Construction costs in North America rose for the 22nd consecutive month in November as labor costs continued to increase, amid growing industry concern over the tight availability of skilled workers.

The Engineering and Construction Cost Index (ECCI) registered 53.2 percent in November, up from 52.6 percent in October, according to IHS Inc. (NYSE: IHS) and the Procurement Executives Group (PEG). The ECCI indicates that construction costs in North America have been on the rise for nearly two years since January 2012.

The attached figure presents the monthly results of the ECCI. A number higher than 50 indicates a monthly increase in prices paid, while a reading lower than 50 shows a price decline.

The index divides construction costs into two major categories: materials/equipment and subcontractor labor. With the materials/equipment portion of the index hovering near 50 since April, it was the labor segment that drove the increase for the month.

The current subcontractor labor index climbed to 58.5 percent, up from 56.4 percent last month, with the strongest gains in November concentrated in Western Canada as well as in the southern and western regions of the United States.

Shale shock

The shale gas boom in the United States is playing a major role in driving increased spending on construction and rising costs for associated labor in North America.

“Labor concerns have been reported in the U.S. Gulf Coast, where demand from new downstream energy projects is expected to increase,” said Laura Hodges, director of the pricing and purchasing service at IHS. “Some in the industry are even suggesting shortages of skilled laborers such as welders and pipefitters in 2014 because of increasing investment in such projects.”

For several years, materials costs were the major factor driving up expenses for North American construction firms, as China’s economic boom ate up the available global supply. However, as China’s growth has slowed, the focus has shifted from materials to labor.

North American construction companies now say their main concern is the continued increase in labor costs. With U.S. spending on construction on the rise and skilled workers aging, the availability of skilled laborers is likely to become tighter.

While costs for these skilled laborers are on the increase, the wage inflation is not likely to climb as high as it did in 2007, when a strong U.S. economy spurred double-digit annual pay increases for these skilled areas. This is largely because the strength of the U.S. economy is not as uniform as it was 2007 and employers are investing in training and mentoring programs to be prepared for this next wave of activity.

The material world

Looking at the material/equipment segment of the ECCI, November recorded the seventh consecutive month of falling prices for carbon steel pipe and a fourth month of declining freight rates between Asia and the United States. Copper-based wire and cable and fabricated structural steel also joined the ranks of falling prices in November and moved below the 50-percent threshold.

About the ECCI

The IHS/PEG Engineering and Construction Cost Index (ECCI) is a diffusion index based on data independently obtained and compiled by IHS from the procurement executives of leading engineering, procurement, and construction firms. The headline index tracks industry-specific trends and variations, identifying market turning points for key projects, and is intended to act as a leading indicator for wage and material inflation specific to this industry.

Each survey response is weighted equally for every $2 billion in spending in North America. Respondents are asked whether prices—either actual paid transactions or company-informed transactions—during the current month for individual materials, equipment, and regional subcontractor rates, were higher, lower or the same as the prior month.

Respondents are then asked for their six-month pricing expectations among these same subcategories. The results are compiled into diffusion indexes, in which a reading greater than 50 represents upward pricing strength and a reading below 50 represents downward pricing strength.

Related Stories

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Airports | Jan 26, 2021

Security concerns will drive demand for airport technology over the next five years

A new report explores where and what spending for “smart” airports is likely to focus on.

Giants 400 | Dec 16, 2020

Download a PDF of all 2020 Giants 400 Rankings

This 70-page PDF features AEC firm rankings across 51 building sectors, disciplines, and specialty services.

Giants 400 | Dec 2, 2020

2020 Airport Sector Giants: Top architecture, engineering, and construction firms in the U.S. airport facilities sector

AECOM, Hensel Phelps, and PGAL top BD+C's rankings of the nation's largest airport sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.

Airports | Nov 20, 2020

Populous survey shows travelers are ready to return to the airport, with proper protection

Survey data points to achievable solutions for airports around the globe.

AEC Tech | Nov 12, 2020

The Weekly show: Nvidia's Omniverse, AI for construction scheduling, COVID-19 signage

BD+C editors speak with experts from ALICE Technologies, Build Group, Hastings Architecture, Nvidia, and Woods Bagot on the November 12 episode of "The Weekly." The episode is available for viewing on demand.

