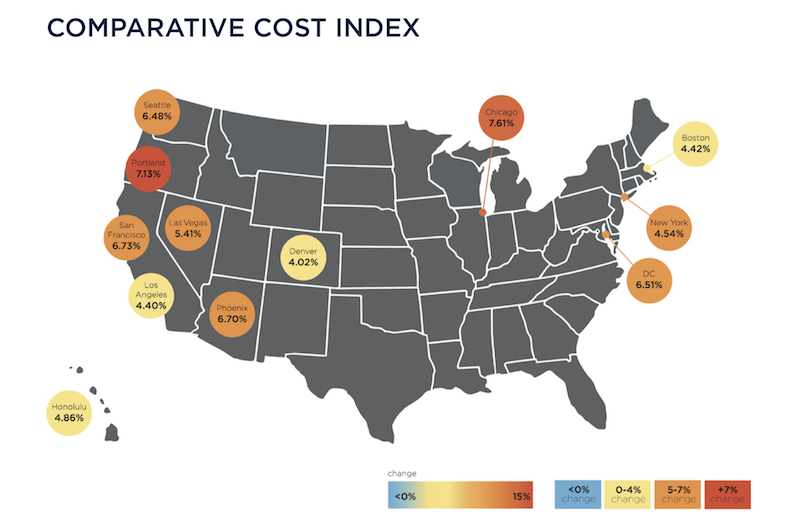

Construction costs nationally rose in 2018 by an average of 5.73%, with Chicago and Portland, Ore., showing the greatest increases among major cities.

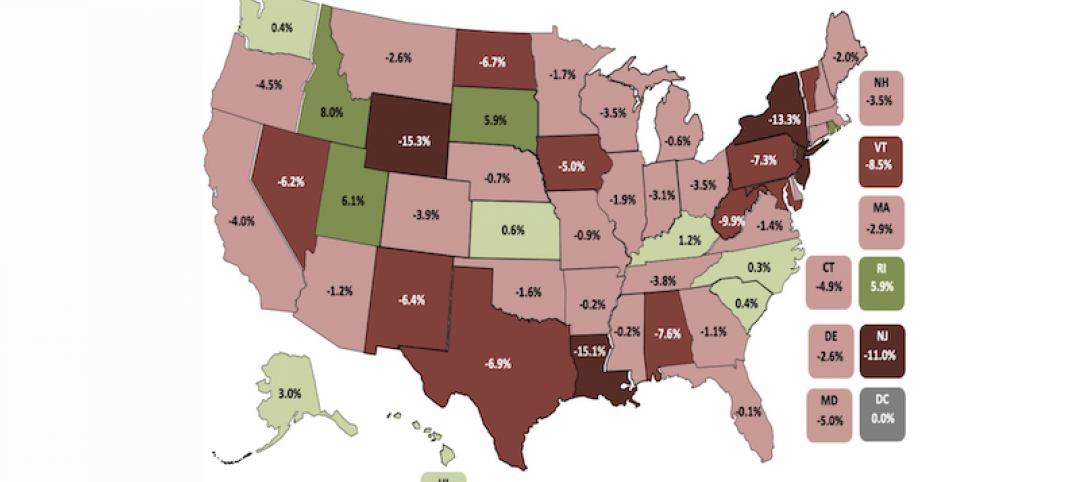

Costs rose at a time when many markets are at or near their construction-activity cycle, and as industry unemployment remained higher than the country’s at large.

Those are two findings in the latest Quarterly Construction Cost Report for North America, released by the property and construction consultant Rider Levett Bucknall (RLB), and based on an analysis of 15 building typologies in 14 metros. (The sectors analyzed include single- and multifamily housing, as well as parking structures.)

The full quarterly report can be accessed here.

