Investors in healthcare buildings view multi-tenant medical offices as their best bets for returns on investments whose financing, to an increasing degree, leans toward cash rather than debt.

Those are some of the findings in a 15-page report that CBRE’s U.S. Healthcare Capital Markets Group has released, based on responses from 80 healthcare real estate investors answering 26 questions. The largest group of respondents (32%) was healthcare real estate developers, followed by healthcare REITs and private capital healthcare investors (27% each).

Nearly one-third (32%) of all respondents say they target transactions that fall between $20 million and $50 million. Another 31% say that their preferred transaction range is $10 million to $20 million. Nearly all of the respondents—96%—are most interested in medical office buildings as the type of building that meets their acquisition criteria. The next preferred building type is ambulatory surgery centers (63%), wellness centers (41%), and assisted living facilities (39%).

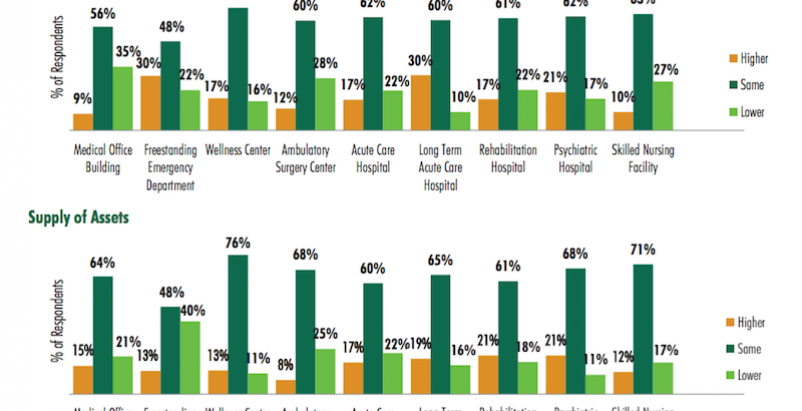

With some notable exceptions, supply (lower row) and demand (upper row) of acqusition properties in the healthcare building sector is expected to be about this same this year as it was in 2015, according to a survey of 80 healthcare real estate investors. Image: CBRE

With some notable exceptions, supply (lower row) and demand (upper row) of acqusition properties in the healthcare building sector is expected to be about this same this year as it was in 2015, according to a survey of 80 healthcare real estate investors. Image: CBRE

The total amount of equity that firms allocated for healthcare real estate investment this year, nearly $14.5 billion, was about 7% less than the $15.5 billion estimate from the 2015 survey. But the 2016 number is still considerably higher than estimates in the years 2011 through 2014, and is actually 132% of the total market transaction volume that traded in the healthcare sector in 2015.

The greatest portion of respondents (29%) says leveraged internal rate of return (IRR) is the investment return measurement they rely on most. However, that’s down from 33% in the 2015 survey. On the other hand, all-cash IRR saw a big jump—to 22% from 12% in 2015—as a relied-upon investment metric.

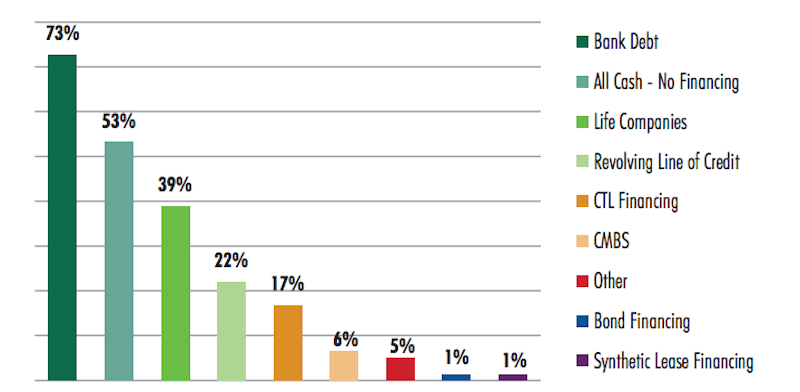

Interestingly, all-cash financing finished second, behind bank debt, as the type of financing the respondents used. Nearly nine of 10 REITs surveyed say they would use all-cash financing, whereas more than three-quarters of the developers would use bank debt to pay for their investments.

Healthcare REITs says they are more disposed to pay cash for acquisitions of medical office buildings, versus developers that lean more thoward bank financing of their deals. Image: CBRE

There’s wide variation in how long respondents hold onto healthcare investments. The greatest number—31%—say 10 years or more. But another 23% say they will hold only an investment for between five and seven years, and the same percentage are holding onto properties for only two and four year.

