries.

RENTCafé attributes low inventory levels and increased demand as the drivers of this construction boom. However, it cautions that “the plethora of new rental units coming online may finally turn the tables in the renters’ favor: where there’s choice, there’s competition and, in this case, competition translates into concessions, lower rents, and a more-relaxed housing landscape in general.”

The website points out that while average rents are at all-time highs, rent growth slowed in 2015 to 5.6%, and is projected to increase by only 4.4% this year.

RENTCafé also notes that hot rental markets like Washington D.C. have cooled over the past year. The city proper will see about 5,100 new apartment units this year, “furthering the prospect of an even more relaxed housing market in the future.”

In this competitive environment, rental properties are attracting tenants with deals and incentives. For example, JOYA, a 431-unit community under construction in Miami, has reduced its rates and is offering a rent-free month. Its amenities include a 3,000-sf 24-hour fitness center, a yoga studio, resident-reserved garage parking, and a resort-style pool.

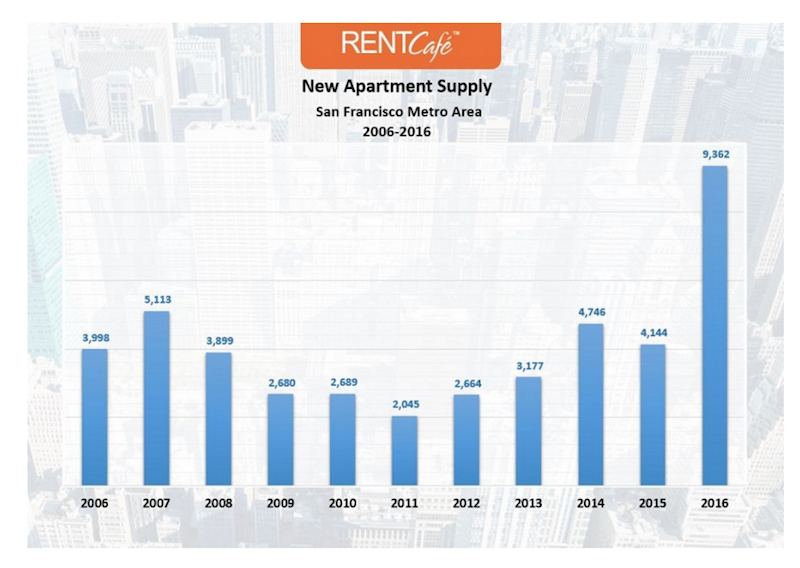

That being said, RENTCafé expects Dallas to remain a hot rental market primarily because of its nearly 4% annual employment growth rate. In pricey San Francisco, nearly 9,500 apartment units are projected to be added this year, a 125% increase over 2015 completions, which could eventually provide some much-needed rent relief. (The average monthly rent in San Francisco is expected to rise by 8% to $2,469 this year.)

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

In other markets, like Sacramento, Portland, Ore., and Seattle, apartment construction still isn’t keeping up with demand.

It would appear that the country’s 50 largest markets are where the bulk of new-apartment construction is occurring. The Census Bureau estimated that, in June, apartment completions in structures with five or more units were tracking nationally at an annualized rate of 386,000 units, a 21% increase over Census’s June 2015 estimate.

Related Stories

Multifamily Housing | Mar 10, 2015

KTGY homes in on seniors with new studio

Its director, Doug Ahlstrom, says designs will emphasize socialization and community.

Multifamily Housing | Mar 10, 2015

Multifamily renovation now drives growth for national restoration business

Response Team 1 has established a national footprint through acquisitions.

Retail Centers | Mar 10, 2015

Retrofit projects give dying malls new purpose

Approximately one-third of the country’s 1,200 enclosed malls are dead or dying. The good news is that a sizable portion of that building stock is being repurposed.

Architects | Mar 9, 2015

Study explores why high ceilings are popular

High ceilings give us a sense of freedom, new research finds

Transit Facilities | Mar 4, 2015

5+design looks to mountains for Chinese transport hub design

The complex, Diamond Hill, will feature sloping rooflines and a mountain-like silhouette inspired by traditional Chinese landscape paintings.

Multifamily Housing | Mar 3, 2015

10 kitchen and bath design trends for 2015

From kitchens made for pet lovers to floating vanities, the nation's top kitchen and bath designers identify what's hot for 2015.

Sponsored | Modular Building | Mar 3, 2015

Modular construction brings affordable housing to many New Yorkers

After city officials waived certain zoning and density regulations, modular microunits smaller than 400 square feet are springing up in New York.

Modular Building | Feb 23, 2015

Edge construction: The future of modular

Can innovative project delivery methods, namely modular construction, bring down costs and offer a solution for housing in urban markets? FXFOWLE’s David Wallance discusses the possibilities for modular.

Multifamily Housing | Feb 23, 2015

Millennials to outgrow Baby Boomers in 2015

The Baby Boomer generation, once the nation's largest living generation, will be outpaced by the Millennials this year, according to the Pew Research Center.

Multifamily Housing | Feb 19, 2015

Is multifamily construction getting too frothy for demand?

Contractors are pushing full speed ahead, but CoStar Group thinks a slowdown might be in order this year.