Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth.

“We anticipate that rents will continue to increase modestly over the course of the year as demand has firmed, albeit at a more moderate rate in line with historic growth levels,” say Yardi Matrix experts in a newly released U.S. Multifamily Outlook.

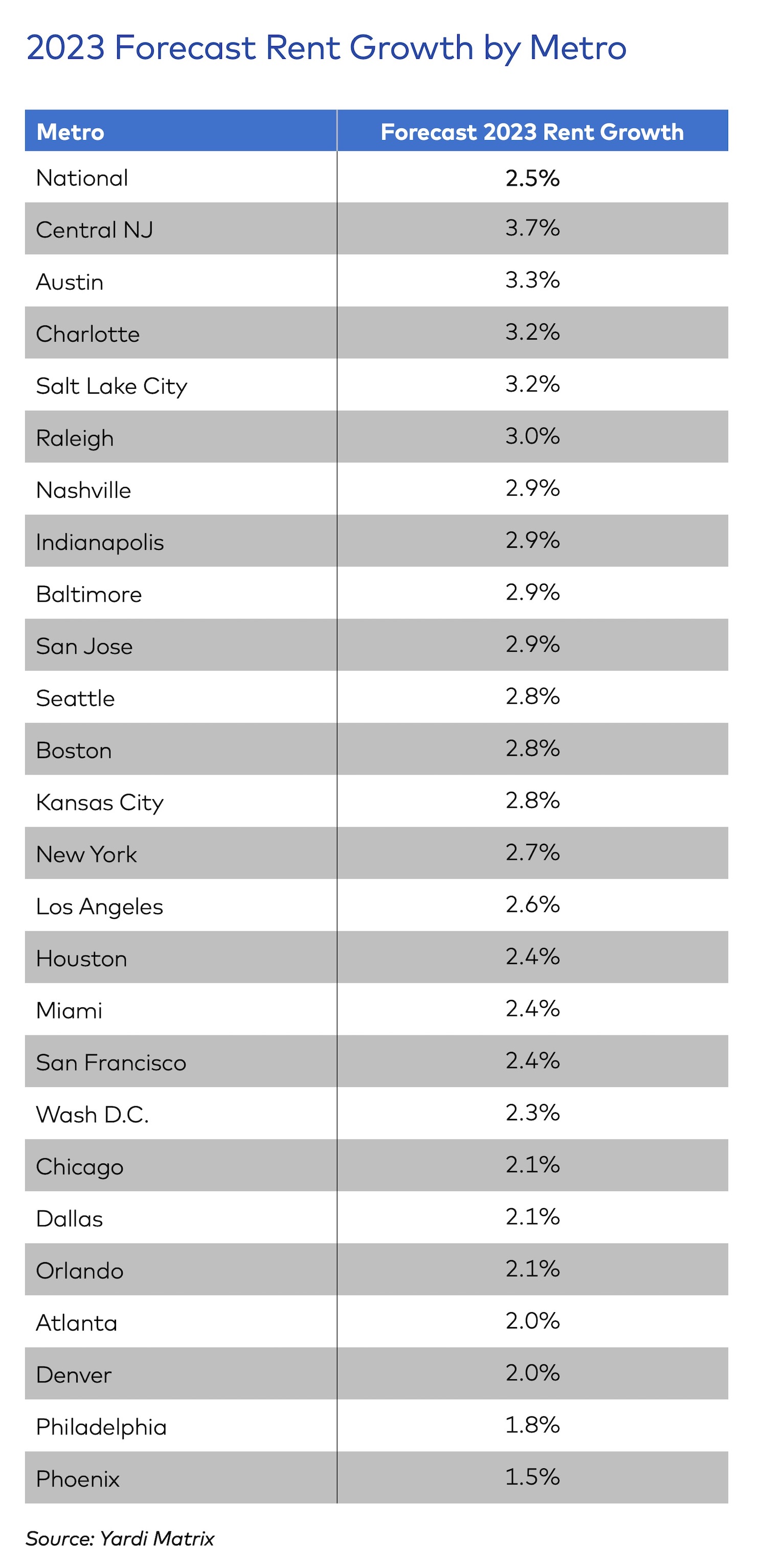

Through the first five months of 2023, U.S. asking rents rose $17, or 0.9%, with year-over-year growth falling to 2.6%.

