Commercial construction is in high demand across the country and contractors are confident in the trajectory of the industry, according to the USG + U.S. Chamber of Commerce Commercial Construction Index (‘Index’), that launched recently. Nearly all contractors surveyed – 96 percent – expect revenues to grow or remain stable this year compared to 2016, with 40 percent expecting an increase and only 3 percent expecting a decrease in revenue.

The Index is a new quarterly economic indicator designed to gauge what drives the commercial construction industry and its leaders, including specific issues like backlog of work, new business pipeline, revenue projections, workforce issues, and access to financing. Given the sector’s importance to the U.S. economy and the outsized role it could play in years to come, the data contained in the Index will be vital to better understanding trends, challenges and opportunities. The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

“This first-of-its-kind Index was born out of a need to understand the issues that affect commercial construction. The Index will deliver critical insights into the future health of the industry,” said Jennifer Scanlon, president and chief executive officer of USG Corporation. “USG is committed to providing solutions for our customers in order to help the entire industry make strong contributions to the U.S. economy. Through the Index we are able to identify areas of strength and pinpoint areas of improvement where industry leaders must focus.”

Two-thirds (66 percent) of contractors said they expect to employ more workers in the next six months, indicating growth in a sector that employs approximately 3 million Americans. But 61 percent of Index respondents reported difficultly finding skilled workers. The contractors reported the biggest shortages in the concrete, interior finishes/millwork, masonry, electrical and plumbing trades.

“The commercial construction industry is a vital engine for the American economy,” said Tom Donohue, president and CEO of the U.S. Chamber. “The projected growth uncovered in this research is good news for employers and workers, but there is reason for concern in the lack of qualified talent available in vital specialties. To get our economy growing to its full potential, we must ensure that we have a workforce that is ready to fill the available jobs. Each quarter, this first-of-its-kind research will make us smarter about future challenges and inform solutions for our country’s leaders.”

The report looks at the results of three leading indicators – backlog levels, new business opportunities and revenue forecasts – to generate a composite index on a scale of 0-100 that serves as an indicator of health for the contractor segment on a quarterly basis. The Q2 2017 composite index score was 76, representing continued health in the sector. This composite score is up two points from a 74 in the Q1 survey, driven primarily by a bump in the ratio between actual and ideal backlog. New business and revenue results also saw slight increases quarter-over-quarter.

The composite scores from the three drivers of confidence were:

Backlog: 81, up four points in Q2 over Q1

Contractors’ current average backlog levels represent 81 percent of their ideal backlog levels, up from 77 percent in Q1. On average, contractors currently hold 9.9 months of backlog, while the ideal amount is 12 months.

New Business: 77, up two points in Q2

Nearly all contractors continue to report high or moderate confidence in the market. Well over half of contractors (59 percent) reported high confidence in new business over the next 12 months (up from 51 percent in Q1), indicating a shift to higher levels of confidence among some respondents.

Revenues: 71, up two points in Q2

An overwhelming 96 percent of contractors expect revenues to grow or remain stable in 2017 over 2016. Of those expecting revenue increases, the actual percentage of expected increases varies widely. Forty percent expect revenue increases of 7 percent or more in the next 12 months.

The Index findings are compiled using survey results from contractors within a DD&A panel of more than 2,700 decision makers from across key facets of the commercial construction industry. This first public report was developed using research from previous quarters, which puts into context the state of contractor sentiment in the U.S. building industry.

Related Stories

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.

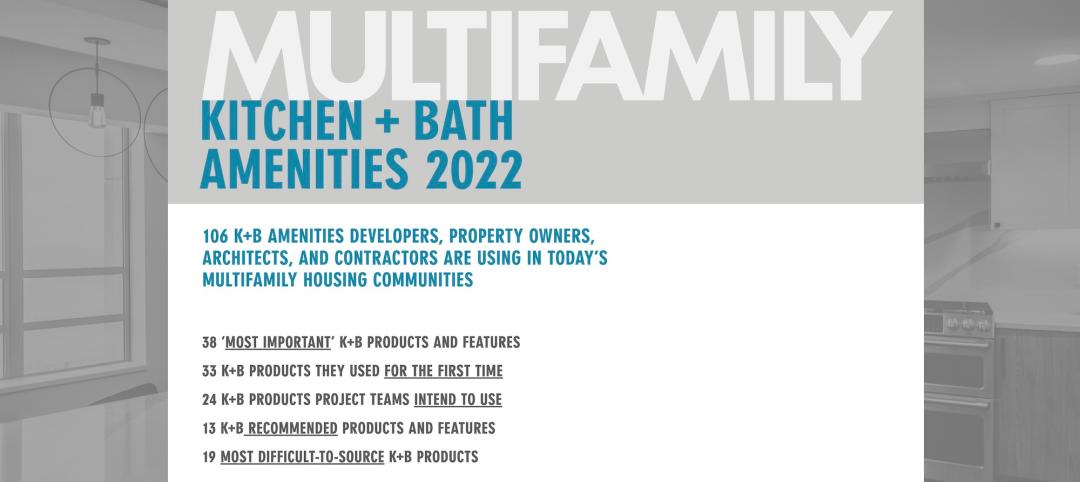

Multifamily Housing | Dec 13, 2022

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Contractors | Nov 30, 2022

Construction industry’s death rate hasn’t improved in 10 years

Fatal accidents in the construction industry have not improved over the past decade, “raising important questions about the effectiveness of OSHA and what it would take to save more lives,” according to an analysis by Construction Dive.