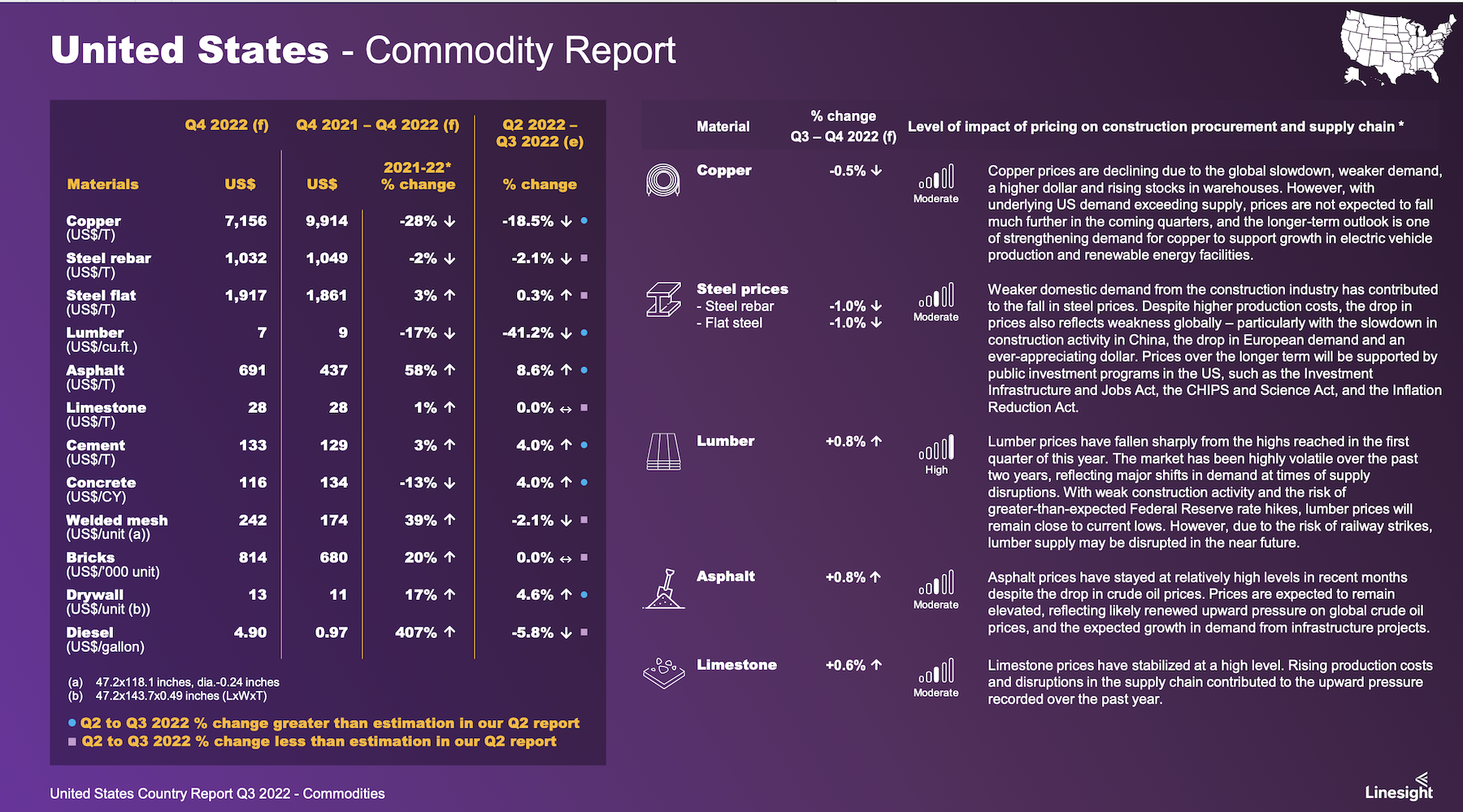

Commercial and institutional construction spending is projected to be down 6.9 percent and 13 percent, respectively, in 2022, impacted by macroeconomic factors that include increasing demand for long-lead equipment, material shortages caused by supply-chain snags and the Russia-Ukraine war, and the instability of costs for fuel and labor.