Airports | Oct 6, 2020

Airport of the Future global student design competition 2020 winners announced

Winning projects reimagine airport mobility in the year 2100 for one of the 20 busiest airports in the world.

Airports | Sep 18, 2020

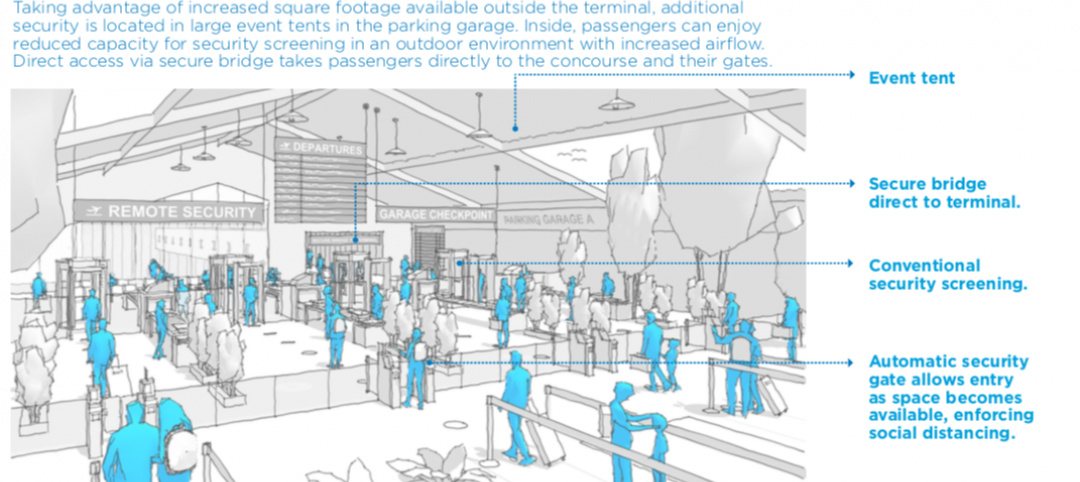

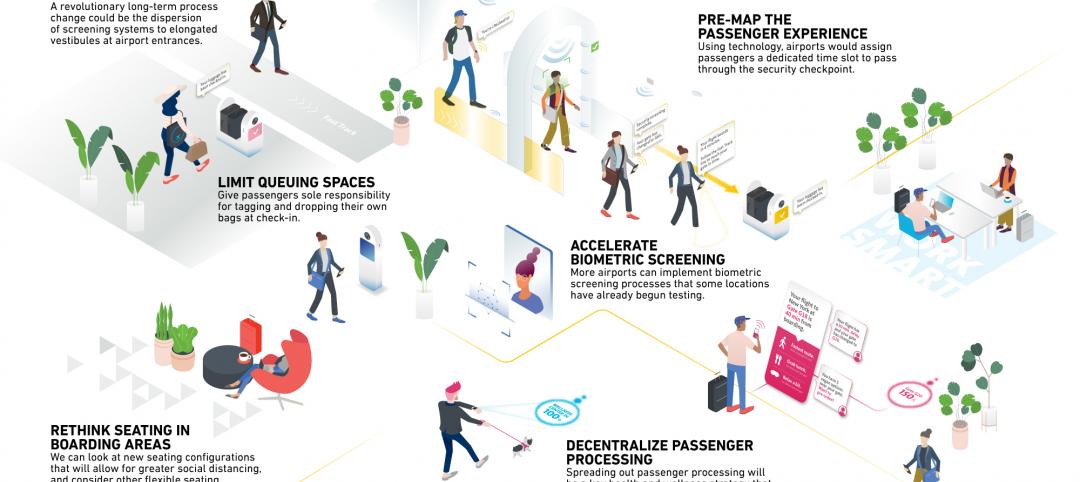

Infection control measures for airport terminals

More automation and scanning, of people and baggage, will help unclog airports.

Airports | Sep 18, 2020

Wings clipped, airports veer to tech to regain passenger trust

Alternative project delivery methods are also being considered.

Airports | Sep 10, 2020

The Weekly show: Curtis Fentress, FAIA, on airport design, and how P3s are keeping university projects alive

The September 10 episode of BD+C's "The Weekly" is available for viewing on demand.