In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

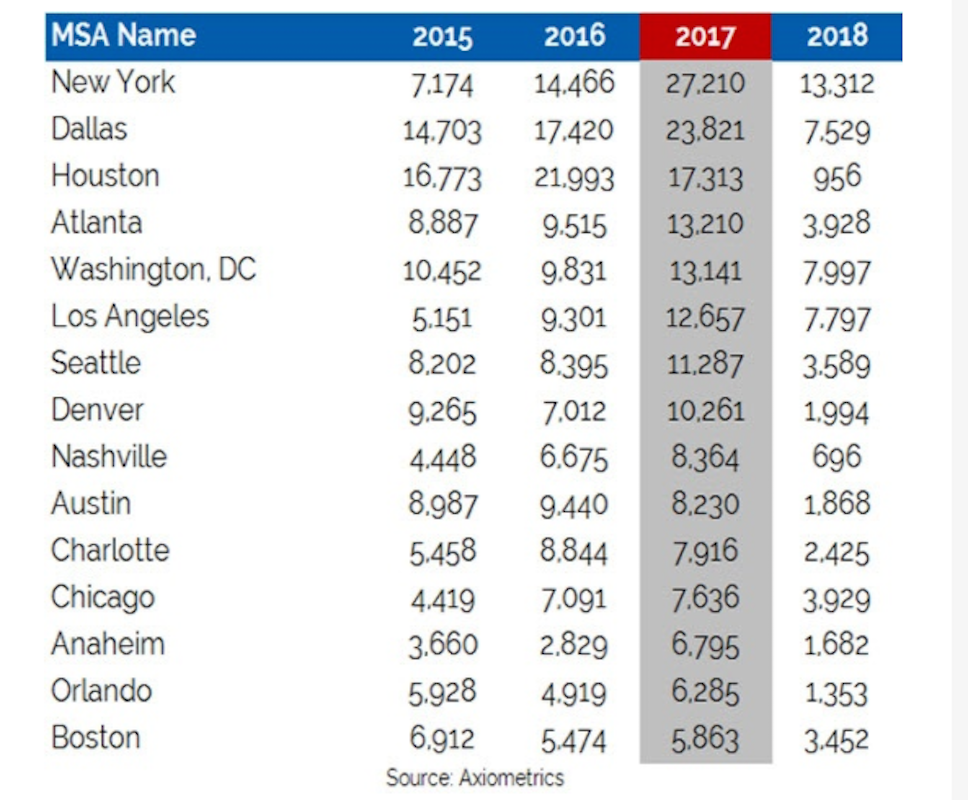

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

| Aug 23, 2013

Mack Urban, West Coast real estate and development firm, formed from intercompany collaboration

Urban Partners, LLC, Harbor Urban, LLC, and Mack Real Estate Group, three leading full service real estate firms known for high quality urban infill development, today announced the formation of Mack Urban, LLC, a premier West Coast real estate investment and development company.

| Aug 22, 2013

Energy-efficient glazing technology [AIA Course]

This course discuses the latest technological advances in glazing, which make possible ever more efficient enclosures with ever greater glazed area.

| Aug 22, 2013

6 visionary strategies for local government projects

Civic projects in Boston, Las Vegas, Austin, and suburban Atlanta show that a ‘big vision’ can also be a spur to neighborhood revitalization. Here are six visionary strategies for local government projects.

| Aug 21, 2013

Chicago's Magellan Development Group builds national presence with new luxury apartments

Chicago-based Magellan Development Group, one of the Midwest’s most prolific large-scale, mixed-use developers, is building a national footprint through two mixed-use projects in Minneapolis and Nashville.

| Aug 21, 2013

SummerHill Apartment Communities creates SoCal division, hires SVP, announces development plans

SummerHill Apartment Communities, a division of SummerHill Housing Group based in San Ramon, Calif., announced today that the firm has hired multifamily industry veteran Patrick S. Simons as senior vice president to lead SummerHill Apartment Communities' new Southern California division. Simons will be focused initially on creating a high volume of future projects throughout Southern California.

| Aug 14, 2013

Green Building Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest green design and construction firms.

| Jul 25, 2013

First look: Studio Gang's residential/dining commons for University of Chicago

The University of Chicago will build a $148 million residence hall and dining commons designed by Studio Gang Architects, tentatively slated for completion in 2016.

| Jul 19, 2013

Reconstruction Sector Construction Firms [2013 Giants 300 Report]

Structure Tone, DPR, Gilbane top Building Design+Construction's 2013 ranking of the largest reconstruction contractor and construction management firms in the U.S.

| Jul 19, 2013

Reconstruction Sector Engineering Firms [2013 Giants 300 Report]

URS, STV, Wiss Janney Elstner top Building Design+Construction's 2013 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 19, 2013

Reconstruction Sector Architecture Firms [2013 Giants 300 Report]

Stantec, HOK, HDR top Building Design+Construction's 2013 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.