All key construction measures for multifamily housing rose by double-digit percentages in 2015, and demand for rentals (which continue to account for the lion’s share of that construction) is expected to remain robust over the next decade, according to “The State of the Nation’s Housing Market 2016,” which the Joint Center for Housing Studies at Harvard University released today.

That’s good news and bad news for renters, as vacancy rates continue to fall and rents continue to rise.

Growth in multifamily starts topped 10% for the fifth consecutive year in 2015, reaching a 27-year high of 397,300 units. Multifamily accounted for more than 30% of all housing starts last year, and permits—the barometer of future construction—rose 18.2% to 486,600 units.

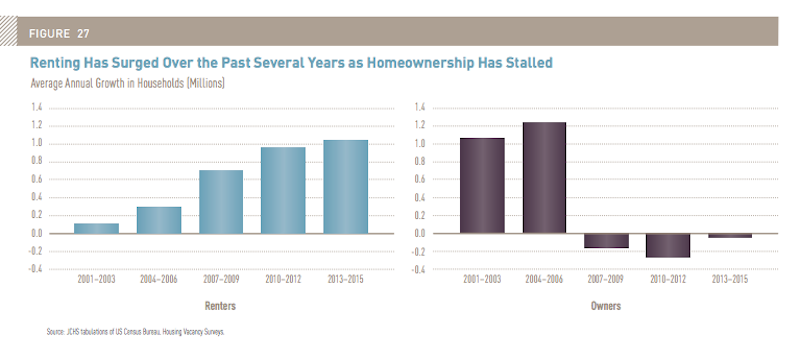

More than 36% of all U.S. households opted to rent last year, the largest share since the late 1960s. Over the past decade, in fact, the number of renters increased by over nine million, the largest 10-year gain on record, with palpable demand across all age groups, income levels, and household types.

The number of renters increased by 9 million in the past decade, the largest 10-year gain on record. Image: Joint Center for Housing Studies' “The State of the Nation's Housing Market”

Somewhat counter-intuitively, given all the press about Millennials not being able to afford to buy a house, Current Population Survey data indicate that much of the jump in rental demand is coming from middle-aged households. Renters in their 50s and 60s rose by 4.3 million between 2005 and 2015. Renters aged 70 or older increased by more than 600,000 during that decade. And even though their cohort’s population actually dipped a bit, households in their 30s and 40s accounted for three million net new renters.

Households under age 30, by comparison, made up only one million net new renters. “reflecting the steep falloff in headship rates among the Millennial generation following the Great Recession,” according to the Harvard report.

The micro-apartment trend for urban markets seems to be having a greater impact on what’s being built overall. The median size of multifamily units fell from nearly 1,200 sf at the 2007 peak to 1,074 sf in 2015, reflecting the shift in the focus of development from the owner to the rental market.

Many new multifamily units are in large structures, with nearly half of the units completed in 2014 in buildings with 50 or more apartments. And about 36 percent of all new multifamily units added between 2000 and 2014 were in high-density neighborhoods, and another 30 percent each in medium- and low-density sections of metro areas. Even so, growth in the multifamily housing stock during this period was even more rapid in rural areas (up 24 percent) than in urban areas (up 19 percent).

The Joint Center has long decried the scarcity of affordable housing in the U.S. A sizable percentage of the multifamily buildings under construction targets higher-end and luxury renters. In addition, the rental vacancy rate last year fell to a 30-year low of 7.1%, a telling indication that supply isn’t keeping up with demand, and that rent appreciation is likely to present challenges for renters at all income levels.

Still, the report postulates that expanding construction of market-rate multifamily product “should provide some slack to tight markets, as older units slowly filter down from higher to lower rents.” And if construction sates high-end demand, “developers in some areas may turn their attention to middle-market rentals,” the report speculates.

The report acknowledges, however, that high development costs make building new units of affordable or even moderate-income multifamily difficult without government subsidies. And absent of public subsidies, “the cost of a typical market-rate rental unit will remain out of reach for the nation’s lowest-income households.”

The Joint Center concludes that with housing assistance insufficient to help most of those in need, “the limited supply of low-cost units promises to keep the pressure on all renters at the lower end of the income scale.”

It’s still not certain how these dynamics will impact homeownership, even when buying is still more affordable than renting in 58% of U.S. markets, according to RealtyTrac’s 2016 Rental Affordability Analysis.