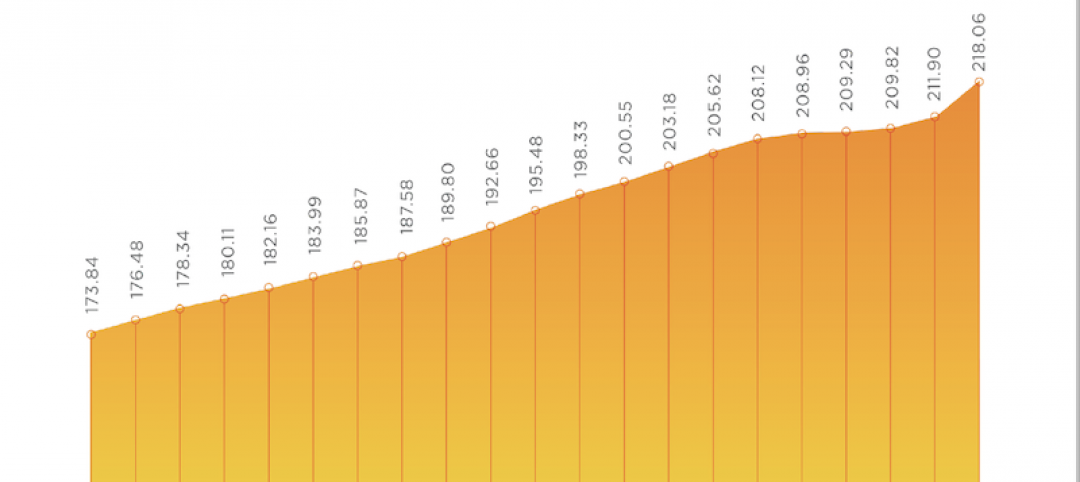

The U.S. Department of Commerce estimates that, as of January 2019, the seasonally adjusted annual rate for Construction Put-in-Place was just under $1.28 trillion, 0.3% above the same monthly estimate a year earlier.

However, the National Construction Cost Index has been on a fairly steady upward trajectory since the first quarter of 2014. As of the first quarter of 2019, that Index stood at 198.33 (relative to the April 2001 base of 100, recalibrated as of April 2011).

Some examples of RLB’s findings include its estimate that the cost of building prime office space is highest in Boston and New York, lowest in Phoenix and Denver. Los Angeles has the highest construction costs for hospitals, and Las Vegas the lowest for elementary schools.

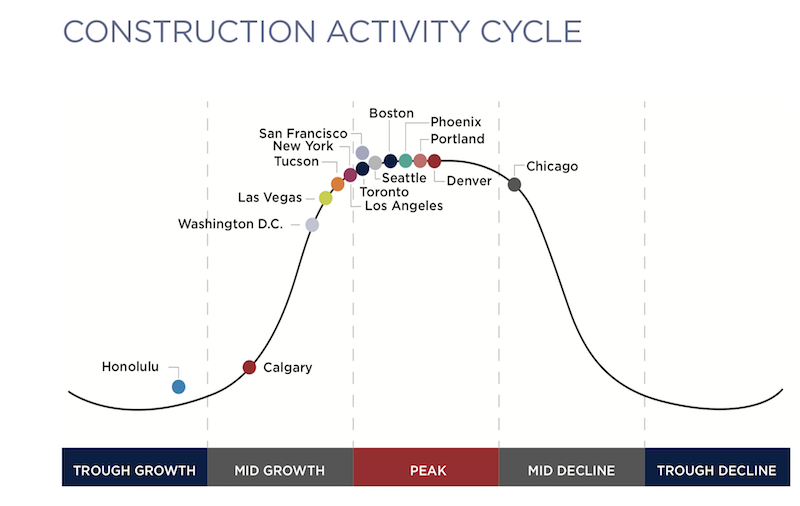

Eight of the 14 markets analyzed were at their construction-activity peaks by the end of last year. Chicago’s construction costs, in general, increased the most (7.61%, to $22.8 billion) among the metros analyzed, even though it was the only city that fell into the “mid decline” category for construction activity. Honolulu, the only city in “trough growth,” saw construction costs rise by 4.86% to $24.8 billion.

Eight of the 14 metros tracked are at the top of their constuction cycles. Image: RLB

Eight of the 14 metros tracked are at the top of their constuction cycles. Image: RLB

San Francisco had the highest construction put-in-place, $26.844 billion, up 6.73%.

Increasingly expensive construction activity occurred despite a decrease in architectural billings, and an industry unemployment rate that, at 5.1% in the fourth quarter of last year, was down from 7.4% in the first quarter of 2018.

The U.S. Gross Domestic Product closed out the fourth quarter at 2.6%, down from a mid-year peak of 4.2%. Inflation last year was up only 1.91%.

The report also analyzes construction costs in Canada, specifically Calgary, Alberta, and Toronto, Ontario. RLB notes that those two cities are driving much of the growth in Canada’s economy.

Related Stories

Market Data | Jul 19, 2021

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.