“We expect continued deceleration, with rent growth of 2.5% for the full year,” states the outlook. The average U.S. apartment rent reached an all-time high of $1,716 in May.

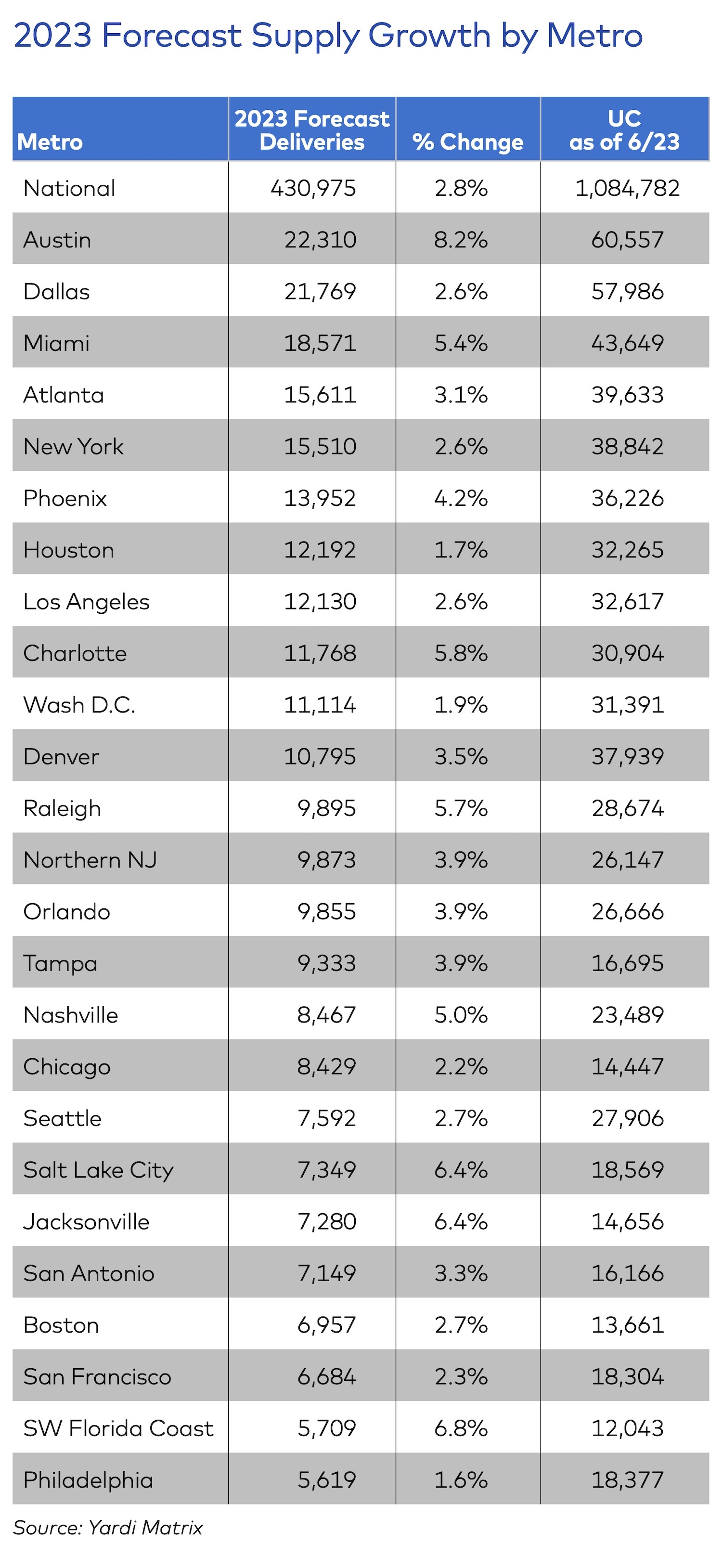

Challenges for the sector include slowing demand, growing issues with affordability, slower population growth and competition from a large number of new units coming online through 2024.

