There are over 1,400 large-scale rental apartment projects under construction in the biggest metros in the U.S. In buildings that will have 50 or more apartments, 321,177 units are projected to be completed by year’s end, representing a 50% increase over the 214,108 completions in 50-plus-unit structures in 2015, according to RENTCafé, a nationwide apartment search website.

This is the highest point for apartment construction in the past five years.

Apartment construction in the country's 50 largest metros is the highest it's been in five years. But with so much new inventory coming on line, rent appreciation has slowed in several of these markets. Image: RENTCafe

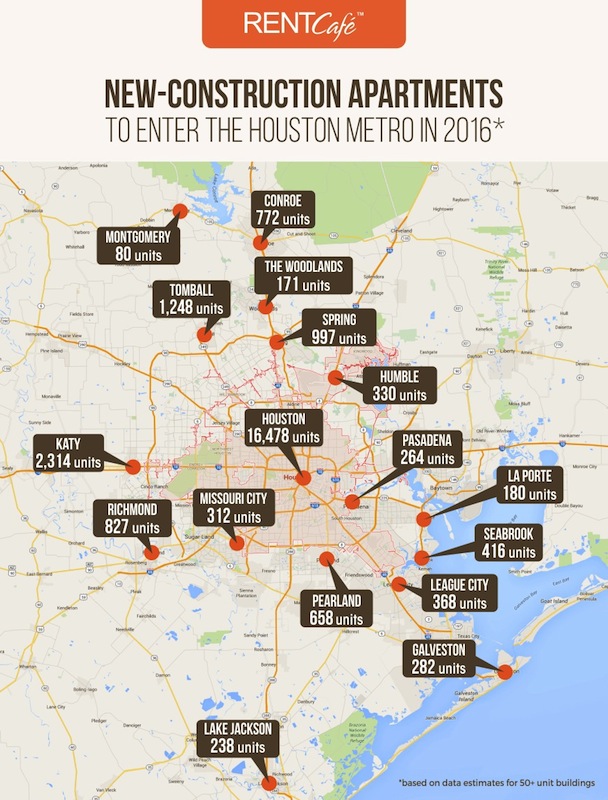

Drawing from data captured by its sister company, Yardi Matrix, RENTCafé examined the construction pipelines in the country’s 50 largest U.S. markets. It found that two Texas cities—Houston and Dallas—rank first and second among the top 20 hottest metros for apartment construction. Houston expects to deliver 25,935 apartment units in 95 developments this year. That total includes Tate at Tanglewood, which will add 417 units to Houston’s Galleria/Uptown submarket.

Greater Houston is expected to have nearly 26,000 new apartment deliveries this year. Texas's four largest metros combined should add 69,000 units. Image: RENTCafe

RENTCafé estimates that more than 69,000 new apartments will be delivered in Texas’s four largest cities, Houston, Dallas, Austin, and San Antonio, representing 22% of the total estimated increase in inventory within the 50 largest metros that include New York (21,177 deliveries), Los Angeles (20,205), and Washington D.C. (18,027).

One-bedroom apartments will account for more than half (51%) of the new rental stock that comes online this year. RENTCafé indicates that studio apartments rank lowest on developers’ preferences for bedroom distribution, whereas two-bedroom apartments are expected to account for 37.5% of new deliveries.

RENTCafé attributes low inventory levels and increased demand as the drivers of this construction boom. However, it cautions that “the plethora of new rental units coming online may finally turn the tables in the renters’ favor: where there’s choice, there’s competition and, in this case, competition translates into concessions, lower rents, and a more-relaxed housing landscape in general.”

The website points out that while average rents are at all-time highs, rent growth slowed in 2015 to 5.6%, and is projected to increase by only 4.4% this year.

RENTCafé also notes that hot rental markets like Washington D.C. have cooled over the past year. The city proper will see about 5,100 new apartment units this year, “furthering the prospect of an even more relaxed housing market in the future.”

In this competitive environment, rental properties are attracting tenants with deals and incentives. For example, JOYA, a 431-unit community under construction in Miami, has reduced its rates and is offering a rent-free month. Its amenities include a 3,000-sf 24-hour fitness center, a yoga studio, resident-reserved garage parking, and a resort-style pool.

