The majority of commercial and industrial contractors are confident about sales growth, profits and staffing levels heading into 2018, according to the latest Associated Builders and Contractors (ABC) Construction Confidence Index (CCI). Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

“There are many reasons for confidence among the nation’s construction firm leaders,” said ABC Chief Economist Anirban Basu. “American wealth has never been greater in absolute terms as the economy experiences faster wage growth, surging equity markets and rising home values. Consumer confidence is at a 17-year high, while unemployment is at a 17-year low.

“Despite the completion of approximately eight and a half years of economic recovery, both inflation and interest rates remain low,” said Basu. “The combination of elevated wealth and confidence with low borrowing costs drives spending and investment, which supports higher demand for construction services.”

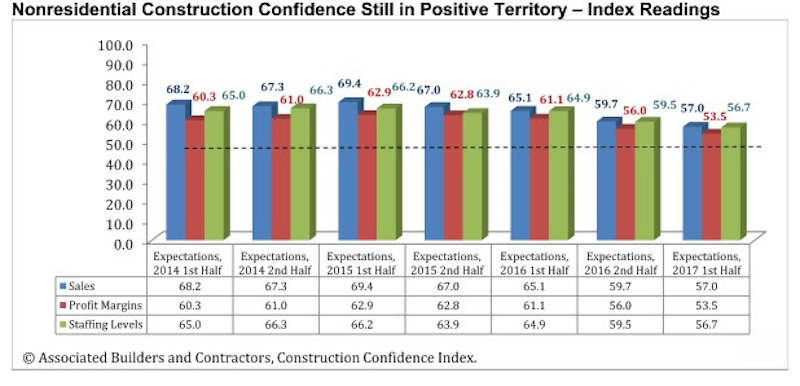

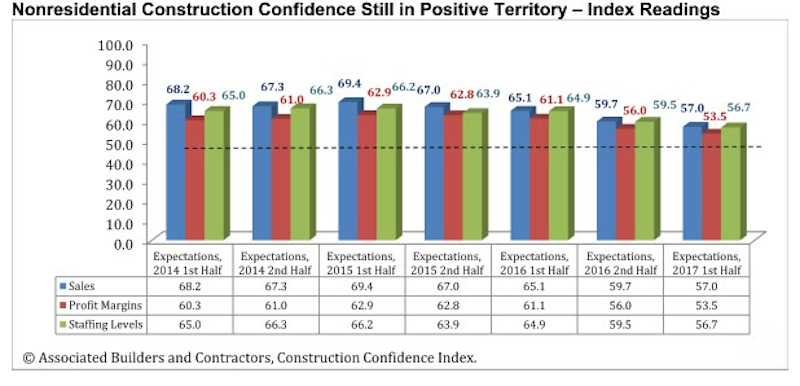

All three diffusion indices in the survey remain above the threshold of 50, which signals ongoing optimism.

The CCI for sales expectations fell from 59.7 to 57;

The CCI for profit margin expectations fell from 56 to 53.5;

The CCI for staffing levels fell from 59.5 to 56.7.

In recent quarters, certain commercial segments have been prone to generate especially large increases in construction spending. These include lodging, office and amusement/recreation. Therefore, commercial contractors are particularly upbeat. Contractors whose businesses rely more heavily on public work remain less ebullient.

The following chart reflects the distribution of responses to ABC’s most recent surveys.

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.