December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

Architects | Mar 25, 2021

The Weekly Show, March 25, 2021: The Just Label for AEC firms, and Perkins Eastman's Well-Platinum design studio

This week on The Weekly show, BD+C editors speak with AEC industry leaders about the Just Label from the International Living Future Institute, and the features and amenities at Perkins Eastman's Well Platinum-certified design studio.

Architects | Mar 23, 2021

Design firms KTGY, Simeone Deary Design Group unite to shape future of architectural design through experiential environments

With a bold vision to reshape how people experience spaces, residential design firm joins forces with interior design group, creating fully integrated architecture, branding, interiors and planning practice.

Architects | Mar 15, 2021

A life in architecture – Lessons from my father

A veteran designer looks back on the lessons his father, a contractor, taught him.

Architects | Mar 11, 2021

Calling all building design professionals: BD+C needs your expertise on design innovation in 2021

This new BD+C research project explores the leading drivers, sources of inspiration, and successful outcomes for design innovation projects and initiatives.

Coronavirus | Mar 11, 2021

The Weekly show, March 11, 2021: 5 building products for COVID-related conditions, and AI for MEP design

This week on The Weekly show, BD+C editors speak with AEC industry leaders about building products and systems that support COVID-related conditions, and an AI tool that automates the design of MEP systems.

Laboratories | Mar 10, 2021

8 tips for converting office space to life sciences labs

Creating a successful life sciences facility within the shell of a former office building can be much like that old “square peg round hole” paradigm. Two experts offer important advice.

AEC Tech | Mar 4, 2021

The Weekly show, March 4, 2021: Bringing AI to the masses, and Central Station Memphis hotel

This week on The Weekly show, BD+C editors speak with AEC industry leaders about the award-winning Central Station Memphis hotel reconstruction project, and how Autodesk aims to bring generative design and AI tools to the AEC masses.

Architects | Mar 1, 2021

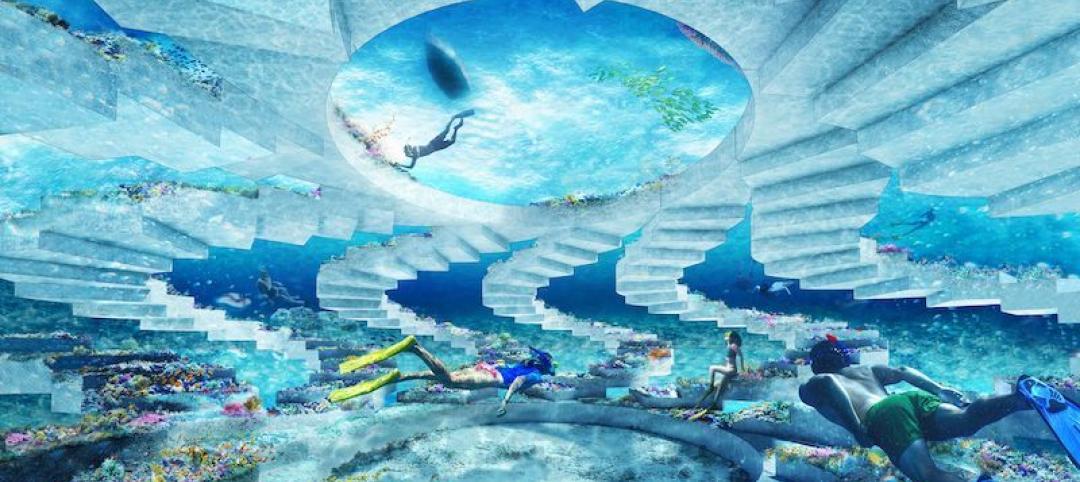

OMA designs 7-mile-long underwater sculpture park

The project will be completed in several phases.

Architects | Mar 1, 2021

AIA elevates 102 members to the College of Fellows

AIA fellowship recognizes significant contributions to the profession of architecture and society.