Construction costs climbed again in March, with increases for a wide range of building materials, including many that are subject to proposed tariffs that could drive prices still higher and cause scarcities, according to an analysis by the Associated General Contractors of America of Labor Department data released today. Association officials warned that tariffs on some items might lead to project delays and cancellations if supplies become unobtainable or too expensive for current budgets.

"Prices increased for many items in March, even before tariffs announced for steel, aluminum and many items imported from China have taken effect," said the association's chief economist, Ken Simonson. "Steel service centers and other suppliers are warning there is not enough capacity at U.S. mills or in the trucking industry to deliver orders on a timely basis. Thus, contractors are likely to experience still higher prices as well as delivery delays in coming months."

The producer price index for inputs to construction industries, goods—a measure of all materials used in construction projects including items consumed by contractors, such as diesel fuel—rose 0.8% in March alone and 5.8% over 12 months. The year-over-year increase was the steepest since 2011, the economist noted.

"Many items contributed to the latest round of increases," Simonson observed. "Moreover, today's report only reflects prices charged as of mid-March. Since then, some tariffs have taken effect, many others have been proposed, and producers of steel and concrete have implemented or announced substantial additional increases."

From March 2017 to March 2018, the producer price index jumped by 13.7% for lumber and plywood, 11.4% for aluminum mill shapes, and 4.9% for steel mill products. The U.S. has been in a dispute with Canada over lumber imports, has imposed tariffs on several types of steel and has announced or recently imposed additional tariffs—not reflected in the March price index—on steel, aluminum and numerous Chinese construction products.

Other construction inputs that rose sharply in price from March 2017 to March 2018 include diesel fuel, 39.7%; copper and brass mill shapes, 11.2%; gypsum products, 8.4%; and plastic construction products, 5.8%. In addition, concrete and other suppliers announced significant price hikes that were due to take effect in April.

Construction officials said the tariffs that have been announced have already triggered a surge of orders that mills say they cannot fill on a timely basis, which will create budget problems, delays and possibly cancellations for infrastructure and other public projects. They said adequate funding of infrastructure would be a better way to foster demand for domestic steel and aluminum without harming contractors.

"Tariffs will harm contractors that are currently working on projects for which they have not bought materials and will disrupt budgets for future construction," said Stephen E. Sandherr, the association's chief executive officer. "The best way to help the U.S. steel and aluminum sector is to continue pushing measures, like regulatory reform and new infrastructure funding, that will boost demand for their products as the economy expands."

View producer price indexes for construction.

Related Stories

Market Data | Oct 31, 2016

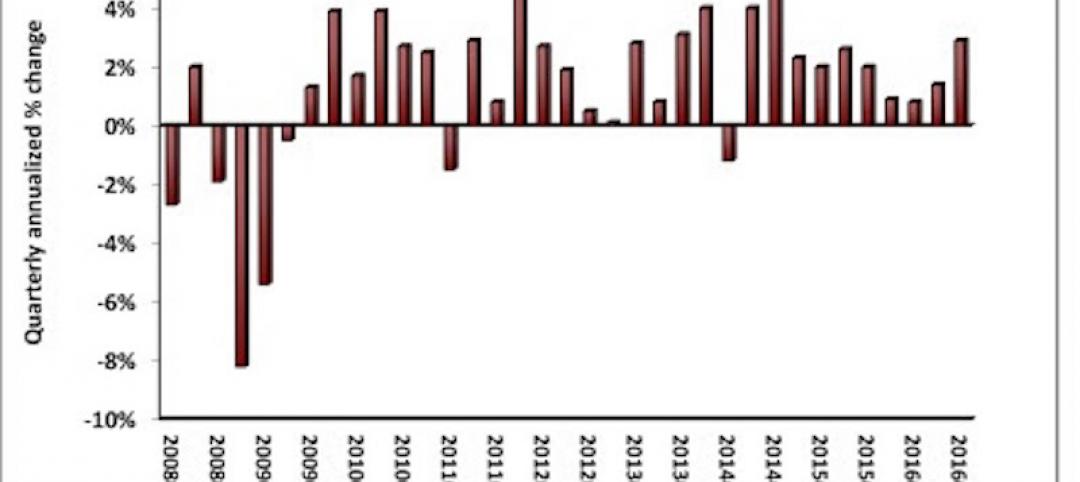

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

High-rise Construction | Oct 21, 2016

The world’s 100 tallest buildings: Which architects have designed the most?

Two firms stand well above the others when it comes to the number of tall buildings they have designed.

Market Data | Oct 19, 2016

Architecture Billings Index slips consecutive months for first time since 2012

“This recent backslide should act as a warning signal,” said AIA Chief Economist, Kermit Baker.

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.