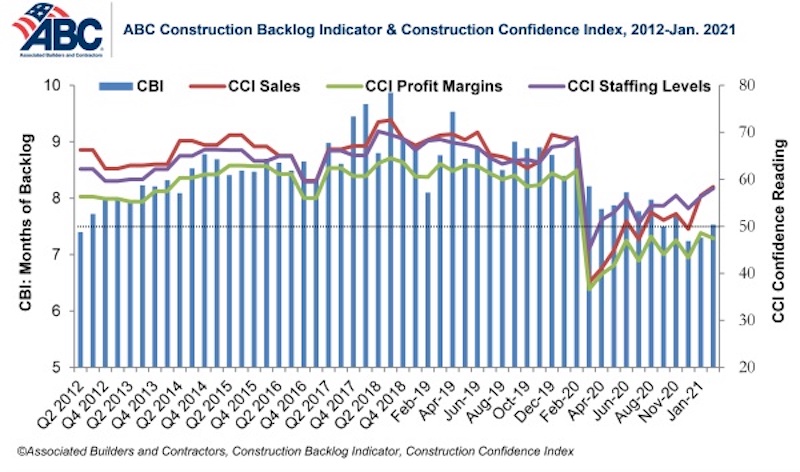

Associated Builders and Contractors reported today that its Construction Backlog Indicator rose to 7.5 months in January 2021, an increase of 0.2 months from its December 2020 reading, according to an ABC member survey conducted from Jan. 20 to Feb. 2. Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in January and remain above the threshold of 50, indicating expectations of growth over the next six months. The index reading for profit margins remained below that threshold, slipping to 47.5 in January.

“Though nonresidential construction spending has continued to recede for the better part of a year, the growing consensus is that the next six months will be a period of improvement,” said ABC Chief Economist Anirban Basu. “While backlog is down substantially from its January 2020 level and profit margins remain under pressure, more than half of contractors expect sales to rise over the next six months and nearly half expect to increase staffing levels.

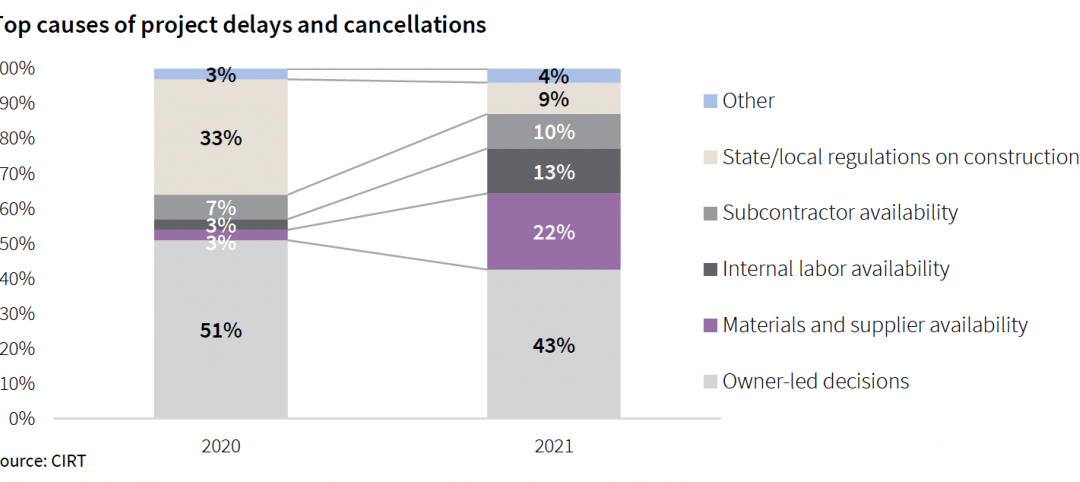

“The anticipation is that the second half of the year will be spectacular for the U.S. economy from a growth perspective, which will help lift industry fortunes as 2022 approaches,” said Basu. “But that is not the entire story. There are also public health and supply chain considerations. During the COVID-19 pandemic, many contractors experienced repeated interruptions in project work. Acquiring key materials and equipment has also become more difficult, with occasional price shocks for certain commodities. With vaccinations proceeding apace, many contractors will benefit from fewer interruptions going forward and the restart of many postponed projects.”

