Construction employment in August remained below the levels reached before the pre-pandemic peak in February 2020 in 39 states, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials urged the House of Representatives to quickly pass the bipartisan infrastructure bill to avoid further cutbacks in construction activity and jobs.

“Construction employment slipped or stagnated from July to August in half the states as the delta variant of COVID-19 affected workers and caused some owners to delay projects,” said Ken Simonson, the association’s chief economist. “In addition, more than half of the respondents in our latest workforce survey reported experiencing projects that have been canceled, postponed, or scaled back.”

From February 2020—the month before the pandemic caused project shutdowns and cancellations—to last month, construction employment increased in only 11 states and the District of Columbia. Texas shed the most construction jobs over the period (-56,700 jobs or -7.3%), followed by New York (-50,700 jobs, -12.4%) and California (-34,900 jobs, -3.8%). Wyoming recorded the largest percentage loss (-16.6%, -3,800 jobs), followed by Louisiana (-14.4%, -19,700 jobs) and New York.

Utah added the most construction jobs since February 2020 (7,400 jobs, 6.5%), followed by North Carolina (4,500, 1.9%), Idaho (3,700 jobs, 6.7%), and South Carolina (3,700 jobs, 3.5%). The largest percentage gains were in South Dakota (7.1%, 1,700 jobs), followed by Idaho and Utah.

From July to August construction employment decreased in 22 states, increased in 25 states and D.C., and was unchanged in three states. The largest decline over the month occurred in Kansas, which lost 2,400 construction jobs or 3.7%. Georgia lost the second-most jobs (-2,300 jobs, -1.1%). The second-largest percentage decline since July, -2.1%, occurred in Alabama (-1,900 jobs) and Wyoming (-400 jobs).

Nevada added the most construction jobs between July and August (3,000 jobs, 3.3%), followed by New York (2,600 jobs, 0.7%) and Tennessee (2,600 jobs, 2.0%). New Hampshire had the largest percentage gain (4.4%, 1,200 jobs), followed by Nevada and Oklahoma (2.3%, 1,800 jobs).

Association officials warned that construction employment was being impacted in many parts of the country because of supply chain challenges and growing market uncertainty caused by the resurgent Delta variant. They said new federal infrastructure investments would provide a needed boost in demand and help put more people to work in construction careers.

“It is vital that Congress complete work on the bipartisan infrastructure bill before the end of month,” said Stephen E. Sandherr, the association’s chief executive officer. “Otherwise, funding will stop for much-needed highway and other public works projects and many more construction workers will lose their jobs.”

View state February 2020-August 2021 data and rankings, 1-month rankings. View AGC’s survey results.