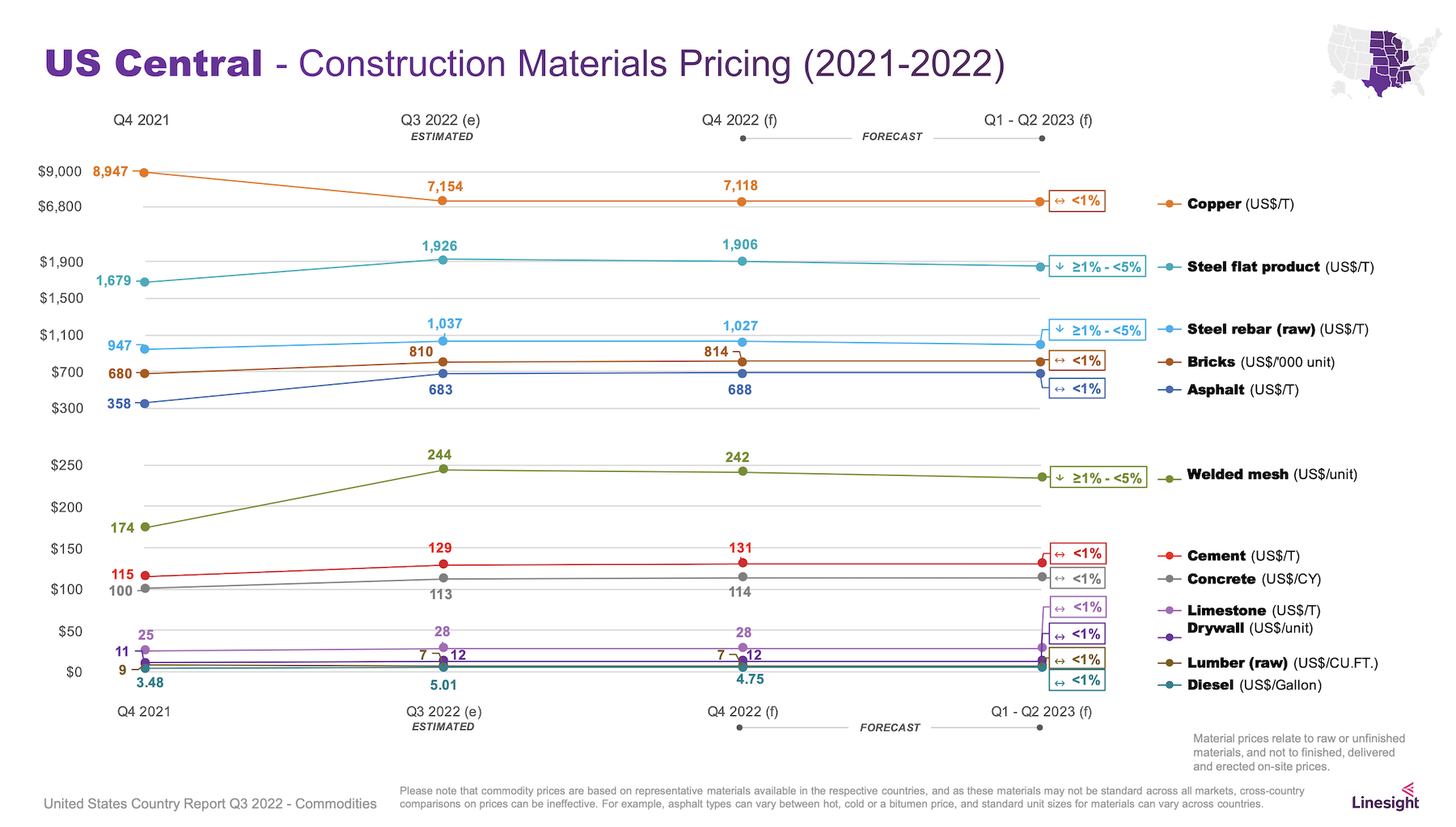

That easing of demand has allowed key commodity prices to stabilize, and there is reason for optimism despite uncertainty about the health of the U.S economy that is only expected to expand by 1 percent next year.

This is the perspective of Linesight, a multinational construction consultant, which has released its Third Quarter Commodity Report for the United States. Patrick Ryan, Linesight’s Executive Vice President for the Americas, states that the “medium to long-term outlook remains positive, with [economic] growth expected in the coming years as inflation comes under control.”

The Report focuses on five key commodities:

•Lumber, whose prices have been on a downward trend since the first quarter. Supply-side fragilities have eased, as post-flood mill inventory in British Columbia is rebuilding.

•Cement and aggregates, whose prices have been affected by oil price turbulence. Linesight sees the slowdown in residential construction as easing pressure on this commodity’s demand, although that could also be negated by commercial demand spurred by the Infrastructure Investment and Jobs Act of 2021.

•Concrete blocks and bricks, whose prices are waning along with residential construction demand that is tamped by rising mortgage interest rates.

•Rebar and structural steel, whose prices had flattened during the previous quarter, and whose weakening future demand, especially from China, anticipates falling prices. However, Linesight also cautions that high energy prices continue to drive up steel’s production costs.

•Copper, whose price declines of late have stabilized. Supply disruptions and the lack of investment in new mining operations continue to contribute to production shortfalls, and demand remains “resilient,” especially as the manufacture of electric vehicle batteries expands.

The Report prognosticates as well about pricing for asphalt, limestone, welded mesh, drywall, and diesel fuel. It also forecasts commodity prices by regions of the country, although the geographic variations are, for the most part, marginal.

Perhaps the most important issue right now affecting commodity prices, says Ryan, is mixed data on the economy. Despite two consecutive quarterly declines, “there are positive indicators being recorded to suggest economic resilience in some key areas,” such as the lowest unemployment rate in five decades, and the Federal Reserve’s aggressive actions to curb inflation.

Another bright spot is labor productivity in the U.S., which still outpaces Germany, the United Kingdom, Hong Kong, Taiwan, South Korea, and Japan.

Related Stories

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Market Data | Nov 14, 2023

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of September 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.4 months in October from 9.0 months in September, according to an ABC member survey conducted from Oct. 19 to Nov. 2. The reading is down 0.4 months from October 2022. Backlog now stands at its lowest level since the first quarter of 2022.

Multifamily Housing | Nov 9, 2023

Multifamily project completions forecast to slow starting 2026

Yardi Matrix has released its Q4 2023 Multifamily Supply Forecast, emphasizing a short-term spike and plateau of new construction.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Market Data | Oct 23, 2023

New data finds that the majority of renters are cost-burdened

The most recent data derived from the 2022 Census American Community Survey reveals that the proportion of American renters facing housing cost burdens has reached its highest point since 2012, undoing the progress made in the ten years leading up to the pandemic.

Contractors | Oct 19, 2023

Crane Index indicates slowing private-sector construction

Private-sector construction in major North American cities is slowing, according to the latest RLB Crane Index. The number of tower cranes in use declined 10% since the first quarter of 2023. The index, compiled by consulting firm Rider Levett Bucknall (RLB), found that only two of 14 cities—Boston and Toronto—saw increased crane counts.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.