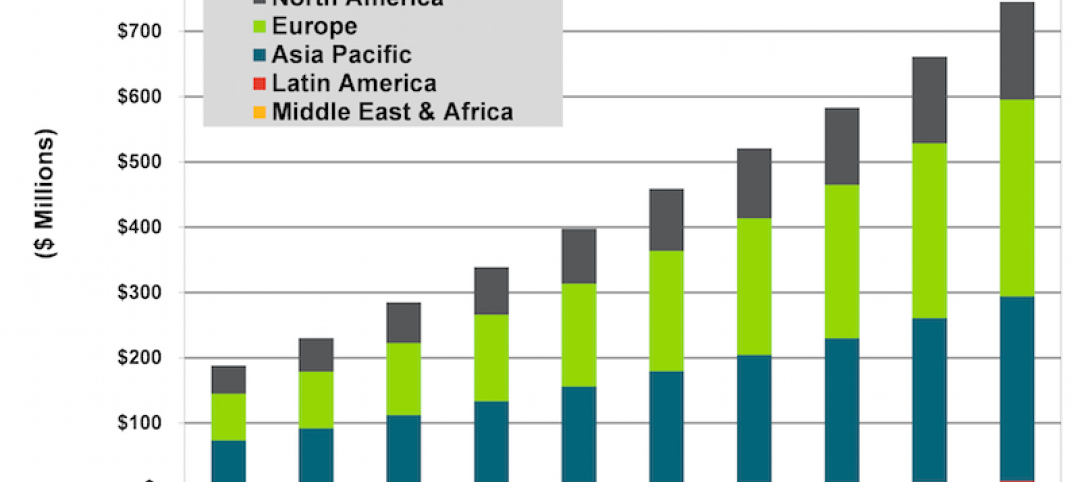

The institutional investment capital that’s been flowing into real estate globally is expected to increase as an already rebounding economy expands. But there’s also a growing consensus among real estate professionals that environmental, social, and governance (ESG) elements will factor more impactfully—and uncertainly—into future development. Broader housing affordability is one of those elements that could create diverse workforces and drive equitable outcomes.

These are some of the trends that arise from a survey of industry experts whose responses form the basis of “Emerging Trends in Real Estate 2022,” the 43rd edition of this series, which was released today. (To download the full report, click here.)

Researchers for the latest report’s co-sponsors, PwC and Urban Land Institute (ULI), interviewed 930 individuals and evaluated survey responses from another 1,200. Private property owners or commercial/multifamily real estate developers accounted for 35% of the respondents; real estate advisory, service, or asset managers 22%.

Among the AEC firms whose representatives were interviewed were BOKA Powell, Brasfield & Gorrie, CM Constructors, Gensler, Kimley Horn, Malasri Engineering, Swinerton, STG Design, Tenet Design, and Turner Construction.

The 100-page report lays out the challenges that lie ahead for the real estate sector to cope with changing consumer expectations and a “massive shift” in the functionality of homes, offices, retail, and healthcare spaces. “Property markets that were once predictable will likely remain in a bubble of uncertainty,” the reports states. It will also be “imperative” for businesses’ strategies to approach environmental, social, and governance issues holistically.

IS HOUSING AFFORDABILITY INTRACTABLE?

