There are over 1,400 large-scale rental apartment projects under construction in the biggest metros in the U.S. In buildings that will have 50 or more apartments, 321,177 units are projected to be completed by year’s end, representing a 50% increase over the 214,108 completions in 50-plus-unit structures in 2015, according to RENTCafé, a nationwide apartment search website.

This is the highest point for apartment construction in the past five years.

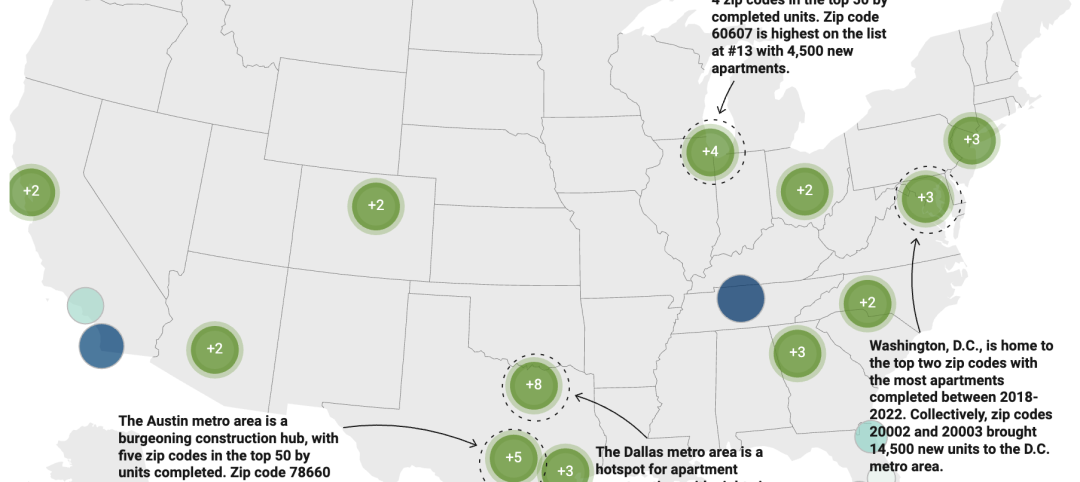

Apartment construction in the country's 50 largest metros is the highest it's been in five years. But with so much new inventory coming on line, rent appreciation has slowed in several of these markets. Image: RENTCafe

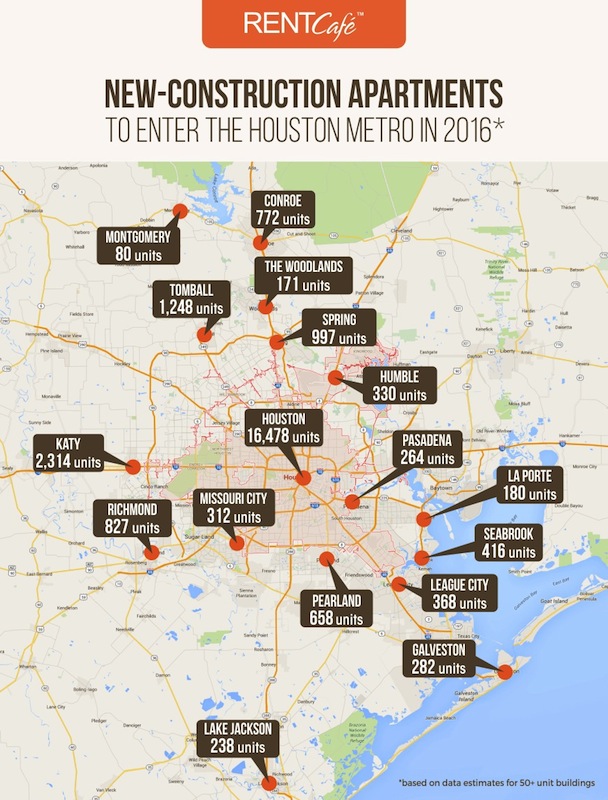

Drawing from data captured by its sister company, Yardi Matrix, RENTCafé examined the construction pipelines in the country’s 50 largest U.S. markets. It found that two Texas cities—Houston and Dallas—rank first and second among the top 20 hottest metros for apartment construction. Houston expects to deliver 25,935 apartment units in 95 developments this year. That total includes Tate at Tanglewood, which will add 417 units to Houston’s Galleria/Uptown submarket.

Greater Houston is expected to have nearly 26,000 new apartment deliveries this year. Texas's four largest metros combined should add 69,000 units. Image: RENTCafe

RENTCafé estimates that more than 69,000 new apartments will be delivered in Texas’s four largest cities, Houston, Dallas, Austin, and San Antonio, representing 22% of the total estimated increase in inventory within the 50 largest metros that include New York (21,177 deliveries), Los Angeles (20,205), and Washington D.C. (18,027).

