Construction employment increased by 22,000 jobs between November and December as nonresidential construction firms added workers for the fourth month in a row while residential construction employment slipped, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said the new employment figures are consistent with the results of a new outlook survey they will be releasing on January 12.

“Nonresidential contractors are increasingly busy and are eager to hire even more workers,” said Ken Simonson, the association’s chief economist. “But the low rate of unemployment and record job openings in construction show how difficult it is bringing enough workers on board.”

Simonson noted that the unemployment rate among former construction workers in December was 5.0%, which tied the lowest December rate since at least 2000 and was down from 9.6% a year earlier. He added that industry job openings totaled 345,000 at the end of November, an all-time high for November data.

Construction employment in December totaled 7,560,000, an increase of 22,000 for the month and 160,000 or 2.2% for the year. However, industry employment still trails the pre-pandemic peak, set in February 2020, by 88,000 positions.

Nonresidential construction firms added 27,000 employees in December, following a pickup of 25,700 in November. The category comprises nonresidential building contractors, with a gain of 3,700 employees; specialty trade contractors, with 12,900 more workers than in November; and heavy and civil engineering construction, which added 10,400 employees. But nonresidential employment remains 169,000 below the February 2020 level. The sector has regained only 74% of the jobs lost at the outset of the pandemic.

Residential construction employment dipped for only the second time in 2021, by 4,100 employees in December. Residential building contractors, such as homebuilders and general contractors that concentrate on multifamily construction, added 700 workers during the month, while residential specialty trade contractors shed 4,800 employees. Residential employment in December remained 82,000 above the February 2020 mark.

Association officials said the jobs figures reflect the industry optimism indicated in the annual Outlook survey they will be releasing during a virtual media briefing on Wednesday, January 12. But they cautioned that labor shortages continue to challenge contractors who are struggling to hire enough workers to keep pace with demand.

“The industry appears well poised for a strong recovery in 2022, but there are certainly clear challenges, including labor shortages, that could undermine construction this year,” said Stephen E. Sandherr, the association’s chief executive officer.

View the construction employment table.