The capital side of the industry has suffered due to heightened interest rates, which show little sign of decreasing in the near-term. Property values are down 15-20% from their peak and are still declining due to the higher cost of capital.

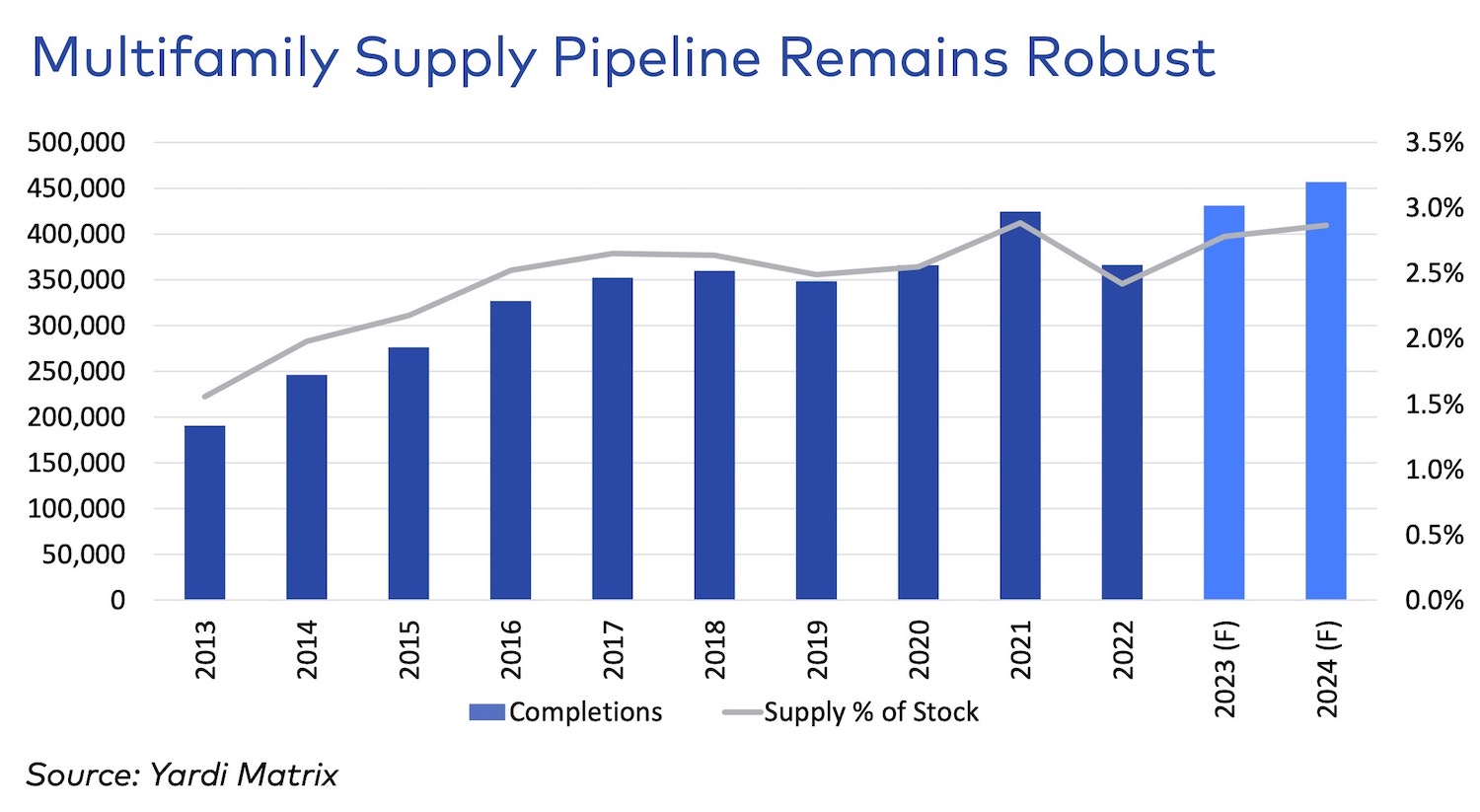

New deliveries will be high at least through the end of 2024, as the 1 million units under construction come online. New starts are now declining, however, because debt is more expensive and fewer banks are financing construction.