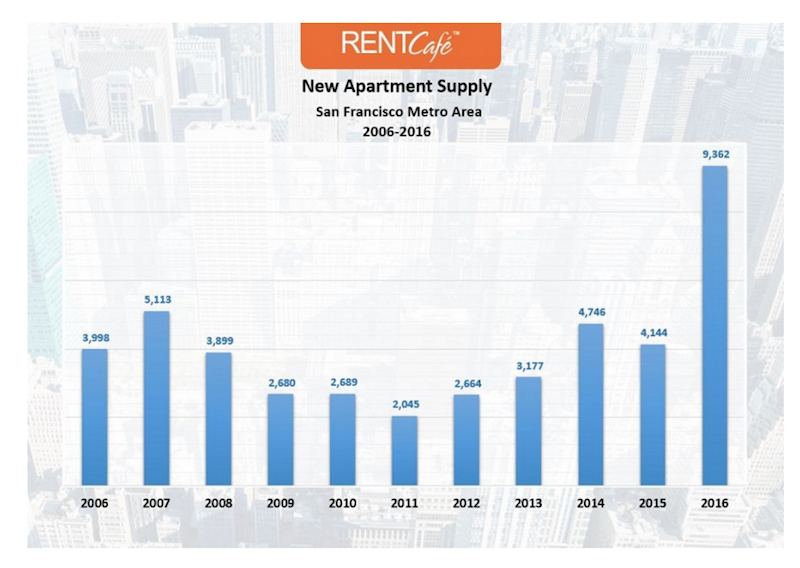

That being said, RENTCafé expects Dallas to remain a hot rental market primarily because of its nearly 4% annual employment growth rate. In pricey San Francisco, nearly 9,500 apartment units are projected to be added this year, a 125% increase over 2015 completions, which could eventually provide some much-needed rent relief. (The average monthly rent in San Francisco is expected to rise by 8% to $2,469 this year.)

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

In other markets, like Sacramento, Portland, Ore., and Seattle, apartment construction still isn’t keeping up with demand.

It would appear that the country’s 50 largest markets are where the bulk of new-apartment construction is occurring. The Census Bureau estimated that, in June, apartment completions in structures with five or more units were tracking nationally at an annualized rate of 386,000 units, a 21% increase over Census’s June 2015 estimate.

Related Stories

Multifamily Housing | Apr 26, 2022

Investment firm Blackstone makes $13 billion acquisition in student-housing sector

Blackstone Inc., a New York-based investment firm, has agreed to buy student-housing owner American Campus Communities Inc.

Mixed-Use | Apr 22, 2022

San Francisco replaces a waterfront parking lot with a new neighborhood

A parking lot on San Francisco’s waterfront is transforming into Mission Rock—a new neighborhood featuring rental units, offices, parks, open spaces, retail, and parking.

Multifamily Housing | Apr 20, 2022

A Frankfurt tower gives residents greenery-framed views

In Frankfurt, Germany, the 27-floor EDEN tower boasts an exterior “living wall system”: 186,000 plants that cover about 20 percent of the building’s facade.

Multifamily Housing | Apr 20, 2022

Prism Capital Partners' Avenue & Green luxury/affordable rental complex is 96% leased

The 232-unit rental property, in Woodbridge, N.J., has surpassed the 96 percent mark in leases.

Senior Living Design | Apr 19, 2022

Affordable housing for L.A. veterans and low-income seniors built on former parking lot site

The Howard and Irene Levine Senior Community, designed by KFA Architecture for Mercy Housing of California, provides badly needed housing for Los Angeles veterans and low-income seniors

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Wood | Apr 13, 2022

Mass timber: Multifamily’s next big building system

Mass timber construction experts offer advice on how to use prefabricated wood systems to help you reach for the heights with your next apartment or condominium project.

Codes and Standards | Apr 13, 2022

LEED multifamily properties fetch higher rents and sales premiums

LEED-certified multifamily properties consistently receive higher rents than non-certified rental complexes, according to a Cushman & Wakefield study of two decades of data on Class A multifamily assets with 50 units or more.

Multifamily Housing | Apr 7, 2022

Ken Soble Tower becomes world’s largest residential Passive House retrofit

The project team for the 18-story high-rise for seniors slashed the building’s greenhouse gas emissions by 94 percent and its heating energy demand by 91 percent.