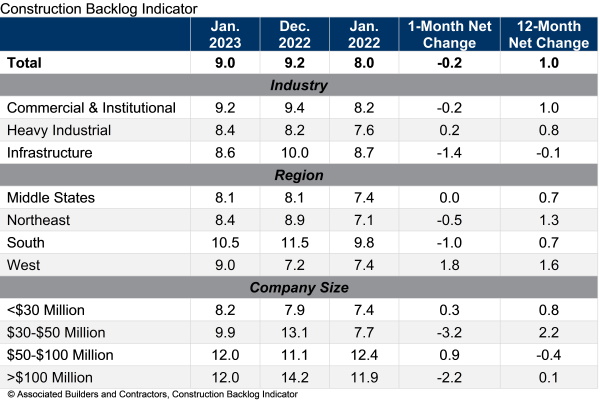

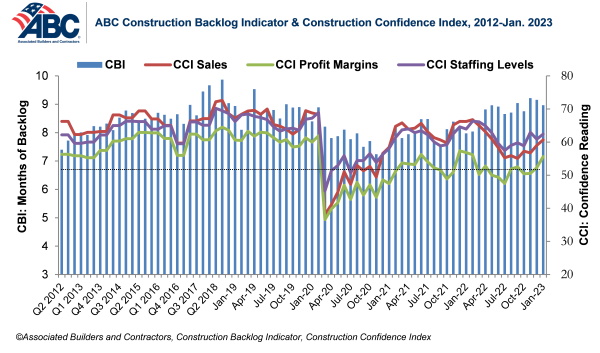

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for January. View the historical Construction Backlog Indicator and Construction Confidence Index data series.

Despite the decline in January, backlog remains elevated by historical standards and is 0.1 months higher than in February 2020, the month before the COVID-19 pandemic began to impact the economy.

ABC’s Construction Confidence Index reading for sales, profit margins and staffing levels increased in January. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“Despite extremely elevated borrowing costs, worker shortages and a generally downcast economic outlook, contractor confidence rebounded in January to a level not seen since the first half of 2022,” said ABC Chief Economist Anirban Basu. “Given the recent employment report, the U.S. economy continues to fend off recession. Some economists have concluded that rather than a hard or soft landing, the U.S. economy is headed for ‘no landing,’ meaning that economic growth will continue despite rising interest rates.

“However, the incredibly strong January jobs report makes it more likely that the Federal Reserve will maintain higher borrowing costs for a longer period,” said Basu. “Eventually, that could cause the economic expansion to unravel, perhaps later this year. That could set the stage for diminished backlog and less confidence for contractors that specialize in privately financed projects as 2024 approaches.”

Related Stories

| Jan 31, 2013

The Opus Group completes construction of corporate HQ for Church & Dwight Co.

The Opus Group announced today the completion of construction on a new 250,000-square-foot corporate headquarter campus for Church & Dwight Co., Inc., in Ewing Township, near Princeton, N.J.

| Jan 31, 2013

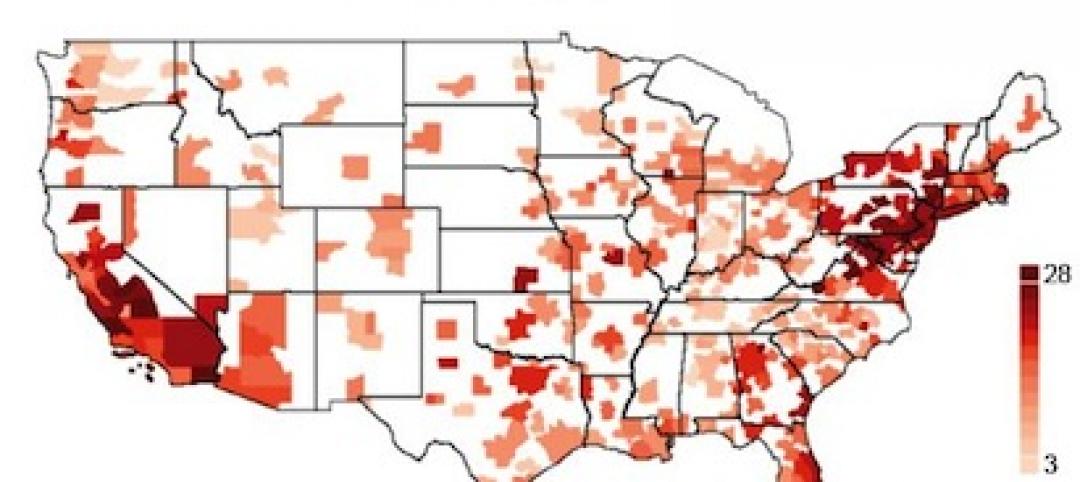

Map of U.S. illustrates planning times for commercial construction

Stephen Oliner, a UCLA professor doing research for the Federal Reserve Board, has made the first-ever estimate of planning times for commercial construction across the United States.

| Jan 29, 2013

Tutor Perini Corp. to Implement Textura Prequalification Management Companywide

Rollout across the Tutor Perini organization will enhance the subcontractor prequalification experience and enable a standardized process in support of the contractor default insurance program.

| Jan 22, 2013

Midwestern Construction Company Acquires Local Architecture Firm

St. Charles, Ill.-based design/build and construction firm acquires architecture firm.

| Jan 16, 2013

2013 40 Under 40 application process now open

Building Design+Construction's 40 Under 40 is open to AEC professionals from around the globe.

| Jan 15, 2013

Hill International selected as PM for Secon Nile Towers in Cairo

The Secon Nile Towers will feature two 23-story buildings: one five-star hotel tower and one residential and retail tower.

| Jan 10, 2013

Guide predicts strongest, weakest AEC markets for 2013

2013 Guide to U.S. AEC markets touts apartments, natural gas, senior housing and transmission and distribution.