Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

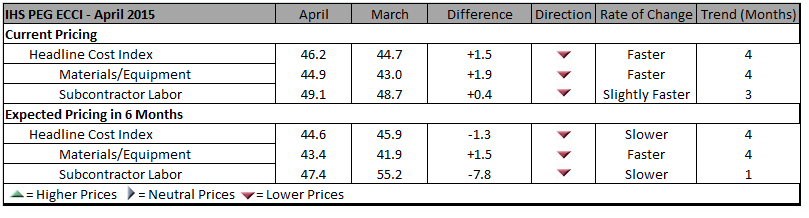

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

Giants 400 | Oct 6, 2022

Top 60 Outpatient Facility Contractors + CM Firms for 2022

Whiting-Turner Contracting Co., PCL Construction, Skanska USA, and Power Construction top the ranking of the nation's largest outpatient facility contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Oct 6, 2022

Top 90 Hospital Facility Contractors + CM Firms for 2022

Turner Construction, Brasfield & Gorrie, DPR Construction, and JE Dunn top the ranking of the nation's largest hospital facility contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Oct 6, 2022

Top 115 Healthcare Sector Contractors + CM Firms for 2022

Turner Construction, Brasfield & Gorrie, DPR Construction, and JE Dunn Construction top the ranking of the nation's largest healthcare sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking factors all healthcare sector work, including hospitals, outpatient facilities, and medical office buildings.

Giants 400 | Oct 6, 2022

Top 90 Healthcare Sector Engineering + EA Firms for 2022

Jacobs, AECOM, WSP, and IMEG Corp. head the ranking of the nation's largest healthcare sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking factors all healthcare sector work, including hospitals, outpatient facilities, and medical office buildings.

Giants 400 | Oct 6, 2022

Top 170 Healthcare Sector Architecture + AE Firms for 2022

HDR, CannonDesign, HKS, and Stantec top the ranking of the nation's largest healthcare sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking factors all healthcare sector work, including hospitals, outpatient facilities, and medical office buildings.

Designers / Specifiers / Landscape Architects | Oct 6, 2022

DAHLIN announces acquisition of Design Line Interiors

DAHLIN Architecture | Planning | Interiors announced today that it is expanding its interiors capabilities with the acquisition of Del Mar, California-based Design Line Interiors.

Contractors | Oct 6, 2022

Modular construction gets boost from impacts of the pandemic

The impact of the Covid pandemic on the construction industry appears to be fueling demand for modular construction methods, especially in the western U.S. and Canada.

Webinar | Oct 6, 2022

Register today! Live webinar: The future of 3D + 360° construction progress management

Learn about the value of digital site documentation and progress monitoring, how reality capture is used for site documentation, and the value of both 3D scans and 360 photos. This live webinar will take place Thursday, October 20 at 2 ET/ 1 CT.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Multifamily Housing | Oct 5, 2022

Co-living spaces, wellness-minded designs among innovations in multifamily housing

The booming multifamily sector shows no signs of a significant slowdown heading into 2023. Here is a round up of Giants 400 firms that are driving innovation in this sector.