The Tax Cuts and Jobs Act of 2017 created the designation “Opportunity Zone,” for which the Internal Revenue Service will allow tax advantages for certain investments in lower-income areas when an Opportunity Fund invests more than 90% of its assets in a zoned property.

As of last December, there were nearly 8,800 Opportunity Zones in the U.S. and its five possessions, according to the Treasury Department. Developers must invest in Qualified Opportunity Zones by the end of this year to meet a seven-year holding period that allows them to exclude 15% of the deferred capital gain. The IRS is in the final stages of finalizing this program’s regulatory framework.

One such investment entity is Chicago-based Decennial Group, which is targeting investment of $1 billion in development projects to leverage the tax incentives created by the 2017 law. Over the next decade the JV could look to invest up to $20 billion for new projects, according to The Real Deal, which also reports that Decennial Group is exploring 250 potential projects in Opportunity Zones around the country, and is in advanced negotiations on at least three projects.

Decennial Group is a joint venture comprised of Scott Goodman, the founding principal of Farpoint Development, a real estate development company; Bob Clark, founder and CEO of Clayco, the full-service development, planning, architecture, engineering, and construction firm; and Shawn Clark, president of CRG, Clayco’s real estate and development company.

According to a prepared statement, Decennial Group will focus on commercial, industrial, multifamily, and energy projects located in Opportunity Zones, and especially in America’s heartland region.