Related Stories

Market Data | Apr 16, 2019

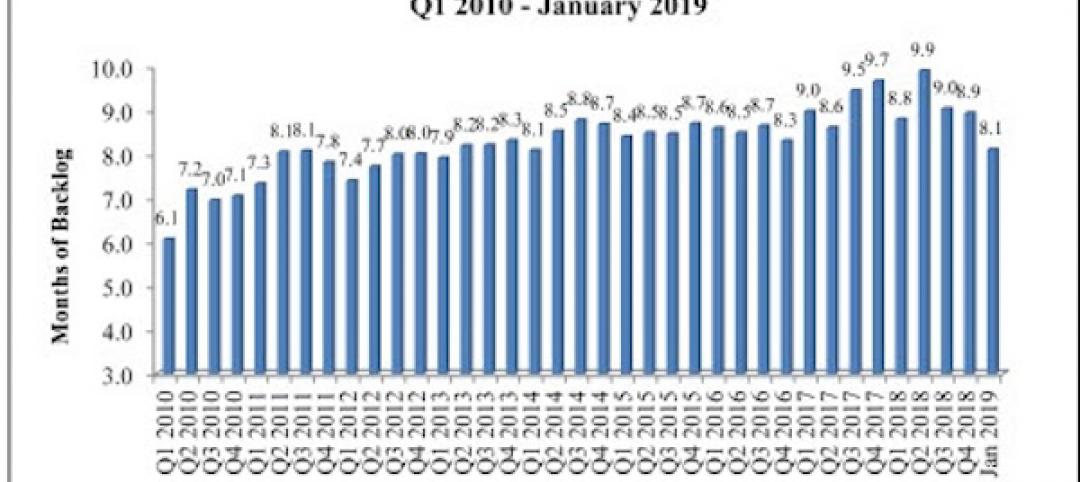

ABC’s Construction Backlog Indicator rebounds in February

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

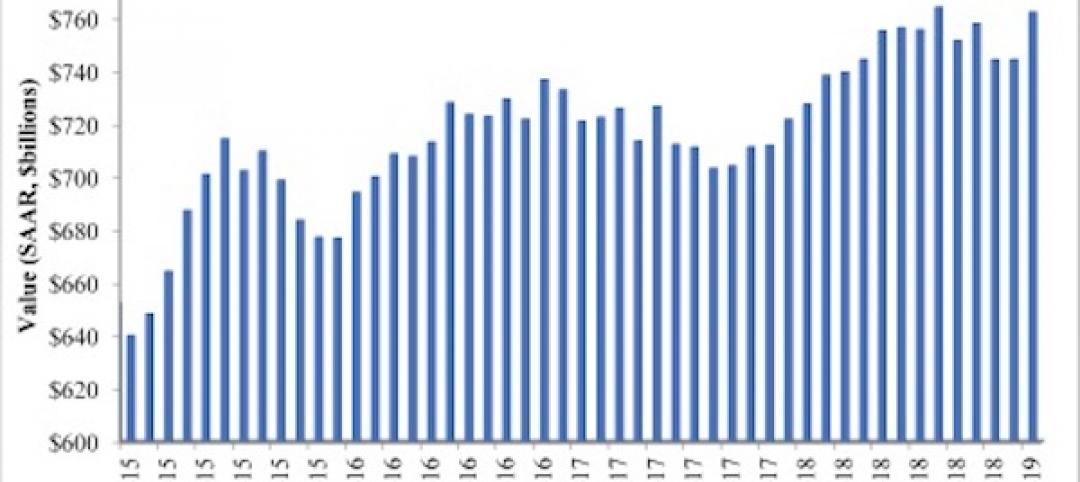

Nonresidential spending expands again in February

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

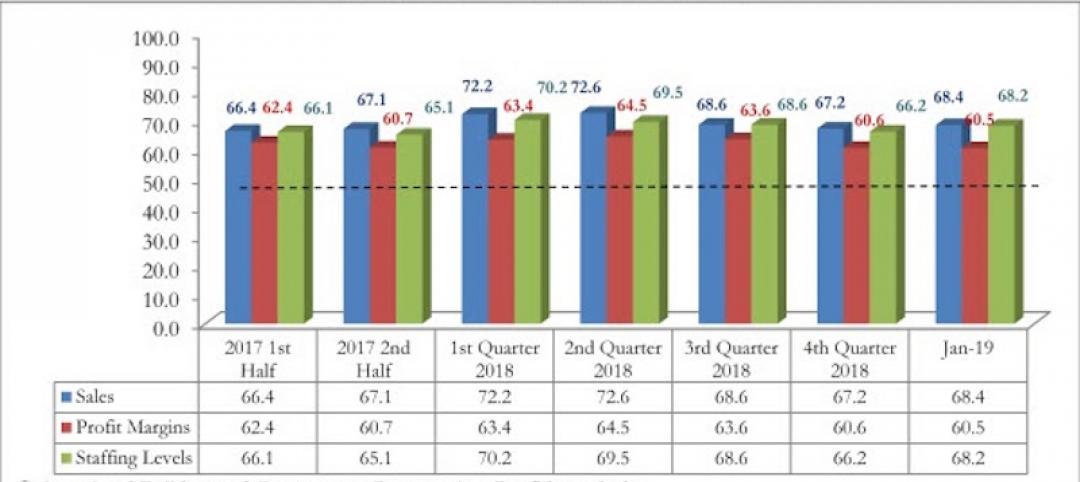

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

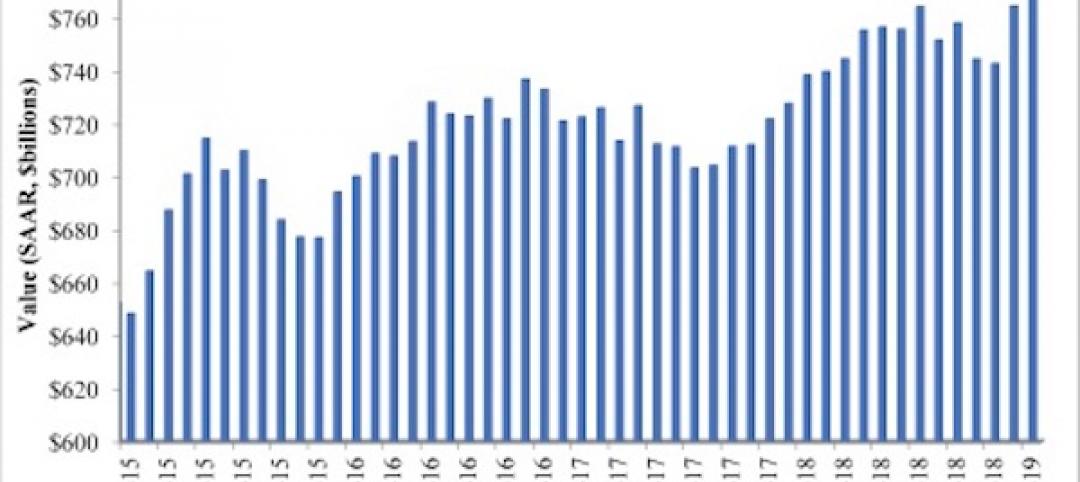

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.

Market Data | Mar 6, 2019

Global hotel construction pipeline hits record high at 2018 year-end

There are a record-high 6,352 hotel projects and 1.17 million rooms currently under construction worldwide.

Market Data | Feb 28, 2019

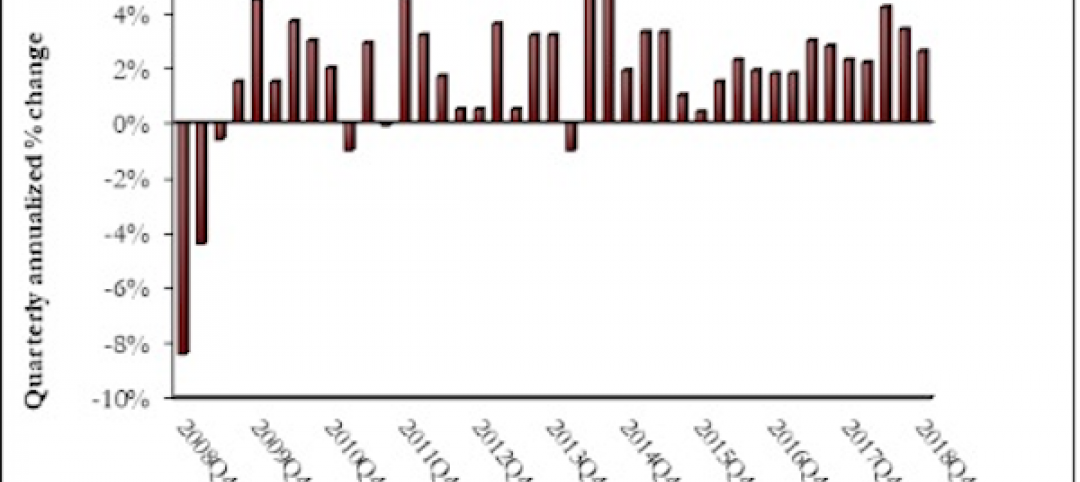

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.