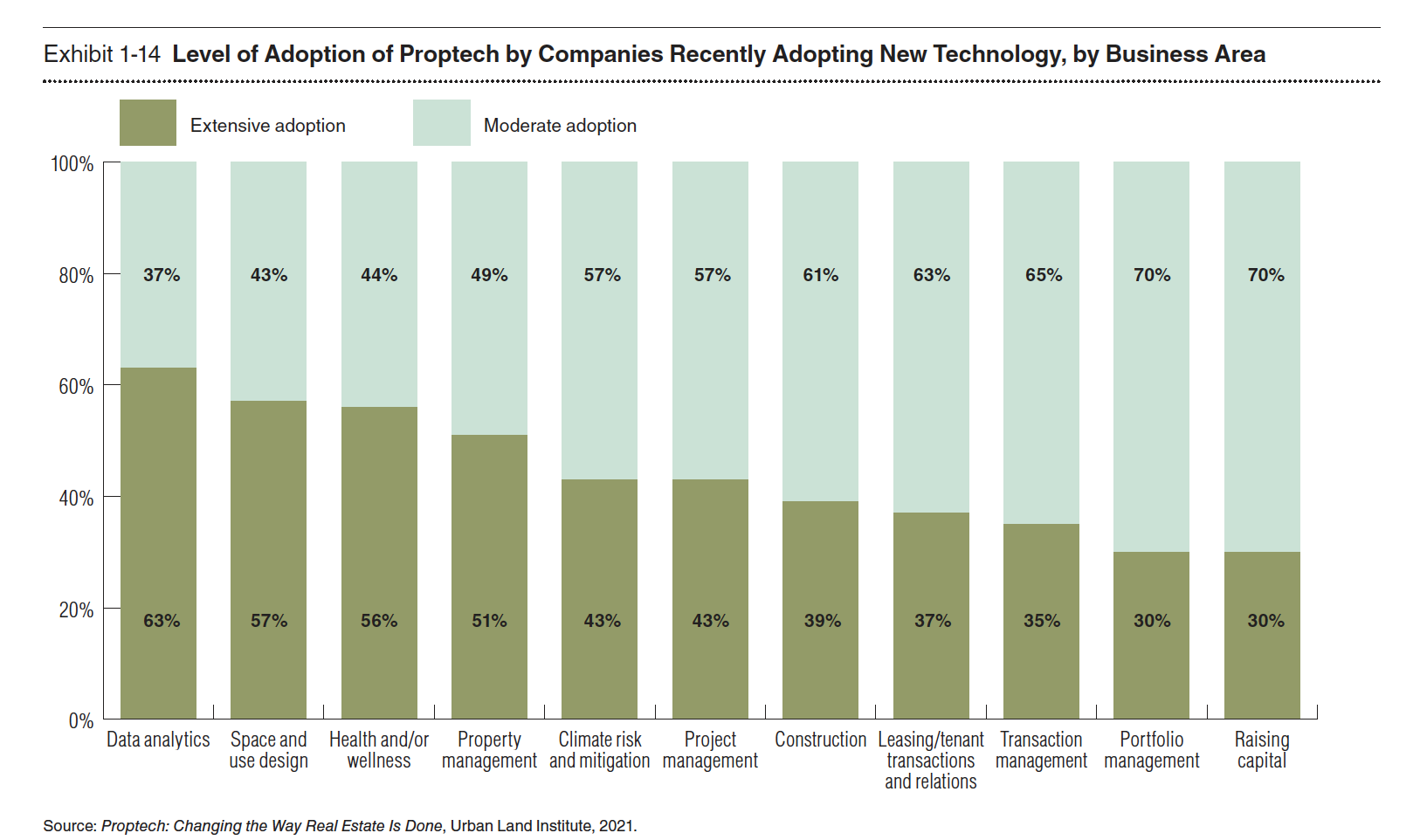

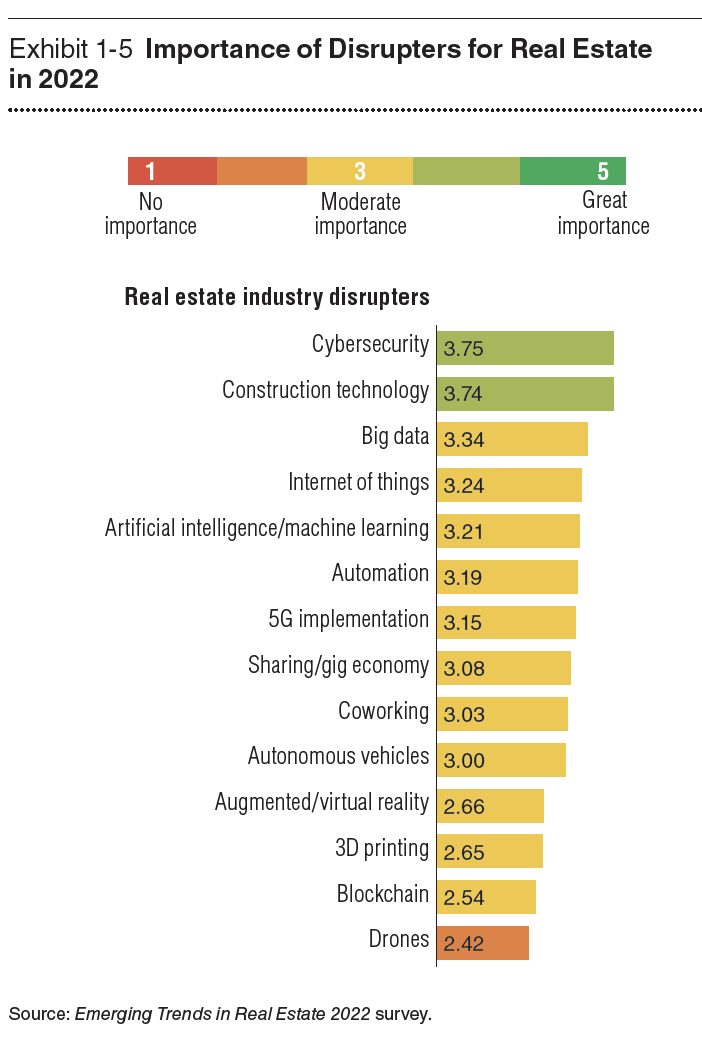

The report finds the real estate community optimistic about its future, and the main reason is “an abundance of investable capital, low interest rates, and continued demand for many product types,” says Byron Carlock, a Partner and U.S. Real Estate Practice Leader for PwC. The real estate industry is also finally getting into the 21st Century by adopting technology to assess investments and manage properties. But despite higher acceptance, property technology “still has significant areas of future growth,” the report states.

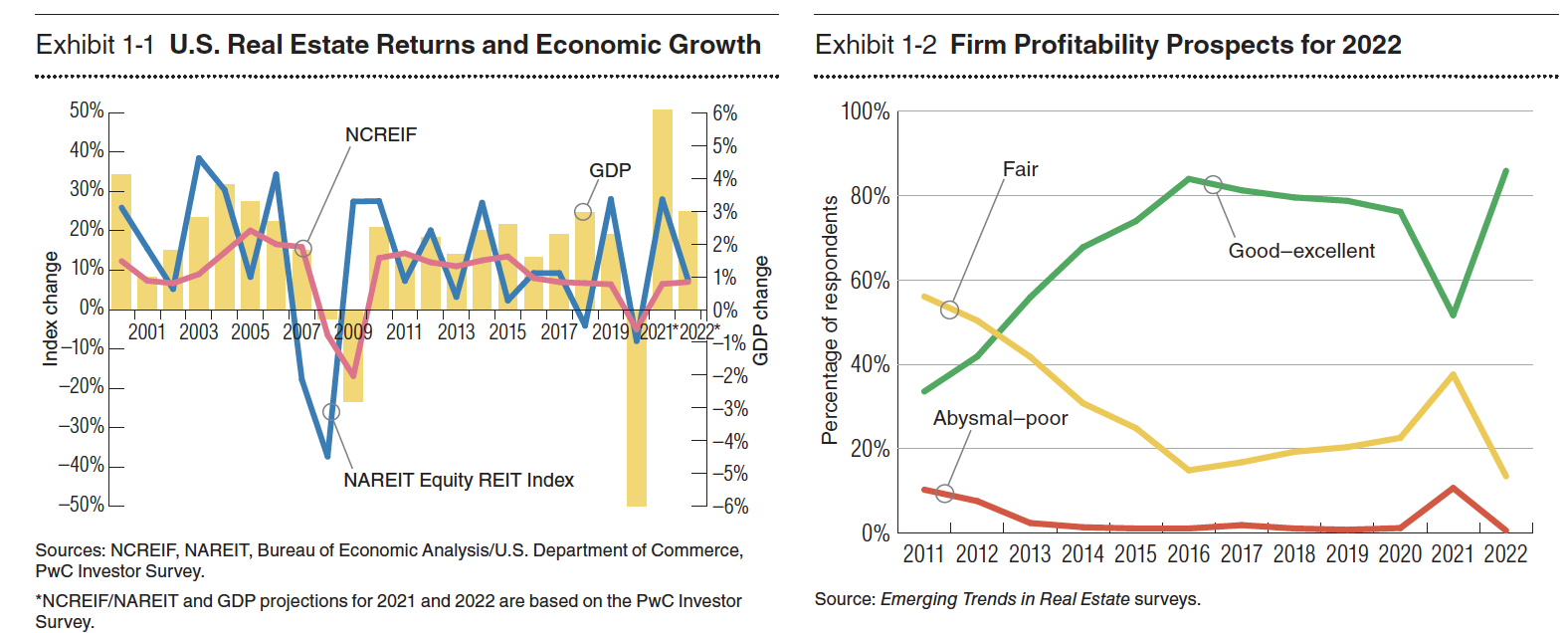

The report highlights several other trends that include a rebound from a COVID-19 induced “brief and muted real estate downturn” in real estate investment. Economic output is forecasted to grow “at the highest rate in decades” in 2021 and 2022. One area of concern, however, is housing affordability, which “worsened” during the pandemic and as the economy reopened. “Affordability will likely continue to deteriorate in the absence of significant private-sector and government intervention,” the report asserts.

