Construction employment in August remained below the levels reached before the pre-pandemic peak in February 2020 in 39 states, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials urged the House of Representatives to quickly pass the bipartisan infrastructure bill to avoid further cutbacks in construction activity and jobs.

“Construction employment slipped or stagnated from July to August in half the states as the delta variant of COVID-19 affected workers and caused some owners to delay projects,” said Ken Simonson, the association’s chief economist. “In addition, more than half of the respondents in our latest workforce survey reported experiencing projects that have been canceled, postponed, or scaled back.”

From February 2020—the month before the pandemic caused project shutdowns and cancellations—to last month, construction employment increased in only 11 states and the District of Columbia. Texas shed the most construction jobs over the period (-56,700 jobs or -7.3%), followed by New York (-50,700 jobs, -12.4%) and California (-34,900 jobs, -3.8%). Wyoming recorded the largest percentage loss (-16.6%, -3,800 jobs), followed by Louisiana (-14.4%, -19,700 jobs) and New York.

Utah added the most construction jobs since February 2020 (7,400 jobs, 6.5%), followed by North Carolina (4,500, 1.9%), Idaho (3,700 jobs, 6.7%), and South Carolina (3,700 jobs, 3.5%). The largest percentage gains were in South Dakota (7.1%, 1,700 jobs), followed by Idaho and Utah.

From July to August construction employment decreased in 22 states, increased in 25 states and D.C., and was unchanged in three states. The largest decline over the month occurred in Kansas, which lost 2,400 construction jobs or 3.7%. Georgia lost the second-most jobs (-2,300 jobs, -1.1%). The second-largest percentage decline since July, -2.1%, occurred in Alabama (-1,900 jobs) and Wyoming (-400 jobs).

Nevada added the most construction jobs between July and August (3,000 jobs, 3.3%), followed by New York (2,600 jobs, 0.7%) and Tennessee (2,600 jobs, 2.0%). New Hampshire had the largest percentage gain (4.4%, 1,200 jobs), followed by Nevada and Oklahoma (2.3%, 1,800 jobs).

Association officials warned that construction employment was being impacted in many parts of the country because of supply chain challenges and growing market uncertainty caused by the resurgent Delta variant. They said new federal infrastructure investments would provide a needed boost in demand and help put more people to work in construction careers.

“It is vital that Congress complete work on the bipartisan infrastructure bill before the end of month,” said Stephen E. Sandherr, the association’s chief executive officer. “Otherwise, funding will stop for much-needed highway and other public works projects and many more construction workers will lose their jobs.”

View state February 2020-August 2021 data and rankings, 1-month rankings. View AGC’s survey results.