Related Stories

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

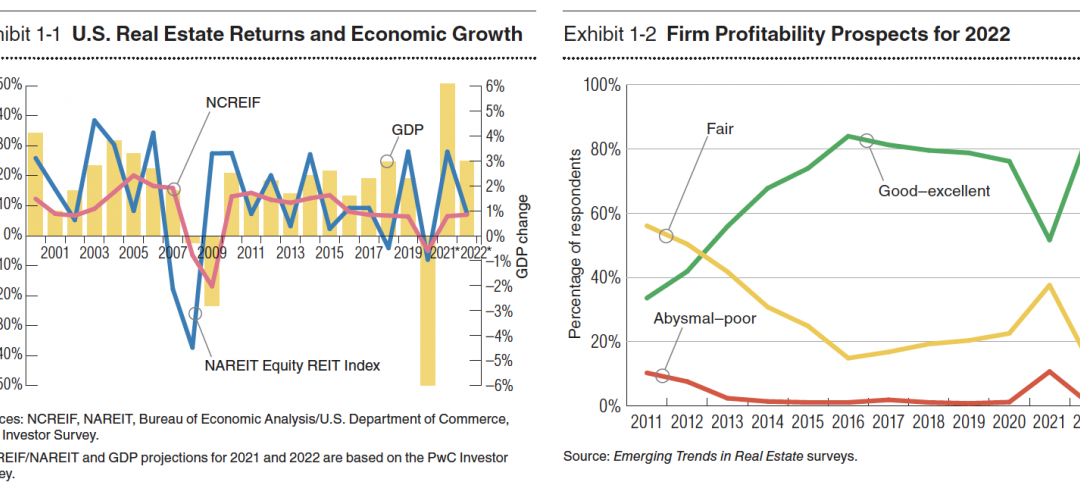

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

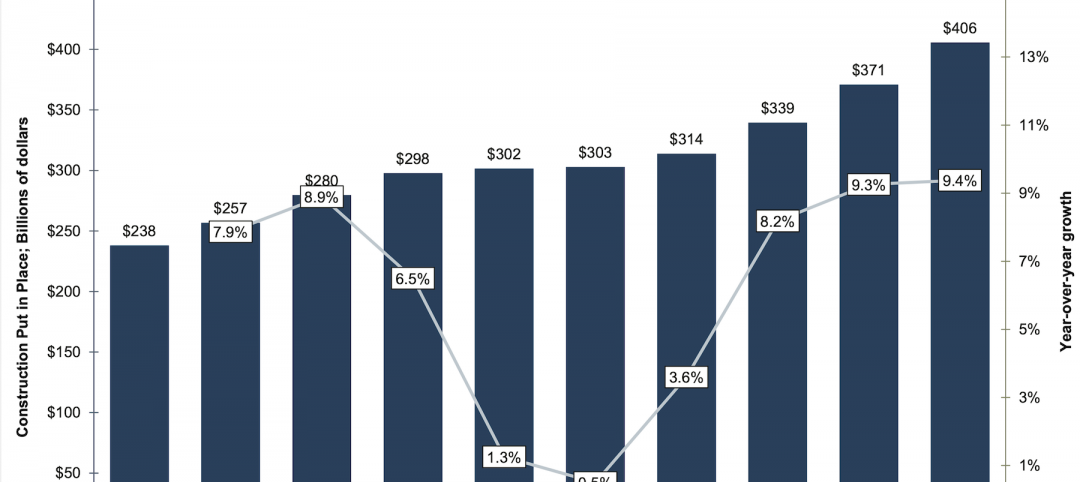

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.