There are over 1,400 large-scale rental apartment projects under construction in the biggest metros in the U.S. In buildings that will have 50 or more apartments, 321,177 units are projected to be completed by year’s end, representing a 50% increase over the 214,108 completions in 50-plus-unit structures in 2015, according to RENTCafé, a nationwide apartment search website.

This is the highest point for apartment construction in the past five years.

Apartment construction in the country's 50 largest metros is the highest it's been in five years. But with so much new inventory coming on line, rent appreciation has slowed in several of these markets. Image: RENTCafe

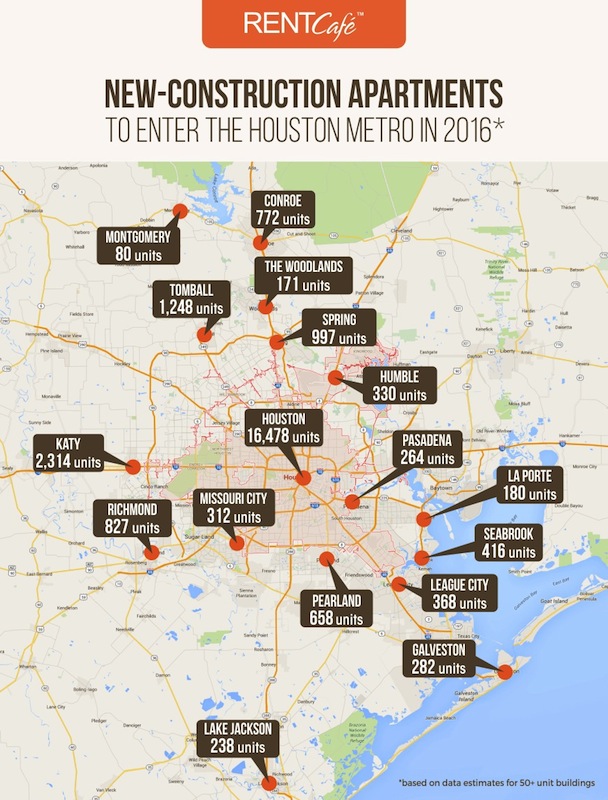

Drawing from data captured by its sister company, Yardi Matrix, RENTCafé examined the construction pipelines in the country’s 50 largest U.S. markets. It found that two Texas cities—Houston and Dallas—rank first and second among the top 20 hottest metros for apartment construction. Houston expects to deliver 25,935 apartment units in 95 developments this year. That total includes Tate at Tanglewood, which will add 417 units to Houston’s Galleria/Uptown submarket.

Greater Houston is expected to have nearly 26,000 new apartment deliveries this year. Texas's four largest metros combined should add 69,000 units. Image: RENTCafe

RENTCafé estimates that more than 69,000 new apartments will be delivered in Texas’s four largest cities, Houston, Dallas, Austin, and San Antonio, representing 22% of the total estimated increase in inventory within the 50 largest metros that include New York (21,177 deliveries), Los Angeles (20,205), and Washington D.C. (18,027).

One-bedroom apartments will account for more than half (51%) of the new rental stock that comes online this year. RENTCafé indicates that studio apartments rank lowest on developers’ preferences for bedroom distribution, whereas two-bedroom apartments are expected to account for 37.5% of new deliveries.

RENTCafé attributes low inventory levels and increased demand as the drivers of this construction boom. However, it cautions that “the plethora of new rental units coming online may finally turn the tables in the renters’ favor: where there’s choice, there’s competition and, in this case, competition translates into concessions, lower rents, and a more-relaxed housing landscape in general.”

The website points out that while average rents are at all-time highs, rent growth slowed in 2015 to 5.6%, and is projected to increase by only 4.4% this year.

RENTCafé also notes that hot rental markets like Washington D.C. have cooled over the past year. The city proper will see about 5,100 new apartment units this year, “furthering the prospect of an even more relaxed housing market in the future.”

In this competitive environment, rental properties are attracting tenants with deals and incentives. For example, JOYA, a 431-unit community under construction in Miami, has reduced its rates and is offering a rent-free month. Its amenities include a 3,000-sf 24-hour fitness center, a yoga studio, resident-reserved garage parking, and a resort-style pool.