Related Stories

Market Data | Aug 2, 2017

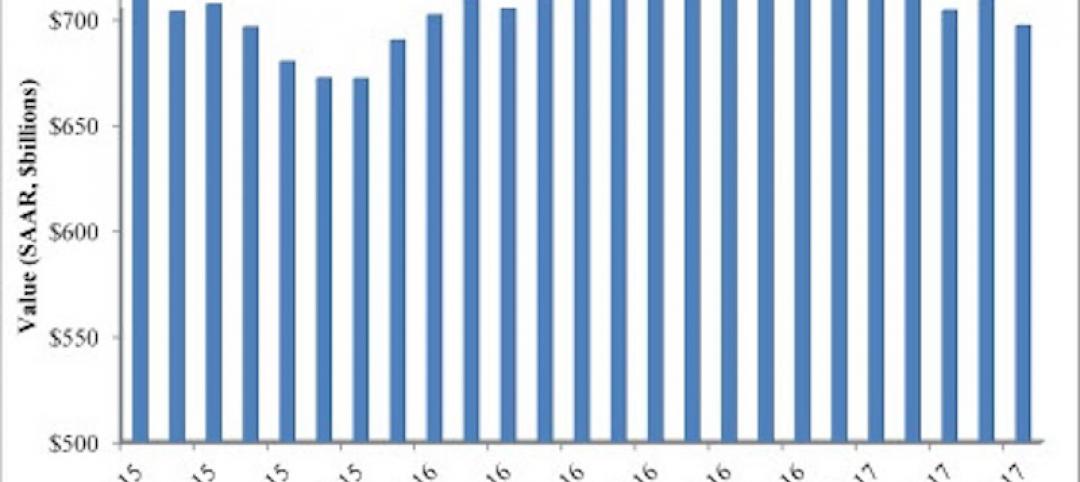

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

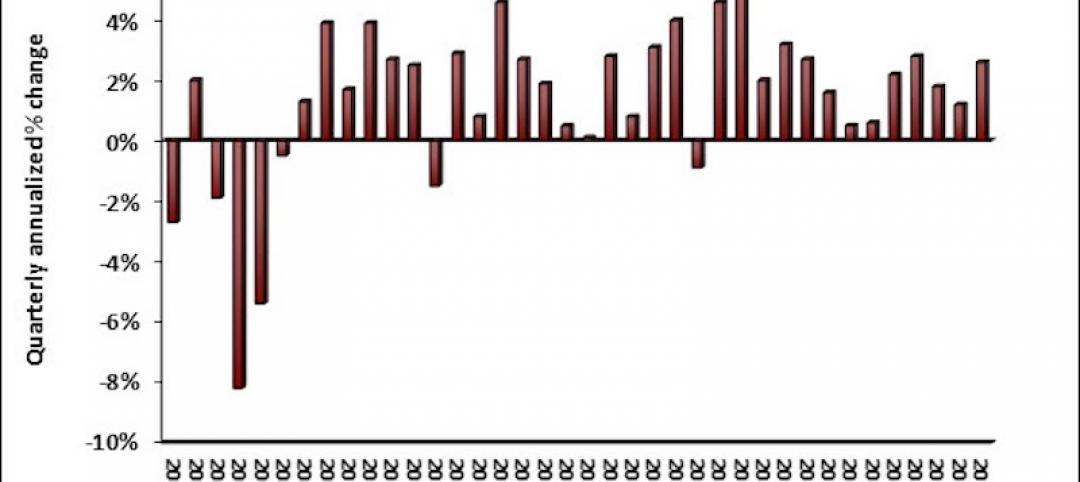

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

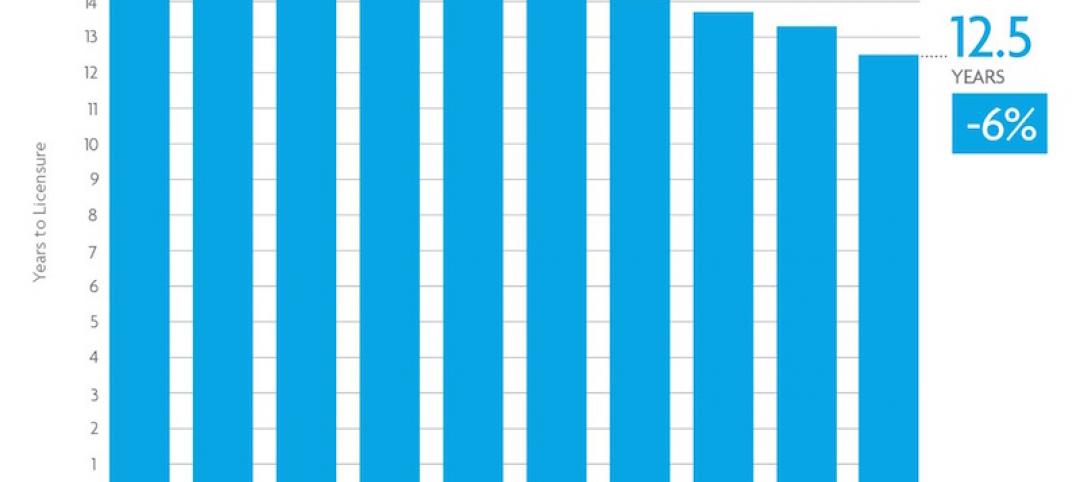

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

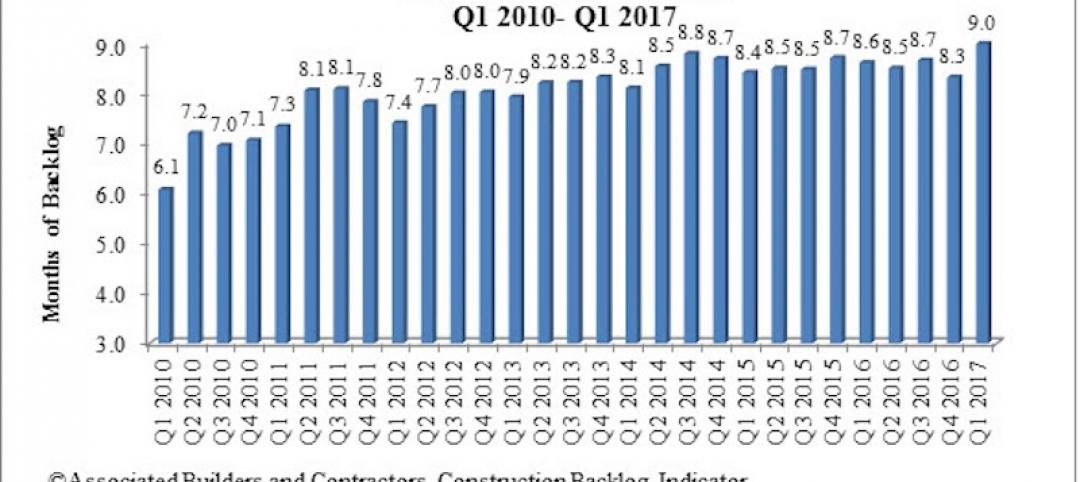

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.