Household formation, which drove the 22% cumulative growth in U.S. asking rents over 2021 and 2022, has slowed but remains positive. Although some pandemic demographic trends are moderating, the desire for more space to balance living, working and family appears to have staying power and should continue to drive demand.

Demand is also boosted by the sharp drop in home sales, which keeps renters in apartments. High mortgage rates also create an affordability hurdle for first-time buyers and middle-income families looking to trade up.

Home mortgage rates rose to 6.5% in March 2023, up 230 basis points from March 2022, increasing monthly mortgage costs by 29% and overall ownership costs by 20%, according to the Harvard Joint Center of Housing Studies.

Related Stories

MFPRO+ New Projects | Aug 4, 2023

Nashville gets 'first-of-its-kind' residential tower

Global architecture firm Goettsch Partners announces the completion of Alcove, a new 356-unit residential tower in Nashville, Tenn., developed by Giarratana LLC.

Apartments | Aug 4, 2023

Anatomy of a model apartment

Page’s interior designers curate model units that harmoniously cater to a range of users, allowing visitors to see a once-empty room as a place of respite and a home.

Multifamily Housing | Jul 31, 2023

6 multifamily housing projects win 2023 LEED Homes Awards

The 2023 LEED Homes Awards winners in the multifamily space represent green, LEED-certified buildings designed to provide clean indoor air and reduced energy consumption.

MFPRO+ New Projects | Jul 27, 2023

OMA, Beyer Blinder Belle design a pair of sculptural residential towers in Brooklyn

Eagle + West, composed of two sculptural residential towers with complementary shapes, have added 745 rental units to a post-industrial waterfront in Brooklyn, N.Y. Rising from a mixed-use podium on an expansive site, the towers include luxury penthouses on the top floors, numerous market rate rental units, and 30% of units designated for affordable housing.

Affordable Housing | Jul 27, 2023

Houston to soon have 50 new residential units for youth leaving foster care

Houston will soon have 50 new residential units for youth leaving the foster care system and entering adulthood. The Houston Alumni and Youth (HAY) Center has broken ground on its 59,000-sf campus, with completion expected by July 2024. The HAY Center is a nonprofit program of Harris County Resources for Children and Adults and for foster youth ages 14-25 transitioning to adulthood in the Houston community.

Adaptive Reuse | Jul 27, 2023

Number of U.S. adaptive reuse projects jumps to 122,000 from 77,000

The number of adaptive reuse projects in the pipeline grew to a record 122,000 in 2023 from 77,000 registered last year, according to RentCafe’s annual Adaptive Reuse Report. Of the 122,000 apartments currently undergoing conversion, 45,000 are the result of office repurposing, representing 37% of the total, followed by hotels (23% of future projects).

Multifamily Housing | Jul 25, 2023

San Francisco seeks proposals for adaptive reuse of underutilized downtown office buildings

The City of San Francisco released a Request For Interest to identify office building conversions that city officials could help expedite with zoning changes, regulatory measures, and financial incentives.

High-rise Construction | Jul 25, 2023

World's largest market-rate, Phius Design-certified multifamily high-rise begins leasing

The Phius standard represents a "sweet spot" for aggressive decarbonization and energy reduction, while remaining cost-effective.

Designers | Jul 20, 2023

Mary Cook Associates brews up coffeehouse-inspired apartment community

The MCA design team worked closely with the developer and design architect to create an interior concept inspired by Decatur, Ga.’s, tree-lined streets, boutique retail, and vibrant restaurant and coffee shop scene.

Multifamily Housing | Jul 13, 2023

Walkable neighborhoods encourage stronger sense of community

Adults who live in walkable neighborhoods are more likely to interact with their neighbors and have a stronger sense of community than people who live in car-dependent communities, according to a report by the Herbert Wertheim School of Public Health and Human Longevity Science at University of California San Diego.