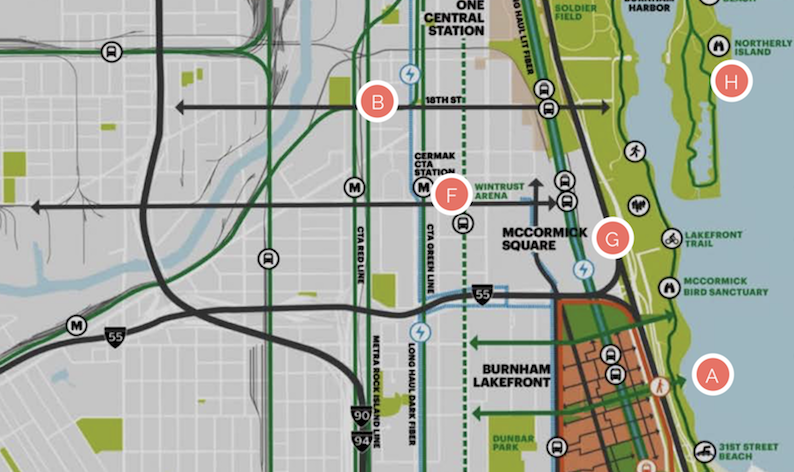

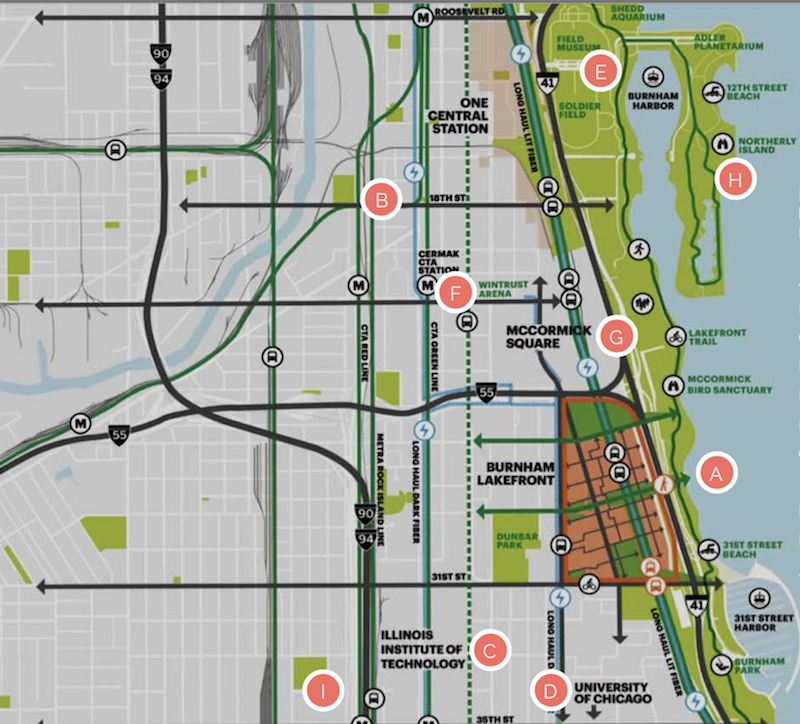

One of Farpoint Development's investments is Burnham Lakefront, located within an Opportunity Zone on Chicago's South Side. Image: Farpoint Development

Among Goodman’s development projects is Burnham Lakefront, a 100-acre campus within a recently designated Opportunity Zone that’s the former site of Michael Reese Hospital near the McCormick Place Marshalling Yard on Chicago South Side. The developer is planning 12 million sf of vertical construction along two miles of lakefront.

“Decennial will make smart, long-term investments throughout the country, but we will begin by capitalizing on deep relationships and an already strong pipeline of deals in the Heartland, where we have unparalleled investing experience,” says Goodman.

Bob Clark adds that CRG will provide development and site selection expertise as well as design-build services so that Decennial Group can “act quickly on great OZ opportunities around the country.”

Decennial Group is distinguishing itself from other OZ funds with a renewable energy strategy that’s being led by David Pavlik, cofounder and principal with 11 Million Acres, a leading energy real estate development platform that has structured over $2 billion in renewable energy and infrastructure projects.

The joint venture has tapped Steve Glickman, founder and CEO of Washington D.C.-based Develop LLC, as a senior advisor to the management team. Glickman is cofounder and former CEO of the economic Innovation Group, which was an architect of the Opportunity Zone program.

Related Stories

Products and Materials | Jul 31, 2024

Top building products for July 2024

BD+C Editors break down July's top 15 building products, from Façades by Design to Schweiss Doors's Strap Latch bifold door.

Casinos | Jul 26, 2024

New luxury resort casino will be regional draw for Shreveport, Louisiana area

Live! Casino & Hotel Louisiana, the first land-based casino in the Shreveport-Bossier market, recently topped off. The $270+ project will serve as a regional destination for world-class gaming, dining, entertainment, and hotel amenities.

MFPRO+ News | Jul 22, 2024

6 multifamily WAFX 2024 Prize winners

Over 30 projects tackling global challenges such as climate change, public health, and social inequality have been named winners of the World Architecture Festival’s WAFX Awards.

Senior Living Design | Jun 24, 2024

Not your grandparents’ senior living community: Redefining aging in place

Perkins Eastman’s Senior Living and Residential teams are putting a new face on home for seniors who don’t want to move away in retirement.

Mass Timber | Jun 10, 2024

5 hidden benefits of mass timber design

Mass timber is a materials and design approach that holds immense potential to transform the future of the commercial building industry, as well as our environment.

Mixed-Use | May 22, 2024

Multifamily properties above ground-floor grocers continue to see positive rental premiums

Optimizing land usage is becoming an even bigger priority for developers. In some city centers, many large grocery stores sprawl across valuable land.

Senior Living Design | May 16, 2024

Healthy senior living campus ‘redefines the experience of aging’

MBH Architects, in collaboration with Eden Housing and Van Meter Williams Pollack LLP, announces the completion of Vivalon’s Healthy Aging Campus, a forward-looking project designed to redefine the experience of aging in Marin County.

MFPRO+ Special Reports | May 6, 2024

Top 10 trends in affordable housing

Among affordable housing developers today, there’s one commonality tying projects together: uncertainty. AEC firms share their latest insights and philosophies on the future of affordable housing in BD+C's 2023 Multifamily Annual Report.

Mixed-Use | Apr 23, 2024

A sports entertainment district is approved for downtown Orlando

This $500 million mixed-use development will take up nearly nine blocks.

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.