All key construction measures for multifamily housing rose by double-digit percentages in 2015, and demand for rentals (which continue to account for the lion’s share of that construction) is expected to remain robust over the next decade, according to “The State of the Nation’s Housing Market 2016,” which the Joint Center for Housing Studies at Harvard University released today.

That’s good news and bad news for renters, as vacancy rates continue to fall and rents continue to rise.

Growth in multifamily starts topped 10% for the fifth consecutive year in 2015, reaching a 27-year high of 397,300 units. Multifamily accounted for more than 30% of all housing starts last year, and permits—the barometer of future construction—rose 18.2% to 486,600 units.

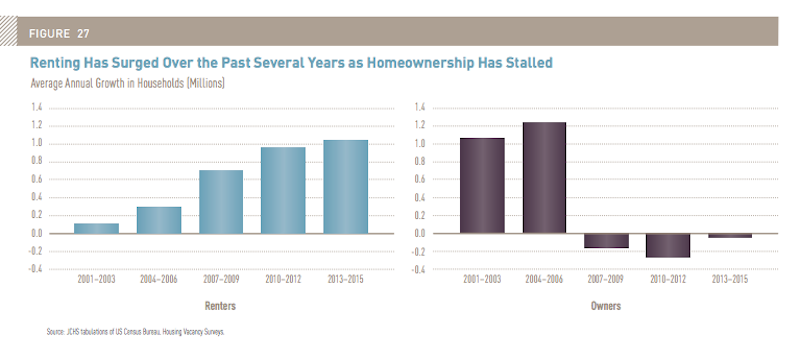

More than 36% of all U.S. households opted to rent last year, the largest share since the late 1960s. Over the past decade, in fact, the number of renters increased by over nine million, the largest 10-year gain on record, with palpable demand across all age groups, income levels, and household types.

The number of renters increased by 9 million in the past decade, the largest 10-year gain on record. Image: Joint Center for Housing Studies' “The State of the Nation's Housing Market”

Somewhat counter-intuitively, given all the press about Millennials not being able to afford to buy a house, Current Population Survey data indicate that much of the jump in rental demand is coming from middle-aged households. Renters in their 50s and 60s rose by 4.3 million between 2005 and 2015. Renters aged 70 or older increased by more than 600,000 during that decade. And even though their cohort’s population actually dipped a bit, households in their 30s and 40s accounted for three million net new renters.

Households under age 30, by comparison, made up only one million net new renters. “reflecting the steep falloff in headship rates among the Millennial generation following the Great Recession,” according to the Harvard report.

The micro-apartment trend for urban markets seems to be having a greater impact on what’s being built overall. The median size of multifamily units fell from nearly 1,200 sf at the 2007 peak to 1,074 sf in 2015, reflecting the shift in the focus of development from the owner to the rental market.

Many new multifamily units are in large structures, with nearly half of the units completed in 2014 in buildings with 50 or more apartments. And about 36 percent of all new multifamily units added between 2000 and 2014 were in high-density neighborhoods, and another 30 percent each in medium- and low-density sections of metro areas. Even so, growth in the multifamily housing stock during this period was even more rapid in rural areas (up 24 percent) than in urban areas (up 19 percent).

The Joint Center has long decried the scarcity of affordable housing in the U.S. A sizable percentage of the multifamily buildings under construction targets higher-end and luxury renters. In addition, the rental vacancy rate last year fell to a 30-year low of 7.1%, a telling indication that supply isn’t keeping up with demand, and that rent appreciation is likely to present challenges for renters at all income levels.

Still, the report postulates that expanding construction of market-rate multifamily product “should provide some slack to tight markets, as older units slowly filter down from higher to lower rents.” And if construction sates high-end demand, “developers in some areas may turn their attention to middle-market rentals,” the report speculates.

The report acknowledges, however, that high development costs make building new units of affordable or even moderate-income multifamily difficult without government subsidies. And absent of public subsidies, “the cost of a typical market-rate rental unit will remain out of reach for the nation’s lowest-income households.”

The Joint Center concludes that with housing assistance insufficient to help most of those in need, “the limited supply of low-cost units promises to keep the pressure on all renters at the lower end of the income scale.”

It’s still not certain how these dynamics will impact homeownership, even when buying is still more affordable than renting in 58% of U.S. markets, according to RealtyTrac’s 2016 Rental Affordability Analysis.

“Renters in 2016 will be caught between a bit of a rock and a hard place, with rents becoming less affordable as they rise faster than wages, but home prices rising even faster than rents,” said Daren Blomquist, Vice President at RealtyTrac. “In markets where home prices are still relatively affordable, 2016 may be a good time for some renters to take the plunge into homeownership before rising prices and possibly rising interest rates make it increasingly tougher to afford to buy a home.”

Related Stories

MFPRO+ News | Jun 3, 2024

Seattle mayor wants to scale back energy code to spur more housing construction

Seattle’s mayor recently proposed that the city scale back a scheduled revamping of its building energy code to help boost housing production. The proposal would halt an update to the city’s multifamily and commercial building energy code that is scheduled to take effect later this year.

Resiliency | Jun 3, 2024

Houston’s buyout program has prevented flood damage but many more homes at risk

Recent flooding in Houston has increased focus on a 30-year-old program to buy out some of the area’s most vulnerable homes. Storms dropped 23 inches of rain on parts of southeast Texas, leading to thousands of homes being flooded in low-lying neighborhoods around Houston.

MFPRO+ New Projects | May 29, 2024

Two San Francisco multifamily high rises install onsite water recycling systems

Two high-rise apartment buildings in San Francisco have installed onsite water recycling systems that will reuse a total of 3.9 million gallons of wastewater annually. The recycled water will be used for toilet flushing, cooling towers, and landscape irrigation to significantly reduce water usage in both buildings.

MFPRO+ News | May 28, 2024

ENERGY STAR NextGen Certification for New Homes and Apartments launched

The U.S. Environmental Protection Agency recently launched ENERGY STAR NextGen Certified Homes and Apartments, a voluntary certification program for new residential buildings. The program will increase national energy and emissions savings by accelerating the building industry’s adoption of advanced, energy-efficient technologies, according to an EPA news release.

MFPRO+ News | May 24, 2024

Austin, Texas, outlaws windowless bedrooms

Austin, Texas will no longer allow developers to build windowless bedrooms. For at least two decades, the city had permitted developers to build thousands of windowless bedrooms.

Mass Timber | May 22, 2024

3 mass timber architecture innovations

As mass timber construction evolves from the first decade of projects, we're finding an increasing variety of mass timber solutions. Here are three primary examples.

Mixed-Use | May 22, 2024

Multifamily properties above ground-floor grocers continue to see positive rental premiums

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land.

MFPRO+ News | May 21, 2024

Massachusetts governor launches advocacy group to push for more housing

Massachusetts’ Gov. Maura Healey and Lt. Gov. Kim Driscoll have taken the unusual step of setting up a nonprofit to advocate for pro-housing efforts at the local level. One Commonwealth Inc., will work to provide political and financial support for local housing initiatives, a key pillar of the governor’s agenda.

MFPRO+ News | May 21, 2024

Baker Barrios Architects announces new leadership roles for multifamily, healthcare design

Baker Barrios Architects announced two new additions to its leadership: Chris Powers, RA, AIA, NCARB, EDAC, as Associate Principal and Director (Healthcare); and Mark Kluemper, AIA, NCARB, as Associate Principal and Technical Director (Multifamily).

MFPRO+ News | May 20, 2024

Florida condo market roiled by structural safety standards law

A Florida law enacted after the Surfside condo tower collapse is causing turmoil in the condominium market. The law, which requires buildings to meet certain structural safety standards, is forcing condo associations to assess hefty fees to make repairs on older properties. In some cases, the cost per unit runs into six figures.