One-bedroom apartments will account for more than half (51%) of the new rental stock that comes online this year. RENTCafé indicates that studio apartments rank lowest on developers’ preferences for bedroom distribution, whereas two-bedroom apartments are expected to account for 37.5% of new deliveries.

RENTCafé attributes low inventory levels and increased demand as the drivers of this construction boom. However, it cautions that “the plethora of new rental units coming online may finally turn the tables in the renters’ favor: where there’s choice, there’s competition and, in this case, competition translates into concessions, lower rents, and a more-relaxed housing landscape in general.”

The website points out that while average rents are at all-time highs, rent growth slowed in 2015 to 5.6%, and is projected to increase by only 4.4% this year.

RENTCafé also notes that hot rental markets like Washington D.C. have cooled over the past year. The city proper will see about 5,100 new apartment units this year, “furthering the prospect of an even more relaxed housing market in the future.”

In this competitive environment, rental properties are attracting tenants with deals and incentives. For example, JOYA, a 431-unit community under construction in Miami, has reduced its rates and is offering a rent-free month. Its amenities include a 3,000-sf 24-hour fitness center, a yoga studio, resident-reserved garage parking, and a resort-style pool.

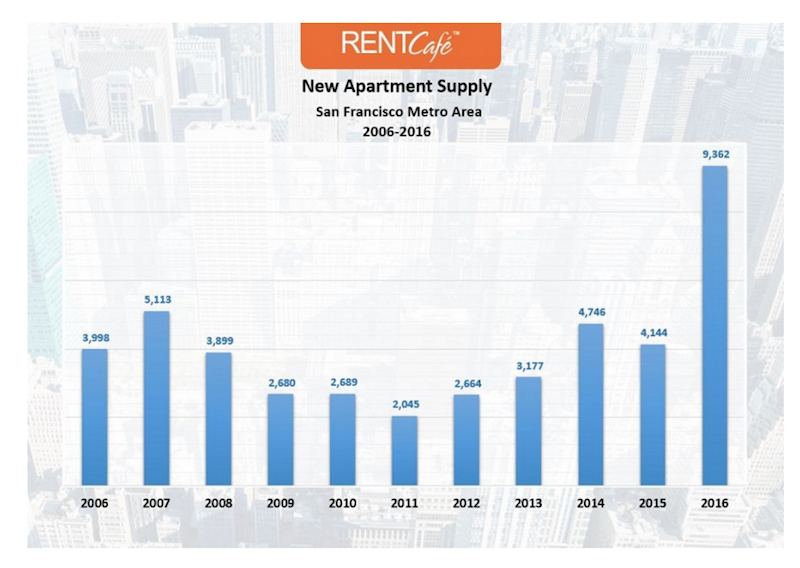

That being said, RENTCafé expects Dallas to remain a hot rental market primarily because of its nearly 4% annual employment growth rate. In pricey San Francisco, nearly 9,500 apartment units are projected to be added this year, a 125% increase over 2015 completions, which could eventually provide some much-needed rent relief. (The average monthly rent in San Francisco is expected to rise by 8% to $2,469 this year.)

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

In other markets, like Sacramento, Portland, Ore., and Seattle, apartment construction still isn’t keeping up with demand.

It would appear that the country’s 50 largest markets are where the bulk of new-apartment construction is occurring. The Census Bureau estimated that, in June, apartment completions in structures with five or more units were tracking nationally at an annualized rate of 386,000 units, a 21% increase over Census’s June 2015 estimate.

Related Stories

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

Industrial Facilities | Nov 14, 2023

Some AEC firms are plugging into EV charging market

Decentralized electrical distribution is broadening recharger installation to several building types.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

MFPRO+ News | Nov 1, 2023

Washington, D.C., Queens, N.Y., lead nation in number of new apartments by zip code

A study of new apartment construction by zip code showed Washington D.C., and the Queens borough of New York City are the hottest multifamily markets since 2018, according to RentCafe.

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Mass Timber | Oct 27, 2023

Five winners selected for $2 million Mass Timber Competition

Five winners were selected to share a $2 million prize in the 2023 Mass Timber Competition: Building to Net-Zero Carbon. The competition was co-sponsored by the Softwood Lumber Board and USDA Forest Service (USDA) with the intent “to demonstrate mass timber’s applications in architectural design and highlight its significant role in reducing the carbon footprint of the built environment.”