Related Stories

Market Data | Nov 2, 2018

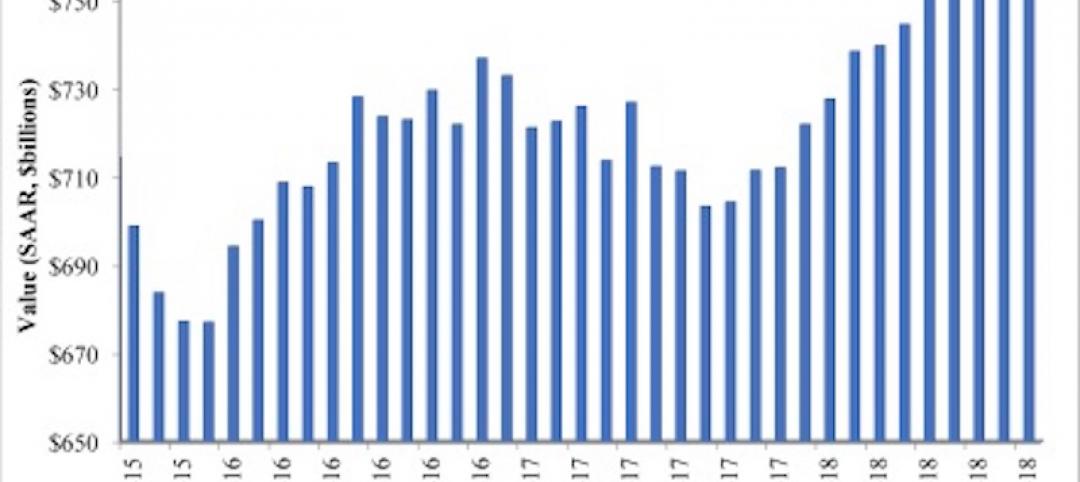

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

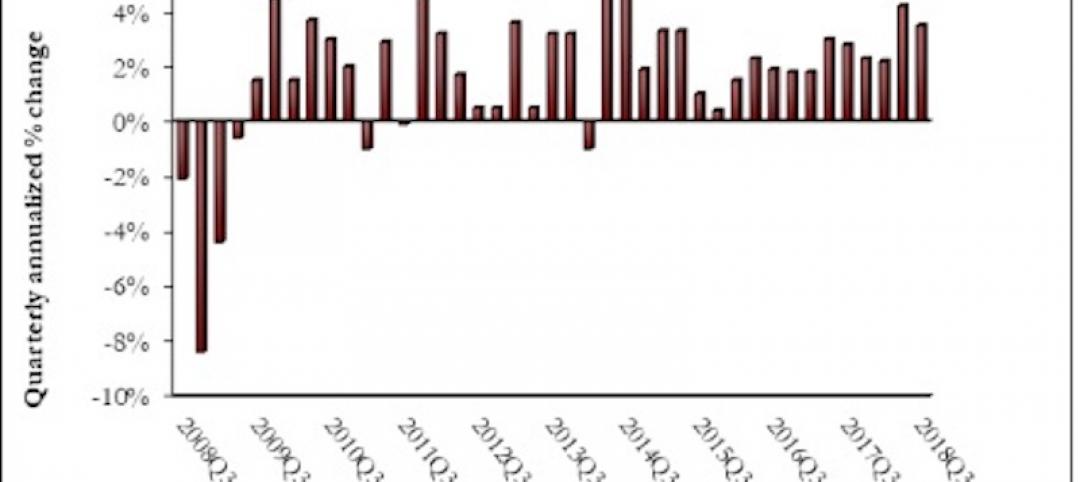

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

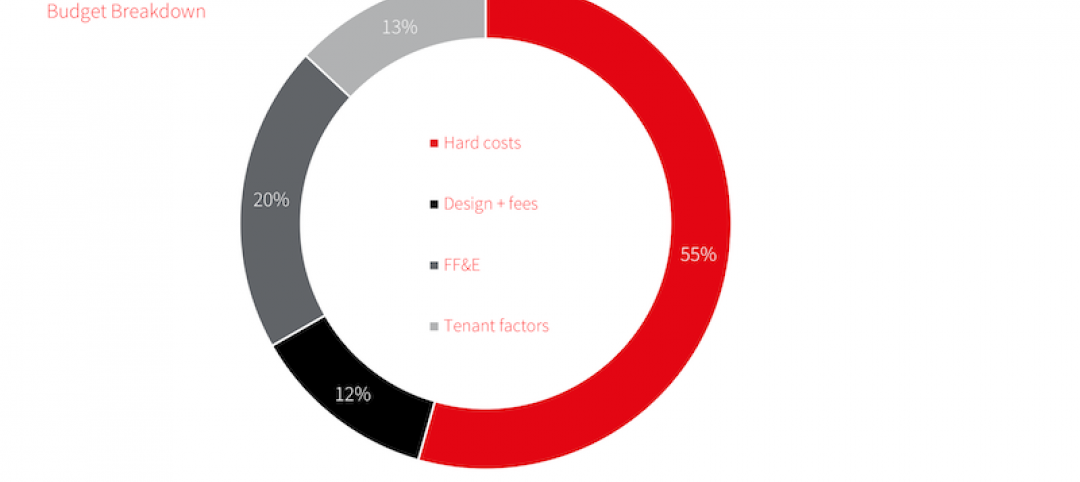

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.