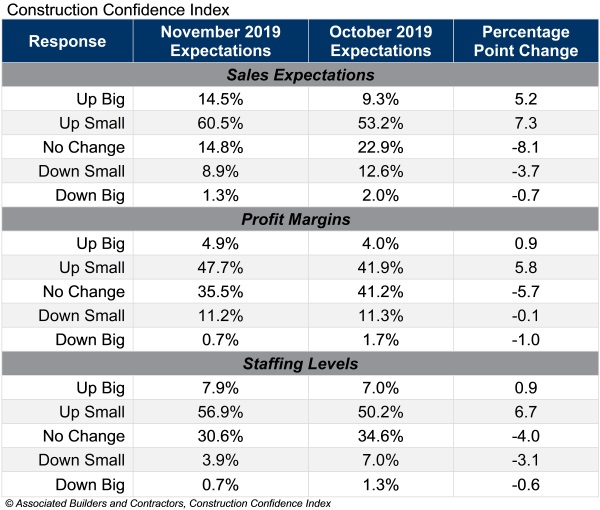

Confidence among U.S. construction industry leaders increased in November 2019 with respect to sales, profit margins, and staffing, according to the Associated Builders and Contractors Construction Confidence Index.

Sales and profit margin expectations reached their highest levels since May 2019, while staffing expectations reached their highest level since April 2019.

Three-quarters of contractors expect sales to rise over the next six months and, as a result, nearly 65% expect to increase their staffing levels, indicating that the average contractor will face even greater challenges recruiting and retaining talent through the first half of 2020.

More than 50% of contractors expect their profit margins to increase over the next six months for the first time since August 2019. Fewer than 12% expect margins to decline, strongly suggesting that demand for construction services remains elevated and purchasers are willing to pay enough to offset rising compensation costs.

• The CCI for sales expectations increased from 63.8 to 69.5 in November.

• The CCI for profit margin expectations increased from 58.8 to 61.3.

• The CCI for staffing levels increased from 63.6 to 66.9.

“The U.S. economy retains significant momentum entering 2020,” said ABC chief economist Anirban Basu. “Accordingly, the nonresidential construction outlook remains stable. The duration of the economic expansion—already record-shattering—has more room to run. ABC’s Construction Backlog Indicator remained virtually unchanged at 8.8 months in November, and with job growth still apparent, demand for office and other forms of commercial construction will persist. Improved state and local government finances working in conjunction with ultra-low interest rates are helping to fuel additional spending in a variety of infrastructure-related categories, including water systems, flood control and public safety. Though there will always be reasons for concern, including those related to geopolitics, the achievement of a first phase trade deal with China and the new United States-Mexico-Canada trade agreement, which replaced NAFTA, should provide much-needed certainty regarding near-term economic prospects.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

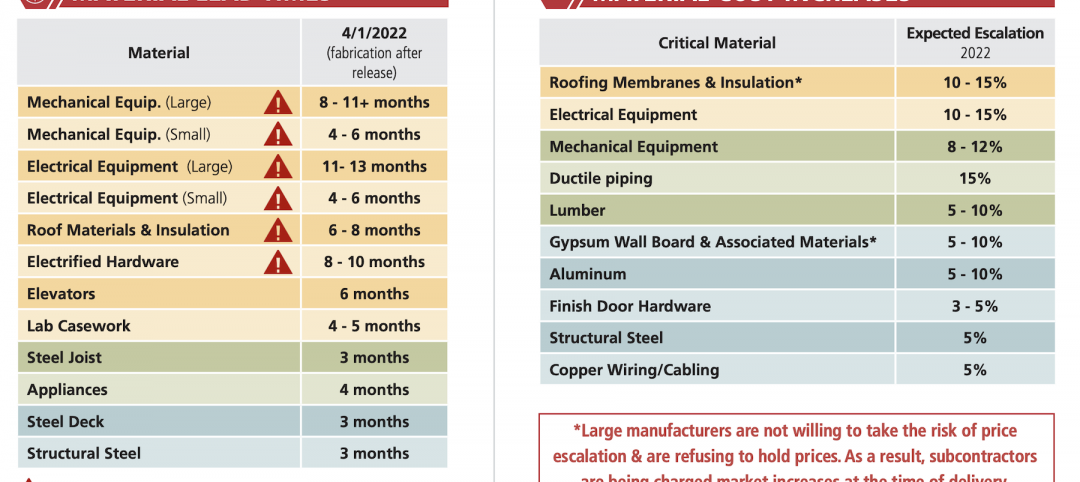

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment