Data from the first quarter U.S. Chamber of Commerce Commercial Construction Index reveals contractors are growing more optimistic, mostly driven by a rise in revenue expectations. They also have better outlooks on hiring and equipment spending plans as business concerns related to the coronavirus pandemic lessen.

In the first quarter of this year, 36% of contractors expect their revenue to increase over the next year, a jump of 11 percentage points from 25% in Q4 2020. Eighty-seven percent expect their revenue to either stay the same or increase, up from 86% last quarter. Most (86%) contractors also report a moderate to high level of confidence that the U.S. market will provide enough new business in the next year. Nearly a quarter (24%) report a high level of confidence, up from 19% in Q4 2020.

Hiring plans are also positive as close to half (46%) of contractors say they will employ more people in the next six months, up from 37% in Q4 2020. The same percentage (46%) expect to keep the same number of workers, and just 3% expect to reduce their staffing, down from 12% in Q4 2020.

“As vaccines continue to roll out, contractors are expecting to hire more workers and anticipating good times ahead. The industry still has a way to go to return to pre-pandemic levels, but rising optimism in the commercial construction industry is a positive sign for the broader economy,” said U.S. Chamber of Commerce Executive Vice President and Chief Policy Officer Neil Bradley. “However, finding skilled workers was a critical issue before the pandemic, and while it has remained a chronic problem over the last year, heightened concern may be emerging again as contractors look to hire. The U.S. Chamber is committed to supporting businesses in retraining and making sure the economy has the skilled workforce it needs.”

The boost in revenue expectations drove a three-point rise in this quarter’s overall Index score to 62 from 59 in Q4 2020. The score for revenue expectations, one the Index’s three leading indicators, jumped five points to 57, while contractors’ confidence in new business opportunities rose two points to 59. Despite the gains, the Index remains 12 points below its score of 74 from Q1 2020 before the pandemic.

Skilled Worker Shortage Causes Ongoing Challenges

Alongside the positive signs of recovery come workforce challenges. This quarter, 85% of contractors report moderate to high levels of difficulty finding skilled workers, up from 83% in Q4 2020. Of those, 45% report a high level of difficulty, up from 42% last quarter, but still down 10 percentage points year-over-year from 55% in Q1 2020 before the pandemic.

Meanwhile, 88% report a moderate to high degree of concern about their workers having adequate skill levels. Forty-six percent report a high degree of concern, up from 36% in Q4 2020. Almost all (94%) contractors who reported a moderate to high degree of concern expect the problem with workers having adequate skill levels will stay the same or get worse in the next six months.

Lumber Concerns Ease, Cost Fluctuation Concerns Rise

Similar to last quarter, 71% of contractors say they face at least one material shortage. Of those, 22% are experiencing a shortage of wood/lumber (down from 31% in Q4 2020), followed by steel (14%), and pipe/PVC (10%).

This quarter, more (82%) contractors say cost fluctuations have a moderate to high impact on their business, up eight percentage points from Q4 2020, and up 17 percentage points year-over-year. Of those experiencing the impact of cost fluctuations, 43% said wood/ lumber is the product of most concern (down from 61% in Q4 2020), followed by steel (35%), and copper (27%).

Additional findings:

— Tariff and trade concerns are up. More (35%) contractors say steel and aluminum tariffs will have a high to very high degree of impact on their business in the next three years, up from 24% saying the same in Q4 2020.

— 37% of contractors plan to increase spending on tools and equipment, increasing from 28% in Q2 2020. Before the pandemic (Q1 2020), 54% said they planned to increase spending.

— 80% of contractors are still experiencing delays due to COVID-19, with an average share of 23% of their projects delayed, but that share is expected to drop to 15% looking ahead six months.

— 58% say worker health and safety remains a top concern for their business, followed by more project shutdowns/delays (50%), fewer projects (35%), and less availability of building products (33%).

The Index comprises three leading indicators to gauge confidence in the commercial construction industry, generating a composite Index on the scale of 0 to 100 that serves as an indicator of health of the contractor segment on a quarterly basis.