“Renters in 2016 will be caught between a bit of a rock and a hard place, with rents becoming less affordable as they rise faster than wages, but home prices rising even faster than rents,” said Daren Blomquist, Vice President at RealtyTrac. “In markets where home prices are still relatively affordable, 2016 may be a good time for some renters to take the plunge into homeownership before rising prices and possibly rising interest rates make it increasingly tougher to afford to buy a home.”

Related Stories

Transit Facilities | Dec 4, 2023

6 guideposts for cities to create equitable transit-oriented developments

Austin, Texas, has developed an ETOD Policy Toolkit Study to make transit-oriented developments more equitable for current and future residents and businesses.

Multifamily Housing | Nov 30, 2023

A lasting housing impact: Gen-Z redefines multifamily living

Nathan Casteel, Design Leader, DLR Group, details what sets an apartment community apart for younger generations.

Products and Materials | Nov 30, 2023

Top building products for November 2023

BD+C Editors break down 15 of the top building products this month, from horizontal sliding windows to discreet indoor air infusers.

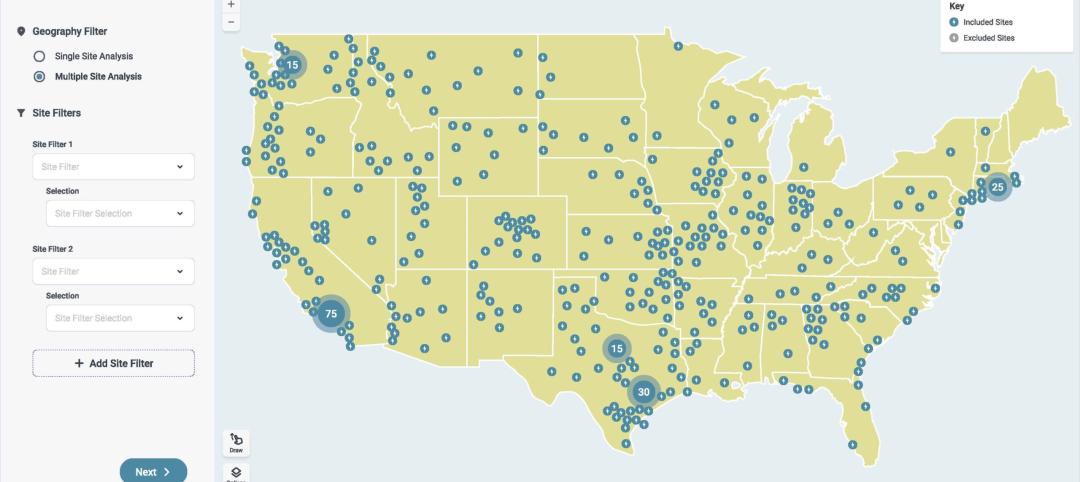

Engineers | Nov 27, 2023

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

MFPRO+ Blog | Nov 27, 2023

7 ways multifamily designers can promote wellness in urban communities

Shepley Bulfinch's Natalie Shutt-Banks, AIA, identifies design elements that multifamily developers can use to maximize space while creating a positive impact on residents and the planet

MFPRO+ New Projects | Nov 21, 2023

An 'eco-obsessed' multifamily housing project takes advantage of downtown Austin’s small lots

In downtown Austin, Tex., architecture firm McKinney York says it built Capitol Quarters to be “eco-obsessed, not just eco-minded.” With airtight walls, better insulation, and super-efficient VRF (variable refrigerant flow) systems, Capitol Quarters uses 30% less energy than other living spaces in Austin, according to a statement from McKinney York.

MFPRO+ News | Nov 21, 2023

California building electrification laws could prompt more evictions and rent increases

California laws requiring apartment owners to ditch appliances that use fossil fuels could prompt more evictions and rent increases in the state, according to a report from the nonprofit Strategic Actions for a Just Economy. The law could spur more evictions if landlords undertake major renovations to comply with the electrification rule.

MFPRO+ News | Nov 21, 2023

Underused strip malls offer great potential for conversions to residential use

Replacing moribund strip malls with multifamily housing could make a notable dent in the housing shortage and revitalize under-used properties across the country, according to a report from housing nonprofit Enterprise Community Partners.

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.