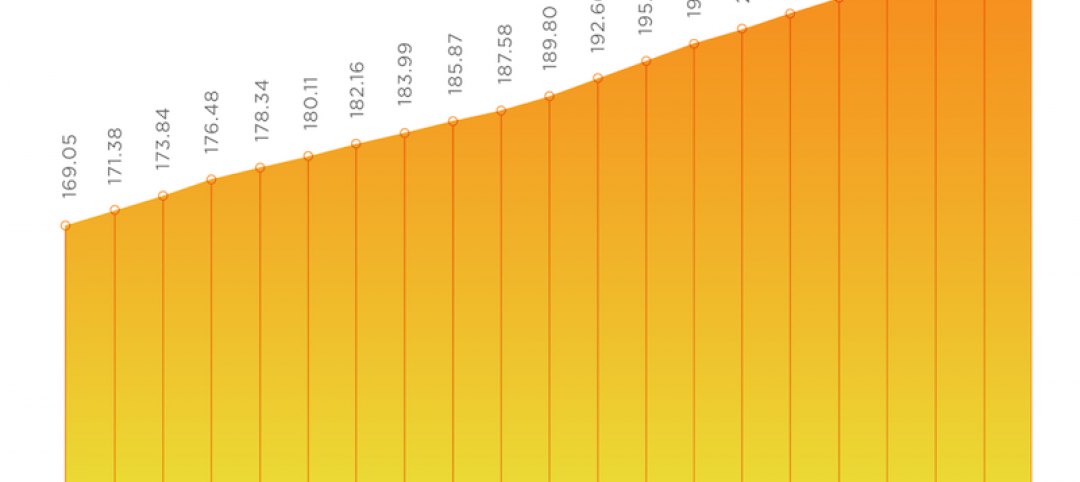

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021. (View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for December 2022.)

Backlog remains at its highest level since the second quarter of 2019. This has been especially true in the South, which has been the case for many of the past several years.

ABC’s Construction Confidence Index reading for profit margins and sales increased in December, while the reading for staffing levels moved lower. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“Contractors enter the new year with plenty of optimism,” said ABC Chief Economist Anirban Basu. “Backlog remains elevated, which means that, even if the economy were to enter recession this year, contractors would likely be insulated from significant harm. Rather than fixate on the possibility of a recession, many contractors remain focused on growth, with expectations for rising sales and staffing levels over the next half year. Even the reading on profit margins increased this month, perhaps reflecting an improved supply chain.

“While 2023 continues to be filled with promise, contractors may soon show more concern,” said Basu. “Anecdotal evidence suggests that financing commercial real estate projects is more difficult, due in part to recession predictions. The general increase in the cost of capital has also jeopardized many projects, with certain contractors noticing an increase in postponements.”

Related Stories

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.