In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

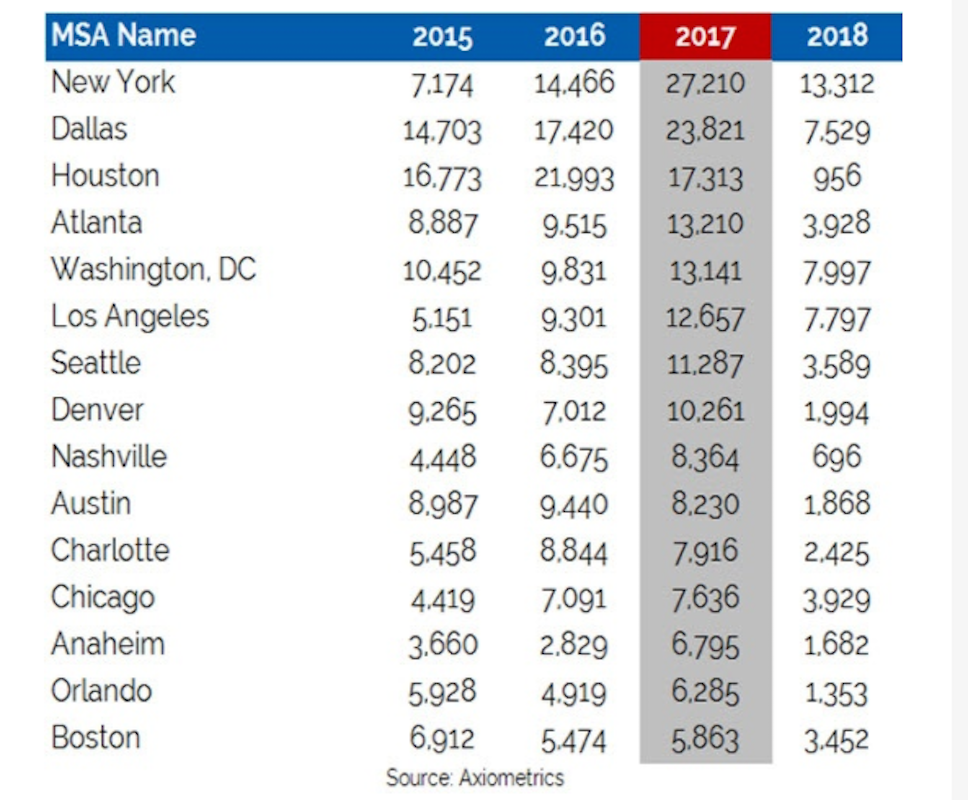

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

MFPRO+ News | Jun 3, 2024

Seattle mayor wants to scale back energy code to spur more housing construction

Seattle’s mayor recently proposed that the city scale back a scheduled revamping of its building energy code to help boost housing production. The proposal would halt an update to the city’s multifamily and commercial building energy code that is scheduled to take effect later this year.

Resiliency | Jun 3, 2024

Houston’s buyout program has prevented flood damage but many more homes at risk

Recent flooding in Houston has increased focus on a 30-year-old program to buy out some of the area’s most vulnerable homes. Storms dropped 23 inches of rain on parts of southeast Texas, leading to thousands of homes being flooded in low-lying neighborhoods around Houston.

MFPRO+ New Projects | May 29, 2024

Two San Francisco multifamily high rises install onsite water recycling systems

Two high-rise apartment buildings in San Francisco have installed onsite water recycling systems that will reuse a total of 3.9 million gallons of wastewater annually. The recycled water will be used for toilet flushing, cooling towers, and landscape irrigation to significantly reduce water usage in both buildings.

MFPRO+ News | May 28, 2024

ENERGY STAR NextGen Certification for New Homes and Apartments launched

The U.S. Environmental Protection Agency recently launched ENERGY STAR NextGen Certified Homes and Apartments, a voluntary certification program for new residential buildings. The program will increase national energy and emissions savings by accelerating the building industry’s adoption of advanced, energy-efficient technologies, according to an EPA news release.

MFPRO+ News | May 24, 2024

Austin, Texas, outlaws windowless bedrooms

Austin, Texas will no longer allow developers to build windowless bedrooms. For at least two decades, the city had permitted developers to build thousands of windowless bedrooms.

Mass Timber | May 22, 2024

3 mass timber architecture innovations

As mass timber construction evolves from the first decade of projects, we're finding an increasing variety of mass timber solutions. Here are three primary examples.

Mixed-Use | May 22, 2024

Multifamily properties above ground-floor grocers continue to see positive rental premiums

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land.

MFPRO+ News | May 21, 2024

Massachusetts governor launches advocacy group to push for more housing

Massachusetts’ Gov. Maura Healey and Lt. Gov. Kim Driscoll have taken the unusual step of setting up a nonprofit to advocate for pro-housing efforts at the local level. One Commonwealth Inc., will work to provide political and financial support for local housing initiatives, a key pillar of the governor’s agenda.

MFPRO+ News | May 21, 2024

Baker Barrios Architects announces new leadership roles for multifamily, healthcare design

Baker Barrios Architects announced two new additions to its leadership: Chris Powers, RA, AIA, NCARB, EDAC, as Associate Principal and Director (Healthcare); and Mark Kluemper, AIA, NCARB, as Associate Principal and Technical Director (Multifamily).

MFPRO+ News | May 20, 2024

Florida condo market roiled by structural safety standards law

A Florida law enacted after the Surfside condo tower collapse is causing turmoil in the condominium market. The law, which requires buildings to meet certain structural safety standards, is forcing condo associations to assess hefty fees to make repairs on older properties. In some cases, the cost per unit runs into six figures.