Construction costs climbed again in March, with increases for a wide range of building materials, including many that are subject to proposed tariffs that could drive prices still higher and cause scarcities, according to an analysis by the Associated General Contractors of America of Labor Department data released today. Association officials warned that tariffs on some items might lead to project delays and cancellations if supplies become unobtainable or too expensive for current budgets.

"Prices increased for many items in March, even before tariffs announced for steel, aluminum and many items imported from China have taken effect," said the association's chief economist, Ken Simonson. "Steel service centers and other suppliers are warning there is not enough capacity at U.S. mills or in the trucking industry to deliver orders on a timely basis. Thus, contractors are likely to experience still higher prices as well as delivery delays in coming months."

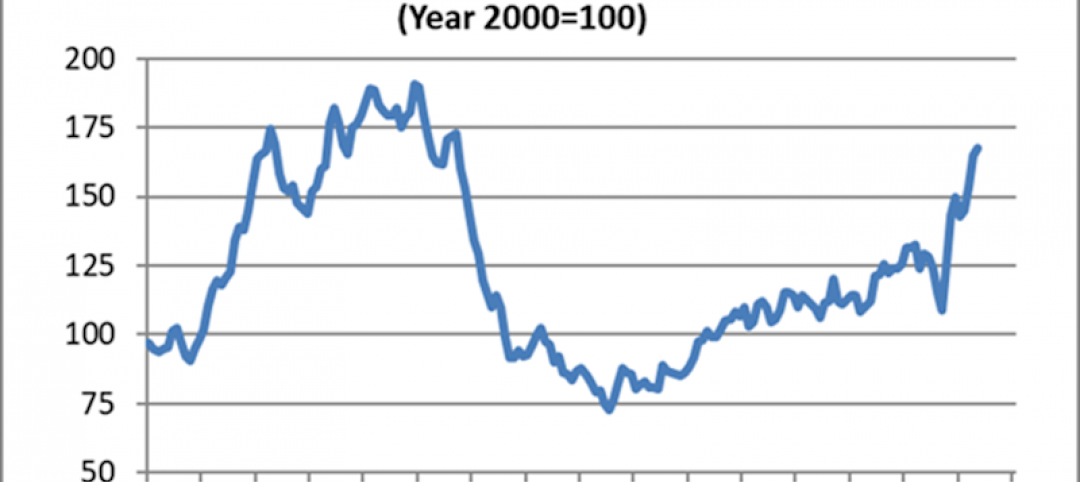

The producer price index for inputs to construction industries, goods—a measure of all materials used in construction projects including items consumed by contractors, such as diesel fuel—rose 0.8% in March alone and 5.8% over 12 months. The year-over-year increase was the steepest since 2011, the economist noted.

"Many items contributed to the latest round of increases," Simonson observed. "Moreover, today's report only reflects prices charged as of mid-March. Since then, some tariffs have taken effect, many others have been proposed, and producers of steel and concrete have implemented or announced substantial additional increases."

From March 2017 to March 2018, the producer price index jumped by 13.7% for lumber and plywood, 11.4% for aluminum mill shapes, and 4.9% for steel mill products. The U.S. has been in a dispute with Canada over lumber imports, has imposed tariffs on several types of steel and has announced or recently imposed additional tariffs—not reflected in the March price index—on steel, aluminum and numerous Chinese construction products.

Other construction inputs that rose sharply in price from March 2017 to March 2018 include diesel fuel, 39.7%; copper and brass mill shapes, 11.2%; gypsum products, 8.4%; and plastic construction products, 5.8%. In addition, concrete and other suppliers announced significant price hikes that were due to take effect in April.

Construction officials said the tariffs that have been announced have already triggered a surge of orders that mills say they cannot fill on a timely basis, which will create budget problems, delays and possibly cancellations for infrastructure and other public projects. They said adequate funding of infrastructure would be a better way to foster demand for domestic steel and aluminum without harming contractors.

"Tariffs will harm contractors that are currently working on projects for which they have not bought materials and will disrupt budgets for future construction," said Stephen E. Sandherr, the association's chief executive officer. "The best way to help the U.S. steel and aluminum sector is to continue pushing measures, like regulatory reform and new infrastructure funding, that will boost demand for their products as the economy expands."

View producer price indexes for construction.

Related Stories

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.

Market Data | Jun 22, 2018

Multifamily market remains healthy – Can it be sustained?

New report says strong economic fundamentals outweigh headwinds.

Market Data | Jun 21, 2018

Architecture firm billings strengthen in May

Architecture Billings Index enters eighth straight month of solid growth.

Market Data | Jun 20, 2018

7% year-over-year growth in the global construction pipeline

There are 5,952 projects/1,115,288 rooms under construction, up 8% by projects YOY.

Market Data | Jun 19, 2018

ABC’s Construction Backlog Indicator remains elevated in first quarter of 2018

The CBI shows highlights by region, industry, and company size.

Market Data | Jun 19, 2018

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

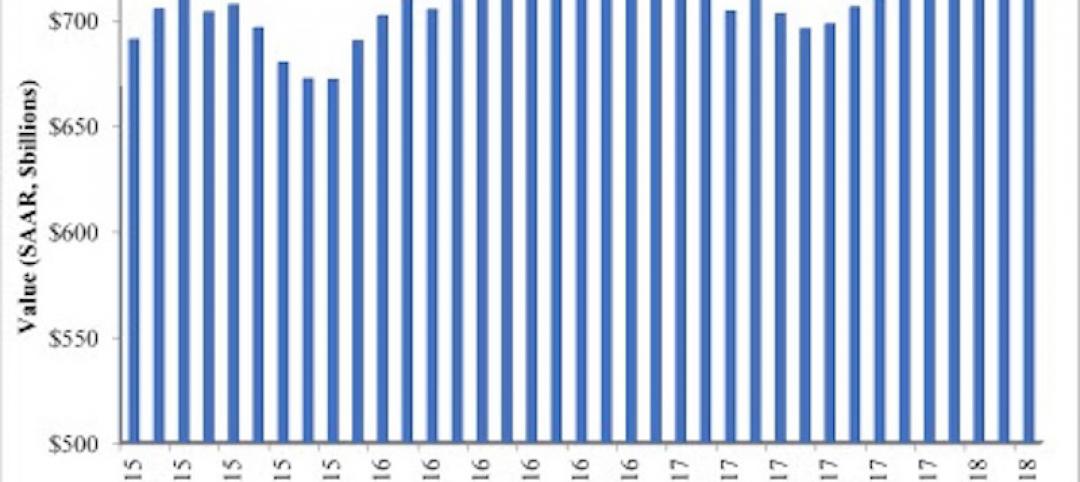

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.