A slight improvement in business conditions has led to fewer architecture firms reporting declining billings, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for January was 44.9* compared to 42.3 in December (any score below 50 indicates a decline in firm billings). Last month’s score indicates overall revenue at U.S architecture firms continued to decline from December to January, however, the pace of decline slowed. Inquiries into new projects during January grew for the second month in a row, with a score of 56.8 compared to 51.7 in December. The value of new design contracts also reflected an easing in the pace of decline, rising to a score of 48.8 in January from 47.0 the previous month.

“The broader economy entered a soft spot during the fourth quarter of last year, and business conditions at design firms have reflected this general slowdown,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While federal stimulus and the increasing pace of vaccinations may begin to accelerate progress in the coming months, the year has gotten off to a slow start, with architecture firms in all regions of the country and in all specializations reporting continued declines in project billings.”

Key ABI highlights for January include:

- Regional averages: South (47.4); West (42.8); Midwest (42.2); Northeast (41.9)

- Sector index breakdown: mixed practice (47.9); multi-family residential (44.4); commercial/industrial (44.3); institutional (39.9)

- Project inquiries index: 56.8

- Design contracts index: 48.8

The regional and sector categories are calculated as a three-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.

To learn more about recent economic developments impacting design and construction, visit AIA’s website.

*Every January the AIA research department updates the seasonal factors used to calculate the ABI, resulting in a revision of recent ABI values.

Related Stories

Market Data | Oct 31, 2016

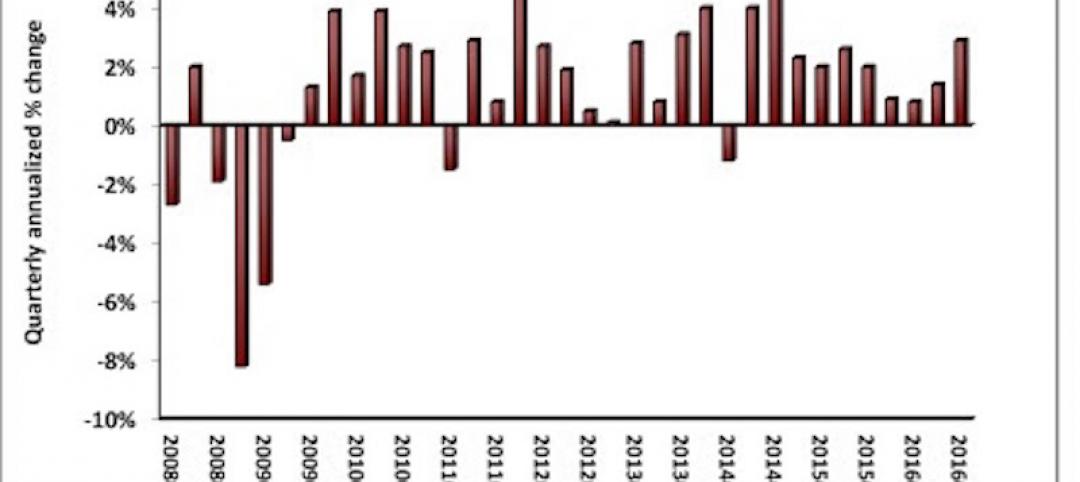

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.