The Q1 2021 results from the three key drivers are:

— Revenue: Contractors’ revenue expectations over the next 12 months increased to 57 (up five points from Q4 2020).

— New Business Confidence: The overall level of contractor confidence increased to 59 (up two points from Q4 2020).

— Backlog: This indicator remained steady from Q4 2020 at 69.

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Note: In last quarter’s report, released on December 10, 2020, the overall index score and backlog component score were incorrectly reported due to a data tallying error. The correct overall index score for Q4 2020 was 59 (originally reported as 60). The correct score for backlog was 69 (originally reported as 70).

Related Stories

Apartments | Aug 22, 2023

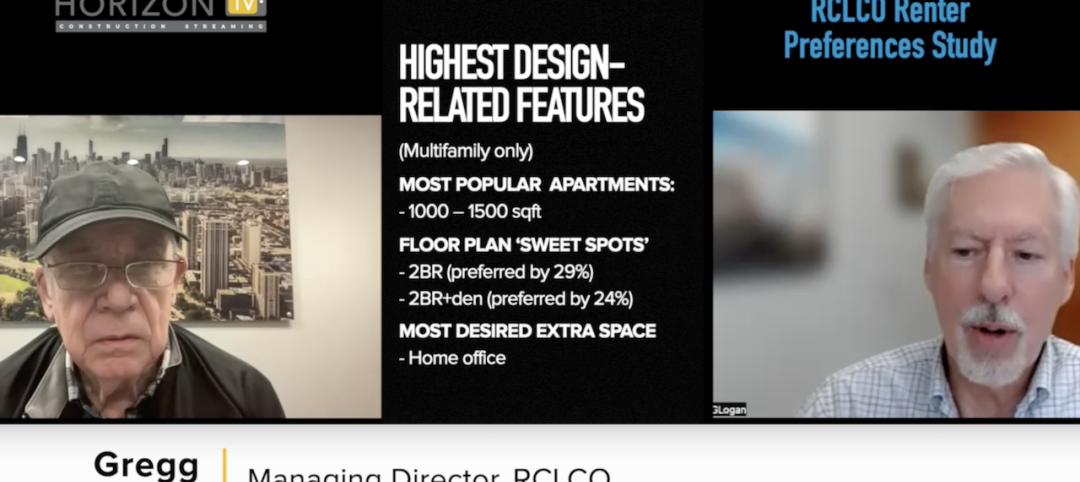

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

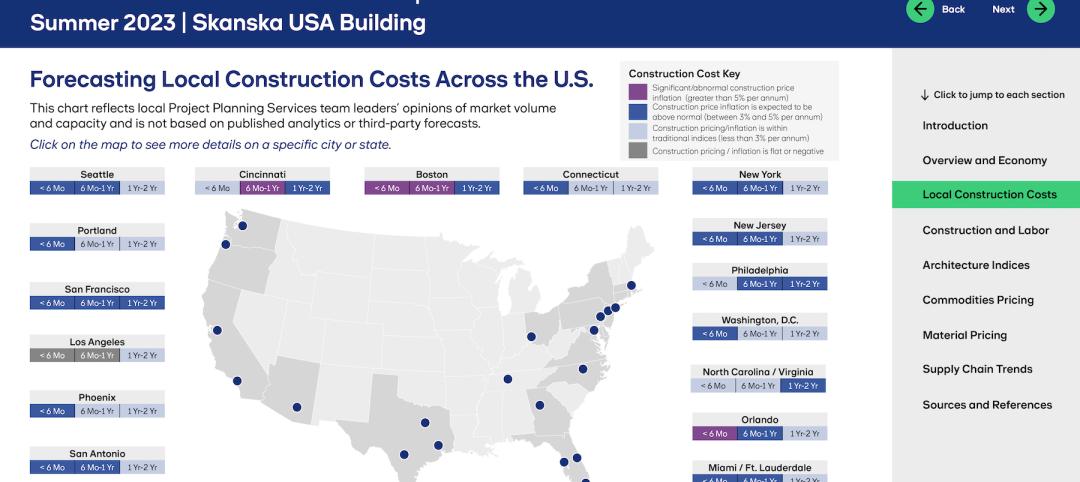

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.