Construction industry leaders remained upbeat with respect to nonresidential construction prospects in March 2019, according to the latest Construction Confidence Index released today by Associated Builders and Contractors.

All three principal components measured by the survey—sales, profit margins and staffing levels— remained well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity. While contractors are slightly less upbeat regarding profit margins and staffing levels than in February, more than 70% of contractors expect to increase staffing levels over the next six months, a reflection of continued elevated demand for construction services. Despite rising wage pressures, more than 56% of survey respondents anticipate rising profit margins, an indication that users of construction services remain willing to pay more to get projects delivered.

- The CCI for sales expectations increased from 69.4 to 69.6 in March.

- The CCI for profit margin expectations fell from 63.3 to 61.8.

- The CCI for staffing levels fell from 68.5 to 67.8.

“Last year, the U.S. economy grew 2.9%, and it expanded an additional 3.2% during the first quarter of 2019,” said ABC Chief Economist Anirban Basu. “All of this is consistent with the notion that demand for nonresidential construction services will remain elevated for the foreseeable future. The CCI findings are also consistent with ABC’s latest Construction Backlog Indicator report, which revealed that many contractors have a growing number of projects in their pipeline.

“A major source of influence on the data is the reemergence of public construction spending,” said Basu. “With nearly 10 years of economic expansion complete, many state and local governments are experiencing their best fiscal health in years, resulting in more funds to invest in roads, transit systems, schools, fire stations and police stations. The combination of spending growth in certain private construction categories and rising infrastructure outlays will keep the average American nonresidential contractor scrambling to retain and recruit workers, especially in the context of a national rate of unemployment effectively at a 50-year low.

“It should be noted that the most recent CCI survey was completed prior to the turmoil associated with the trade dispute between the United States and China, which may impact contractor confidence,” said Basu. “While global investors have exhibited concern, most construction activity involves U.S.-based enterprises providing services to U.S.-based customers, minimizing unease. That said, the imposition of tariffs has the potential to raise costs of equipment and other inputs, which could at least conceivably impact profit margins. Moreover, market turmoil can truncate the availability of financing to prospective construction projects.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

ABC Construction Confidence Index, March 2019

Related Stories

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

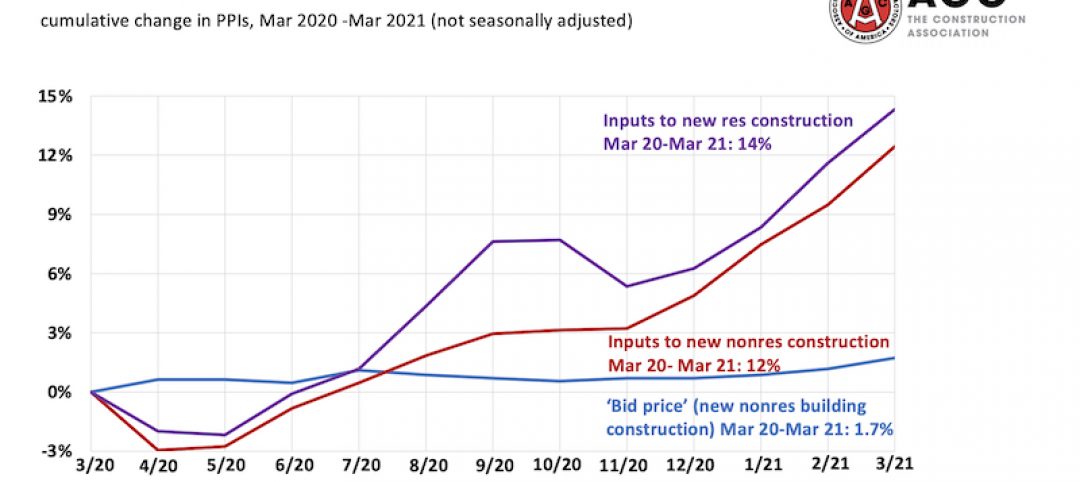

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

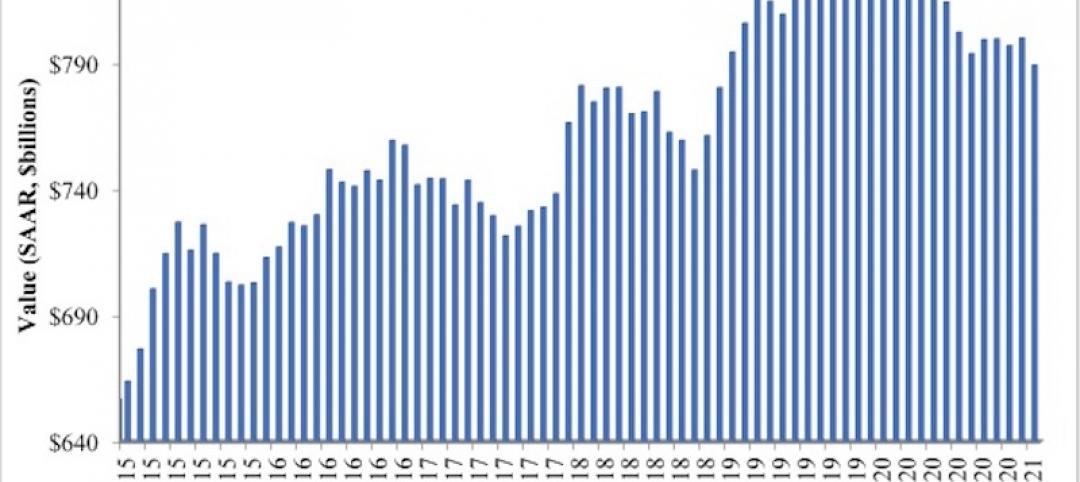

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.