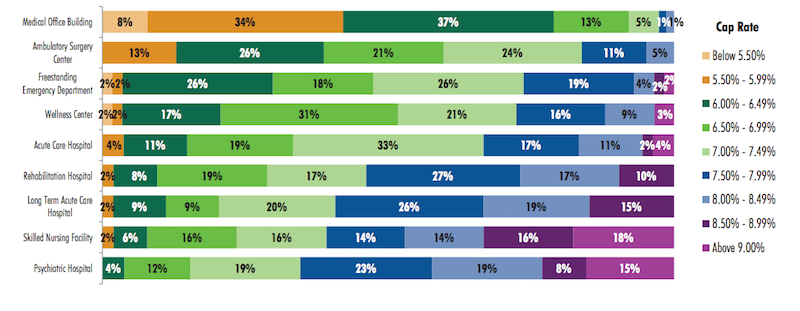

Class A on-campus medical office buildings are the healthcare product type that continues to price most aggressively, vis-à-vis Class A off-campus medical offices, although the differences are narrowing, according to this year’s survey. About 49% of respondents indicate that a market cap rate for Class A on-campus medical offices would be below 6%, compared to 53% who say the cap rate for Class A off-campus product would be below 6.5%.

CBRE's survey finds that the market cap rate that investors target varies considerably by product type in the healthcare sector. Image: CBRE

When discussing their target 10-year IRR for all-cash investments in multi-tenant medical office buildings, 42% of respondents say it falls between 7% and 9.49%. Another 31% say their IRR target for this product type would be between 9.5% and 11.99%. “Respondents indicated a lack of desire for the most aggressively priced product, with only 4% indicating a target all-cash IRR below 7%, compared to 17% in 2015,” CBRE reports.

Single-tenant medical office buildings are pricing the most aggressively, with the largest group of respondents (37%) indicating a cap rate range of 6% to 6.49%, and another 42% indicating a cap rate lower than 5.99% In contrast, more than one quarter of respondents indicates a cap rate of 6% to 6.49% for ambulatory surgery centers, while 31% indicate a cap rate range of 6.5% to 6.99% for wellness centers, and 33% a 7% to 7.49% range for acute care hospitals.

The product types with the least-aggressive pricing, according to the survey’s respondents, are long-term acute care hospitals, skilled nursing facilities, and psychiatric hospitals.

The vast majority of respondents—82%—say their medical office investments this year would make them "net buyers."

Majorities of respondents expect supply of and demand for healthcare sector buildings in general to remain pretty much the same this year as in 2015, with some intriguing collisions: for example 30% of respondents think demand for freestanding emergency departments would be higher even as 40% expect supply of that product type would be lower.

Rents for medical office buildings were up between 2% and 3% for the respondents’ portfolios, and none is predicting much growth beyond that in the next 12 months, which is curious given that 59% of those surveyed say their portfolio’s occupancy rates were higher than the year before.

CBRE’s report touches on a host of other investment topics, including operating expenses, credit ratings, acceptable terms for sale-leasebacks (10 to 14 years appears to be the preferred threshold), and issues revolving around ground lease price floors and structuring.

And when the questions home in on developers specifically, nearly half (48%) of developers who responded predict that development request for proposal (RFP) activity would be similar to last year. The biggest number of developers—36%—says that a lease constant of below 7% was the minimum they would consider for a healthcare development opportunity that met their highest standards of investment. (Nearly half says they’d consider a lease constant below 8% for a new development.)

Most developers (44% of those who responded) prefer at least 50% to 60% of a project to be preleased, and a large majority (82%) of developer-respondents require that 50% to 80% of a project to be preleased before they’d invest.

Related Stories

Industry Research | Feb 8, 2016

Changing of the guard: Big cities giving way to newer, less expensive offerings

U-Haul truck rental costs are a good early predictor of migration trends in the U.S.

Multifamily Housing | Feb 2, 2016

10 top bathroom design trends for 2016

Floating vanities, tricked-out showers, and freestanding tubs highlight the top bathroom design trends, according to a survey of kitchen and bath design professionals by the National Kitchen and Bath Association.

Multifamily Housing | Feb 1, 2016

Top 10 kitchen design trends for 2016

Charging stations, built-in coffeemakers, and pet stations—these are among the top kitchen design trends for the coming year, according to a new survey of kitchen and bath designers by the National Kitchen & Bath Association.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Industry Research | Dec 23, 2015

Meet the world’s next great construction superpower

There’s a new world construction hotbed coming down the pike (more specifically, the Mumbai Nashik Expressway), and it could mean a major boon for AEC firms.

Industry Research | Dec 21, 2015

Experts predict commercial real estate trends for 2016

Midwest Experts Predict Commercial Real Estate Trends for 2016, according to real estate communications firm TaylorJohnson.

Industry Research | Dec 17, 2015

The 2016 commercial construction market: A contractor’s view

The CFO of Tocci Building Companies forecasts the outlook for commercial and institutional construction in 2016.

Office Buildings | Dec 9, 2015

HOK collaborates with IFMA on new workplace strategy research report

Report cites work-life balance as the top reason for implementing “distributed work” strategies.

Industry Research | Dec 8, 2015

AEC leaders say the 'talent wars' are heating up: BD+C exclusive survey

A new survey from Building Design+Construction shows that U.S. architecture, engineering, and construction firms are being stymied by the shortage of experienced design and construction professionals and project managers.

Market Data | Dec 7, 2015

2016 forecast: Continued growth expected for the construction industry

ABC forecasts growth in nonresidential construction spending of 7.4% in 2016 along with growth in employment and backlog.