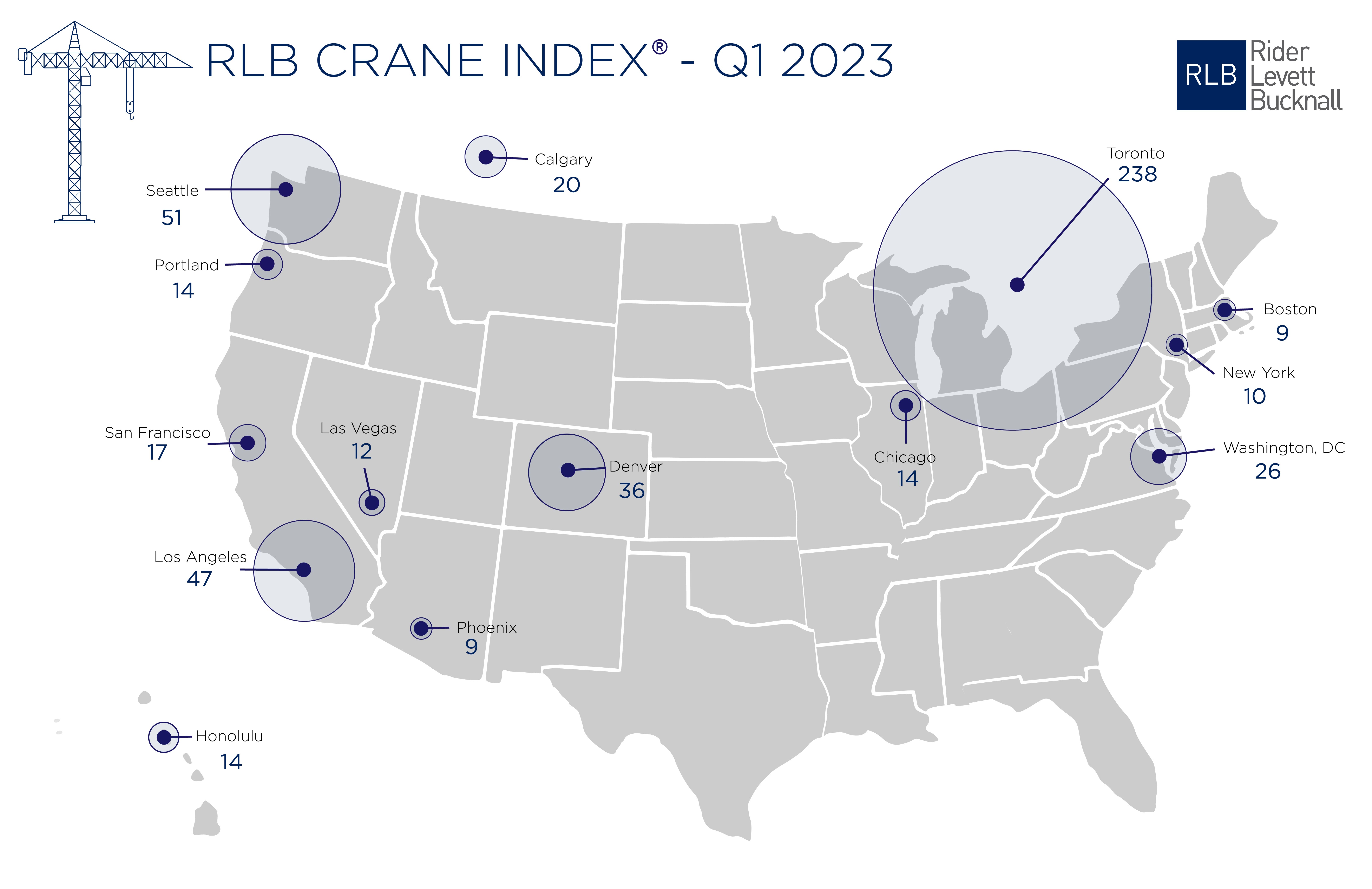

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed construction cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Toronto had a whopping 238 cranes in place in the first quarter. Seattle had 51 cranes to lead all U.S. cities, followed by Los Angeles (47), Denver (36), and Washington, D.C. (26).

The RLB survey reports a nominal increase of 7.04% (34 cranes) from the Q3 2022 edition of the RLB Crane Index. Of the 14 cities surveyed, eight experienced

an increase in cranes, two decreased, and four held steady.

The three top sectors across all cities are residential (51%), mixed use (22%), and commercial (12%).

"Despite continued workforce challenges and economic uncertainties are still concerns for the coming year, we are continuing to see new projects break ground within our 14-key markets. This indicates that investments are continuing to be made into our cities," said the report's authors.

"Notwithstanding concerns for the housing market, residential and mixed-use projects make up 73% of the overall count. We anticipate the number of cranes to remain high into 2023. Despite uncertain market conditions, construction projects will continue to break ground, albeit at a cost," the added.

About the RLB Crane Index

Rider Levett Bucknall’s Crane Index for North America is published biannually. It tracks the number of operating tower cranes in 14 major cities across the U.S. and Canada. The index was the first of its kind, and unlike other industry barometers that track cost and other financial data, the Crane Index tracks the number of fixed cranes on construction sites and gives a simplified measure of the current state of the construction industry’s workload in each location.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

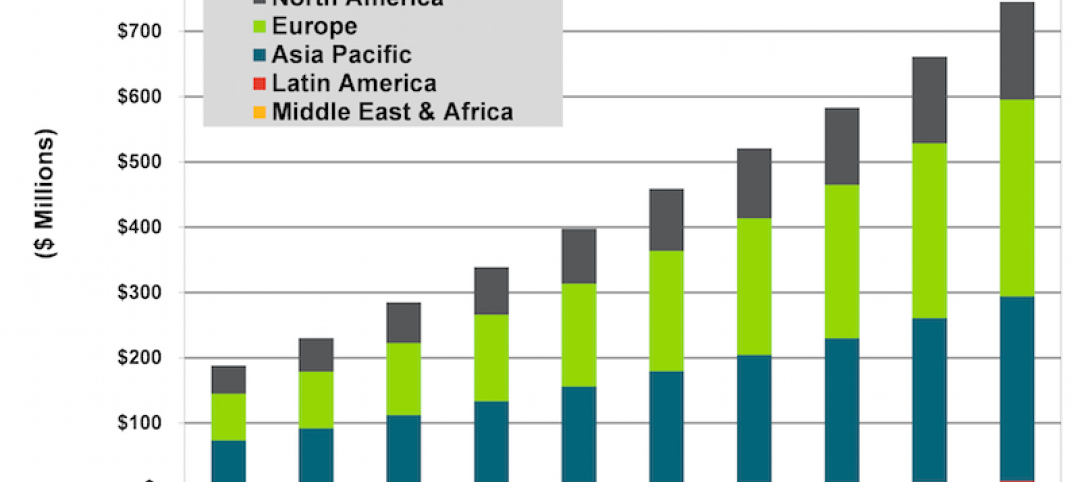

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.