The majority of commercial and industrial contractors are confident about sales growth, profits and staffing levels heading into 2018, according to the latest Associated Builders and Contractors (ABC) Construction Confidence Index (CCI). Despite rising construction labor and materials costs, 55% of contractors expect their profit margins to expand in the first half of 2018.

“There are many reasons for confidence among the nation’s construction firm leaders,” said ABC Chief Economist Anirban Basu. “American wealth has never been greater in absolute terms as the economy experiences faster wage growth, surging equity markets and rising home values. Consumer confidence is at a 17-year high, while unemployment is at a 17-year low.

“Despite the completion of approximately eight and a half years of economic recovery, both inflation and interest rates remain low,” said Basu. “The combination of elevated wealth and confidence with low borrowing costs drives spending and investment, which supports higher demand for construction services.”

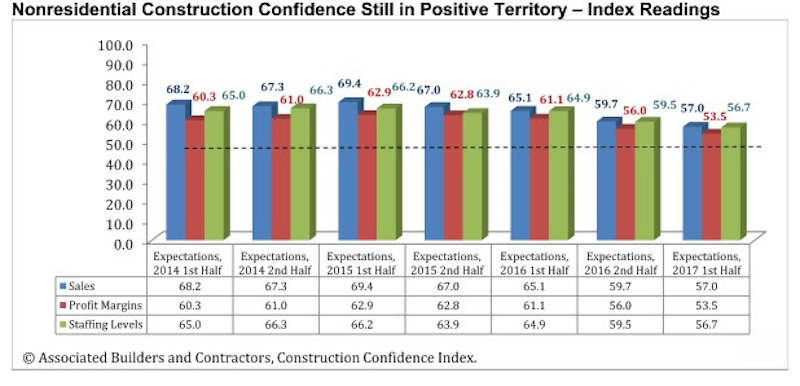

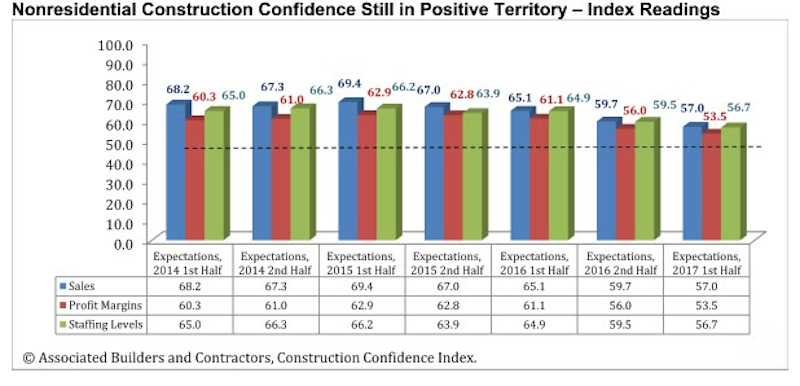

All three diffusion indices in the survey remain above the threshold of 50, which signals ongoing optimism.

The CCI for sales expectations fell from 59.7 to 57;

The CCI for profit margin expectations fell from 56 to 53.5;

The CCI for staffing levels fell from 59.5 to 56.7.

In recent quarters, certain commercial segments have been prone to generate especially large increases in construction spending. These include lodging, office and amusement/recreation. Therefore, commercial contractors are particularly upbeat. Contractors whose businesses rely more heavily on public work remain less ebullient.

The following chart reflects the distribution of responses to ABC’s most recent surveys.

Related Stories

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.