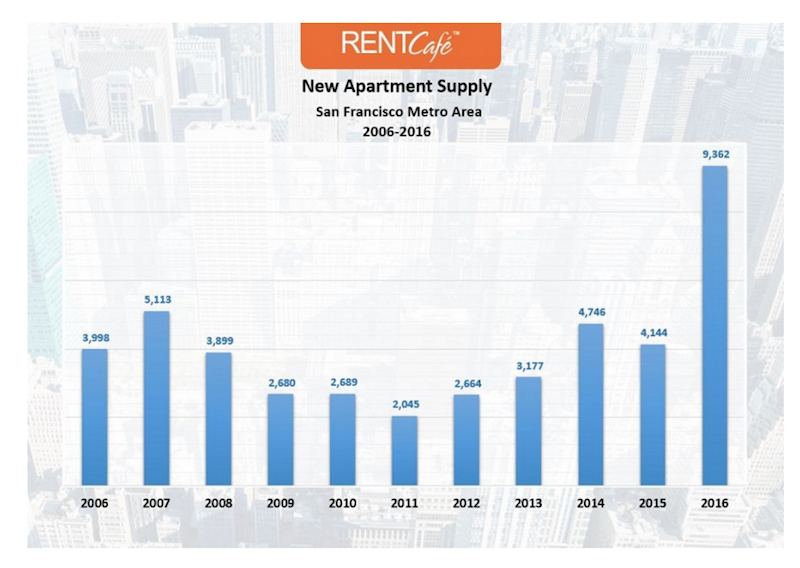

That being said, RENTCafé expects Dallas to remain a hot rental market primarily because of its nearly 4% annual employment growth rate. In pricey San Francisco, nearly 9,500 apartment units are projected to be added this year, a 125% increase over 2015 completions, which could eventually provide some much-needed rent relief. (The average monthly rent in San Francisco is expected to rise by 8% to $2,469 this year.)

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

Is San Francisco is testing the limits of how much rent appreciation any market can bear. Image: RENTCafe

In other markets, like Sacramento, Portland, Ore., and Seattle, apartment construction still isn’t keeping up with demand.

It would appear that the country’s 50 largest markets are where the bulk of new-apartment construction is occurring. The Census Bureau estimated that, in June, apartment completions in structures with five or more units were tracking nationally at an annualized rate of 386,000 units, a 21% increase over Census’s June 2015 estimate.

Related Stories

Multifamily Housing | May 22, 2017

Zaha Hadid Architects residential development takes a page from a classic Bradbury tale

The buildings are on an elevated platform and the surrounding walkways are suspended so as not to disturb the surrounding ecosystems.

Multifamily Housing | May 19, 2017

Above + Beyond: condo tower built atop parking structure

How designers figured out a way to nestle an 18-story condo tower on top of an existing parking structure in Hawaii.

Multifamily Housing | May 17, 2017

Swedish Tower’s 15th floor is reserved for a panoramic garden

C.F. Møller’s design was selected as the winner of a competition organized by Riksbyggen in Västerås.

Mixed-Use | May 17, 2017

The Lincoln Common development has begun construction in Chicago’s Lincoln Park

The mixed-use project will provide new apartments, condos, a senior living facility, and retail space.

High-rise Construction | May 15, 2017

Construction begins on 47-story luxury tower in Chicago’s South Loop

The glass tower is being built at 1326 S. Michigan Avenue.

Multifamily Housing | May 10, 2017

May 2017 National Apartment Report

Median one-bedroom rent rose to $1,012 in April, the highest it has been since January.

Multifamily Housing | May 10, 2017

Triple Treat: Developer transforms mid-rise into unique live-work lofts

Novus Residences’ revolutionary e-lofts concept offers tenants a tempting trio of options—‘live,’ ‘live-work,’ or ‘work’—all on the same floor.

Multifamily Housing | May 3, 2017

Silicon Valley’s high-tech oasis

An award-winning rental complex takes its design cues from its historic location in Silicon Valley.

Multifamily Housing | May 2, 2017

Multifamily housing: 7 exciting, inspiring innovations [AIA Course]

This AIA CES course features seven novel approaches developers and Building Teams are taking to respond to competitive pressures and build more quickly and with more attractive offerings.

Multifamily Housing | Apr 26, 2017

Multifamily amenity trends: The latest in package delivery centers

Package delivery centers provide order and security for the mountains of parcels piling up at apartment and condominium communities.

![Multifamily housing today: 7 exciting, inspiring innovations [AIA Course] Multifamily housing today: 7 exciting, inspiring innovations [AIA Course]](/sites/default/files/styles/list_big/public/Screen%20Shot%202017-05-02%20at%2011.55.02%20AM.png?itok=ZS_4opT9)