U.S. architecture firms have experienced a near complete recovery from the Great Recession, which has allowed firm leaders to reinvest profits back into their businesses. These findings, along with an in depth look at topics such as firm billings, staffing, and international work, are covered in The Business of Architecture: 2016 Firm Survey Report.

Key highlights include:

- Net billings at architecture firms were $28.5 billion at the peak of the market in 2008 and had nearly recovered to $28.4 billion by 2015.

- Percentage of firms reporting a financial loss declined sharply in recent years from more than 20% in 2011 to fewer than 10% by 2015.

- Growing profitability has allowed firms to increase their marketing activities and expand into new geographical areas and building types to diversity their design portfolios.

- Renovations made up a large portion of design work with 45% of building design billings coming from work on existing facilities, including 30% from additions to buildings, and the remaining from historic preservation projects.

- Billings in the residential sector topped $7 billion, more than 30% over 2013 levels.

- Modest gains in diversity of profession with women now comprising 31% of architecture staff (up from 28% in 2013) and minorities making up 21% of staff (up from 20% in 2013).

- Use of Building Information Modeling (BIM) software has become standard at larger firms with 96% of firms with 50 or more employees report using it for billable work (compared to 72% of mid-sized firms and 28% of small firms).

- Newer technologies including 3D printing and 4D/5D modeling are reported being used at only 11% and 8% of firms respectively.

- Energy modeling currently has a low adoption rate with 13% of firms using it for billable work, although this share jumps to 59% for large firms.

“In the coming years we expect firms will be adding technological dimensions to their design work through greater utilization of cloud computing, 3D printing and the use of virtual reality software. This should help further efficiencies, minimize waste and project delivery delays, and lead to increased bottom line outcomes for their clients,” says AIA senior director of research, Michele Russo in a press release.

Related Stories

Market Data | Aug 12, 2021

Steep rise in producer prices for construction materials and services continues in July.

The producer price index for new nonresidential construction rose 4.4% over the past 12 months.

Market Data | Aug 6, 2021

Construction industry adds 11,000 jobs in July

Nonresidential sector trails overall recovery.

Market Data | Aug 2, 2021

Nonresidential construction spending falls again in June

The fall was driven by a big drop in funding for highway and street construction and other public work.

Market Data | Jul 29, 2021

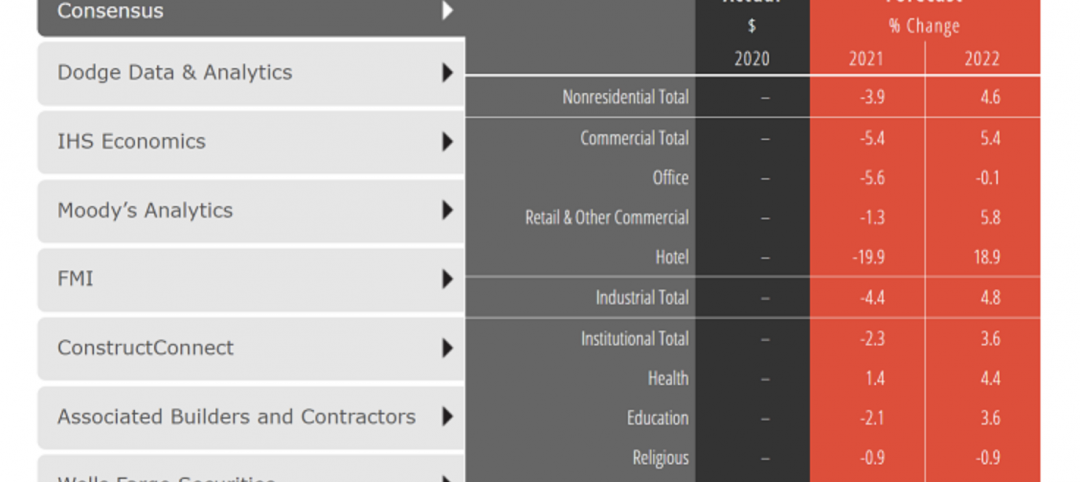

Outlook for construction spending improves with the upturn in the economy

The strongest design sector performers for the remainder of this year are expected to be health care facilities.

Market Data | Jul 29, 2021

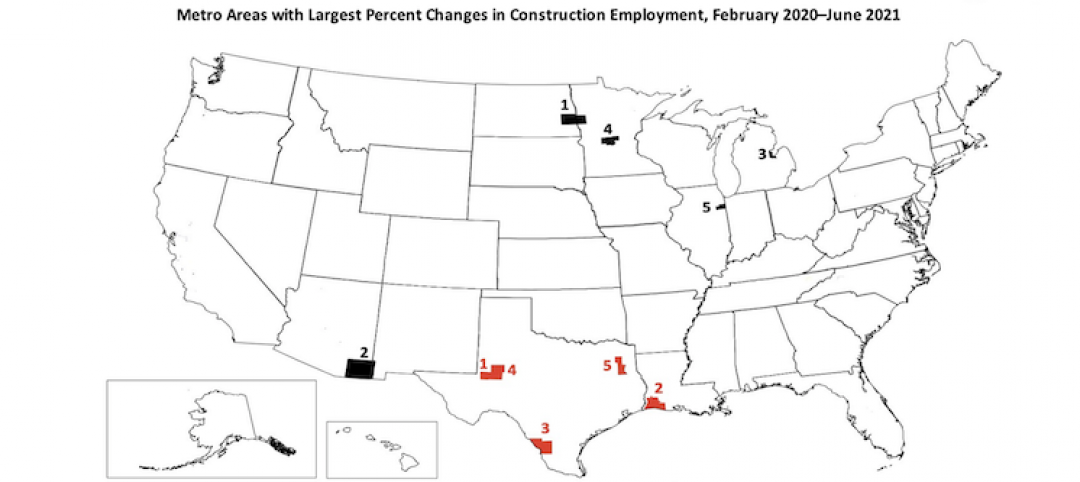

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.