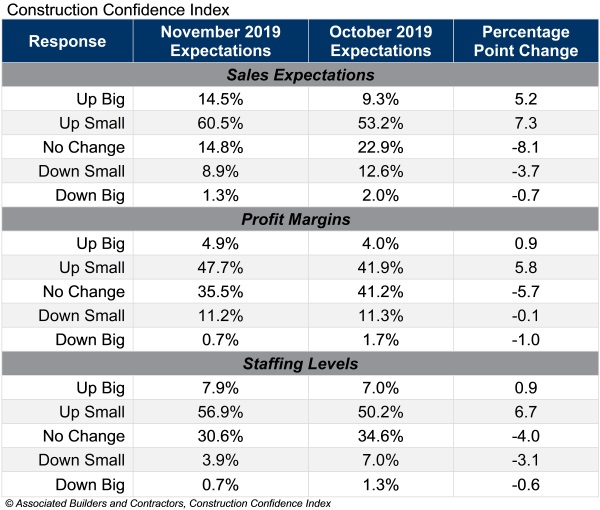

Confidence among U.S. construction industry leaders increased in November 2019 with respect to sales, profit margins, and staffing, according to the Associated Builders and Contractors Construction Confidence Index.

Sales and profit margin expectations reached their highest levels since May 2019, while staffing expectations reached their highest level since April 2019.

Three-quarters of contractors expect sales to rise over the next six months and, as a result, nearly 65% expect to increase their staffing levels, indicating that the average contractor will face even greater challenges recruiting and retaining talent through the first half of 2020.

More than 50% of contractors expect their profit margins to increase over the next six months for the first time since August 2019. Fewer than 12% expect margins to decline, strongly suggesting that demand for construction services remains elevated and purchasers are willing to pay enough to offset rising compensation costs.

• The CCI for sales expectations increased from 63.8 to 69.5 in November.

• The CCI for profit margin expectations increased from 58.8 to 61.3.

• The CCI for staffing levels increased from 63.6 to 66.9.

“The U.S. economy retains significant momentum entering 2020,” said ABC chief economist Anirban Basu. “Accordingly, the nonresidential construction outlook remains stable. The duration of the economic expansion—already record-shattering—has more room to run. ABC’s Construction Backlog Indicator remained virtually unchanged at 8.8 months in November, and with job growth still apparent, demand for office and other forms of commercial construction will persist. Improved state and local government finances working in conjunction with ultra-low interest rates are helping to fuel additional spending in a variety of infrastructure-related categories, including water systems, flood control and public safety. Though there will always be reasons for concern, including those related to geopolitics, the achievement of a first phase trade deal with China and the new United States-Mexico-Canada trade agreement, which replaced NAFTA, should provide much-needed certainty regarding near-term economic prospects.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Nov 30, 2016

Marcum Commercial Construction Index reports industry outlook has shifted; more change expected

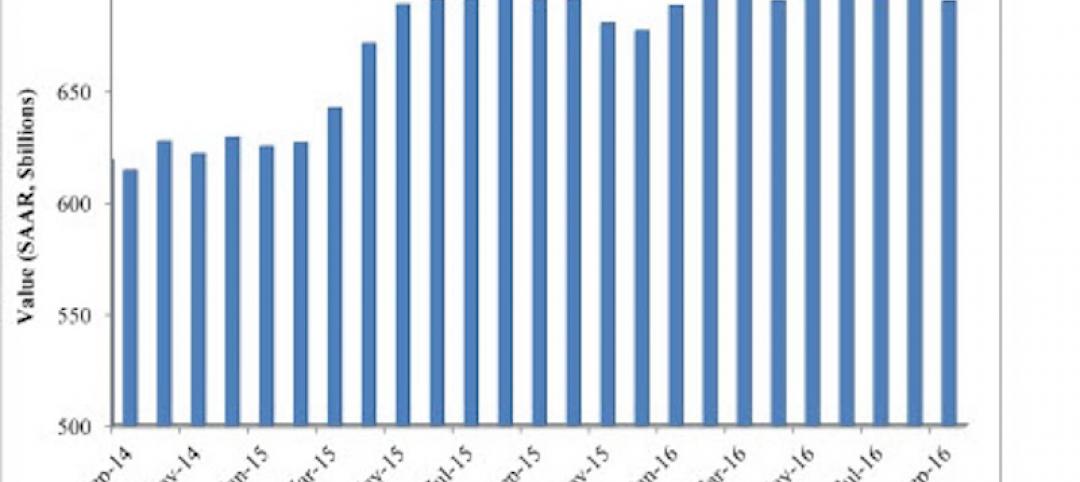

Overall nonresidential construction spending in September totaled $690.5 billion, down a slight 0.7 percent from a year earlier.

Industry Research | Nov 30, 2016

Multifamily millennials: Here is what millennial renters want in 2017

It’s all about technology and convenience when it comes to the things millennial renters value most in a multifamily facility.

Market Data | Nov 29, 2016

It’s not just traditional infrastructure that requires investment

A national survey finds strong support for essential community buildings.

Industry Research | Nov 28, 2016

Building America: The Merit Shop Scorecard

ABC releases state rankings on policies affecting construction industry.

Multifamily Housing | Nov 28, 2016

Axiometrics predicts apartment deliveries will peak by mid 2017

New York is projected to lead the nation next year, thanks to construction delays in 2016

Market Data | Nov 22, 2016

Construction activity will slow next year: JLL

Risk, labor, and technology are impacting what gets built.

Market Data | Nov 17, 2016

Architecture Billings Index rebounds after two down months

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Nov 11, 2016

Brand marketing: Why the B2B world needs to embrace consumers

The relevance of brand recognition has always been debatable in the B2B universe. With notable exceptions like BASF, few manufacturers or industry groups see value in generating top-of-mind awareness for their products and services with consumers.

Industry Research | Nov 8, 2016

Austin, Texas wins ‘Top City’ in the Emerging Trends in Real Estate outlook

Austin was followed on the list by Dallas/Fort Worth, Texas and Portland, Ore.

Market Data | Nov 2, 2016

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.