Remarkably, 82% of respondents claimed that their companies consider ESG elements when making operational or investment decisions. However, the report also observes that investors “have been slow to incorporate environmental risks into underwriting.”

THE SUNBELT OFFERS FERTILE CRE PROSPECTS

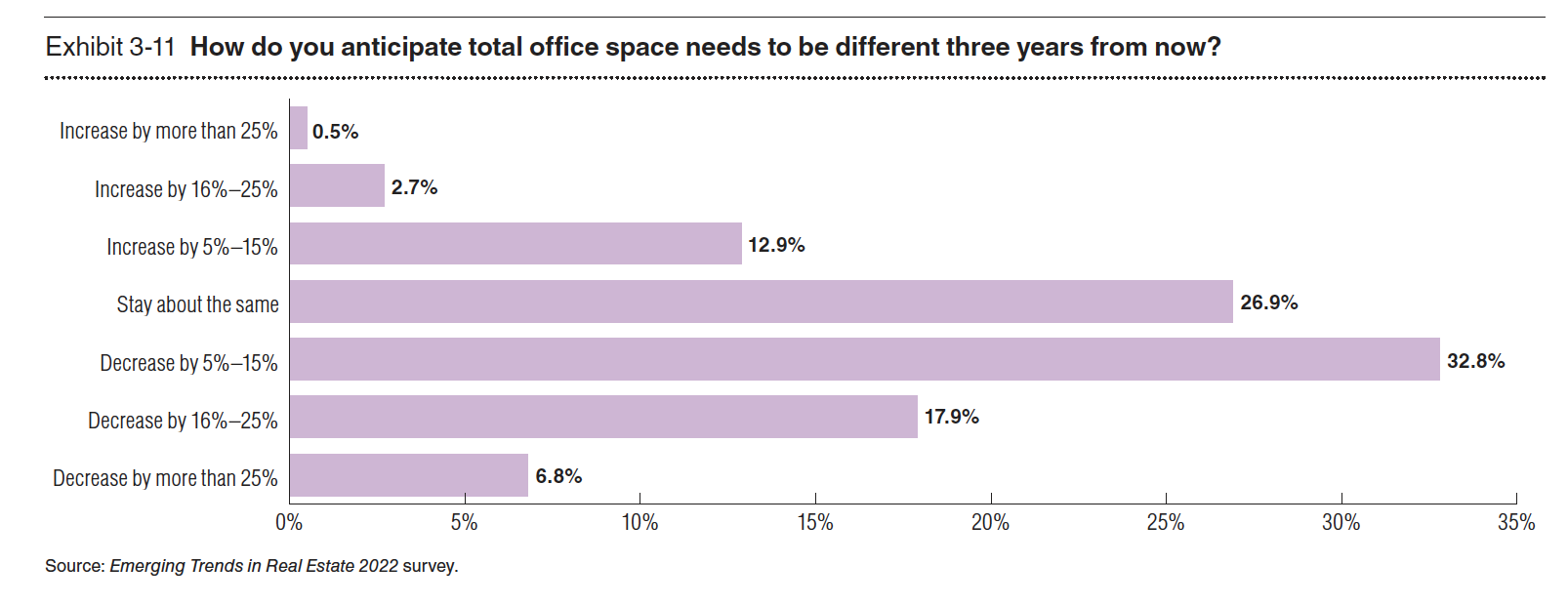

One of the question marks in the real estate sector revolves around the future value of office space. Nearly two-thirds of the report’s respondents believe that fewer than 75% of workers will return to their offices at least three days a week in 2022. In fact, industry leaders predict that the need for office space will decrease by 5-15 percent in the next three years. This trend is already leading to redesigns of offices for hybrid work patterns and flexible usage.

The office conundrum is compounded by what the report calls the Great Relocation, where highly paid office workers are moving away from their workplaces. The report’s authors think this phenomenon could create more of a suburban and Sun Belt future. “Sun Belt metropolitan areas account for the eight to-rated overall real estate prospects [and] occupy the top five places in the homebuilding prospects rating.”

Nashville was identified as the No. 1 market for real estate prospects, based on growth, homebuilding, affordability, and employment opportunity. It was followed by Raleigh-Durham, N.C., Phoenix, Austin, Texas, Tampa-St. Petersburg, Fla., Charlotte, Dallas-Fort Worth, Atlanta, Seattle, and Boston.

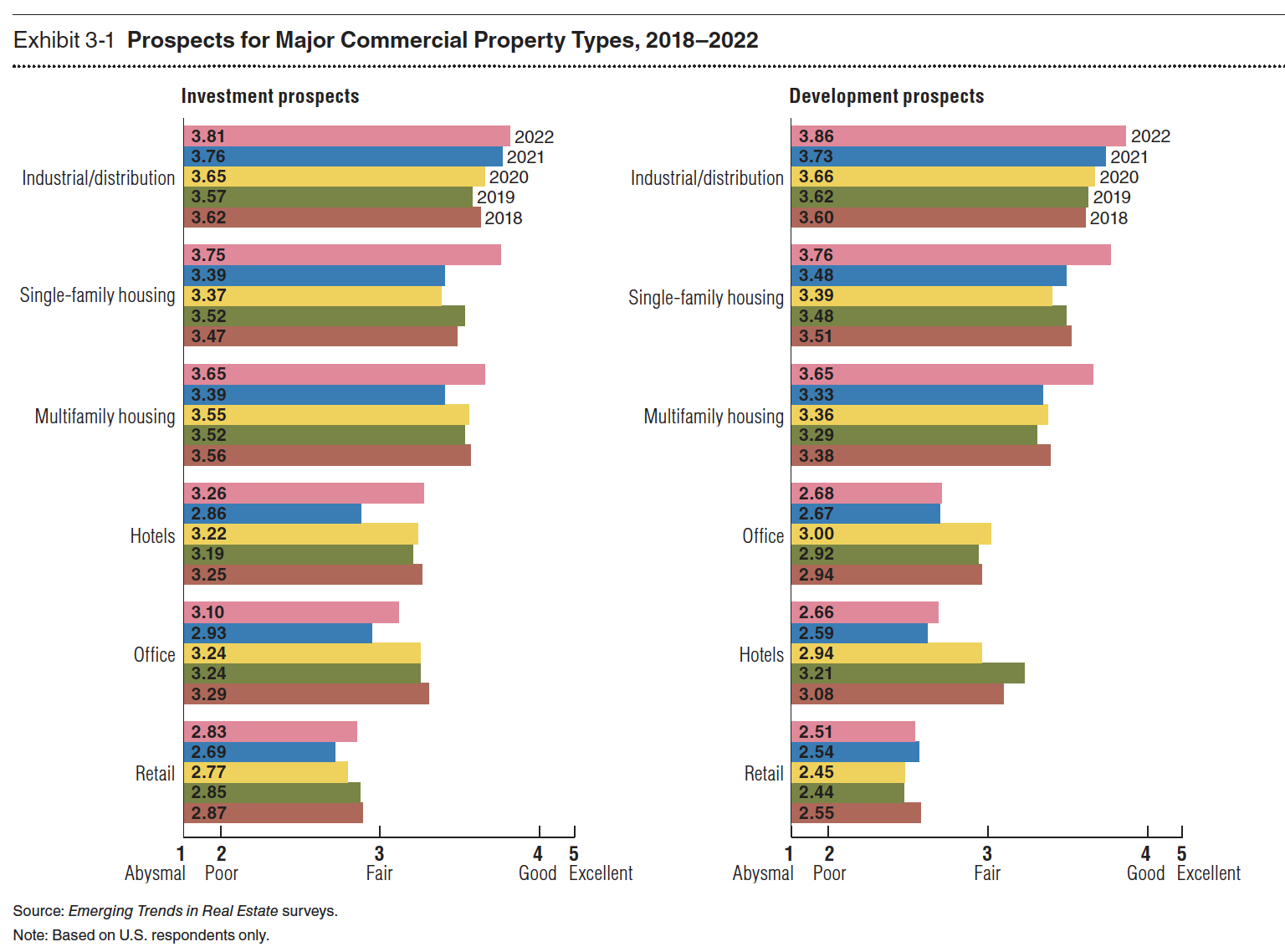

The report points out as well that investors and Real Estate Investment Trusts (REITs) are now more disposed to consider alternative sectors like student and senior housing, life sciences, and industrial. These sectors, the report explains, offer higher returns at lower prices. They are less volatile to business cycles, too.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.