The resolution of global construction disputes remained steady in 2016, and the average time it took to resolve those disputes declined bit, according to the seventh annual Arcadis Global Construction Disputes Report 2017, which is subtitled “Avoiding the Same Pitfalls.”

This report reflects the construction disputes that Arcadis’ team handled around the world. The report infers that the roadblocks to expeditious and less cost dispute resolution often stem from the need for better contract administration, robust documentation, and a proactive approach to risk management.

“Our industry contains the best problem solvers in the world,” the report states. “But there often seems to be a lack of ability or willingness of the project participants to compromise and resolve disputes at the earliest and most inexpensive stage possible.” Roy Cooper, Senior Vice President of Arcadis Contract Solutions, attributes disputes to “human emotions that can impede settlements, as they do with physical factors such as differing site conditions and design errors.”

The world’s economic expansion generally is not seen as an impediment to resolving contract disputes. Global growth is projected at 3.5% in 2017, and 3.6% in 2018, according to the International Monetary Fund.

While the outlook is positive, the report sees risks in labor contraction, increasing commodities prices, and uncertain immigration policies. “A potential widening of global imbalances, coupled with sharp currency exchange rate movements, should those occur in response to major policy shifts, could further intensify protectionist pressures.”

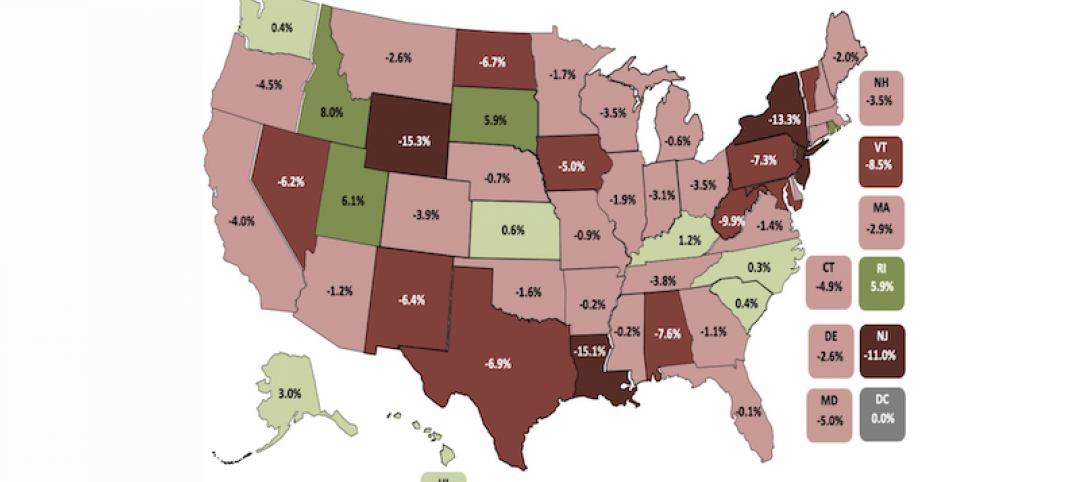

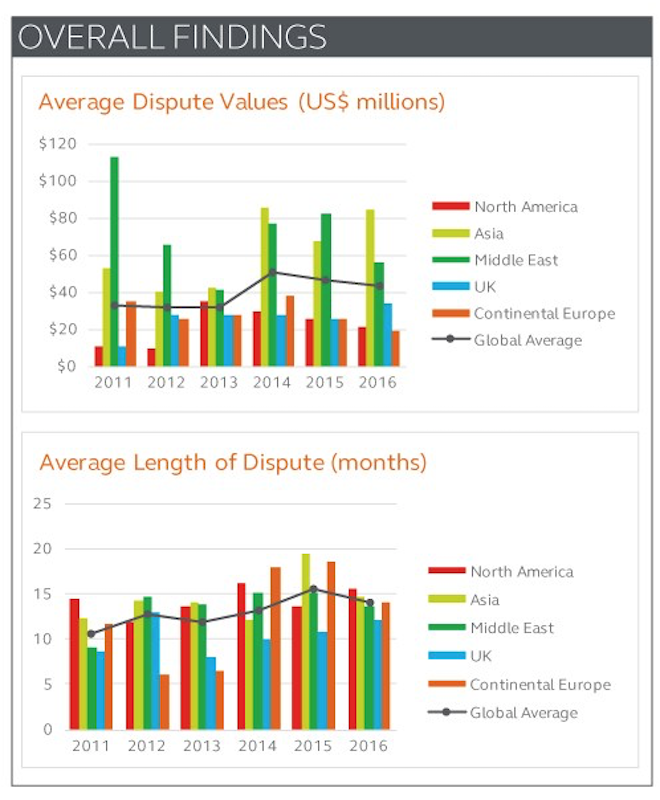

A summary of Arcadis' findings for 2016. Image: Arcadis US

That being said, the global average construction dispute value declined in 2016 by nearly 7% to US$42.8 million (and that includes one US$2 billion dispute Arcadis handled). Asia averaged the highest dispute value, at US$84 million, and the United Kingdom saw a double-digit increase in its average dispute value, to US$34 million.

The global average length of a dispute also fell slightly last year, to 14 months. North America’s dispute duration was the longest of all Arcadis’ regions, an average of 15.6 months. For the third consecutive year, the most common cause for disputes in North America in 2016 was errors and/or omissions in the contract documentation.

Asia had the highest average dispute value last year; North America the longest time it took to resolve a dispute. Image: Arcadis

Globally, Arcadis identifies failure to properly administer a contract among the five most common causes of disputes, along with poorly drafted or incomplete/unsubstantiated claims; the failure of an employer, contractor or subcontractor to understand or comply with its contractual obligations; errors and omissions in the contract; and incomplete design information or employer requires.

The most common methods to resolve construction disputes were, in order of preference, party-to-party negotiation, arbitration, and mediation.

And the most important activities to avoid disputes were led by proper contract administration, accurate documents, and fair and appropriate risk and balances in contracts.

Related Stories

Market Data | Jul 19, 2021

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

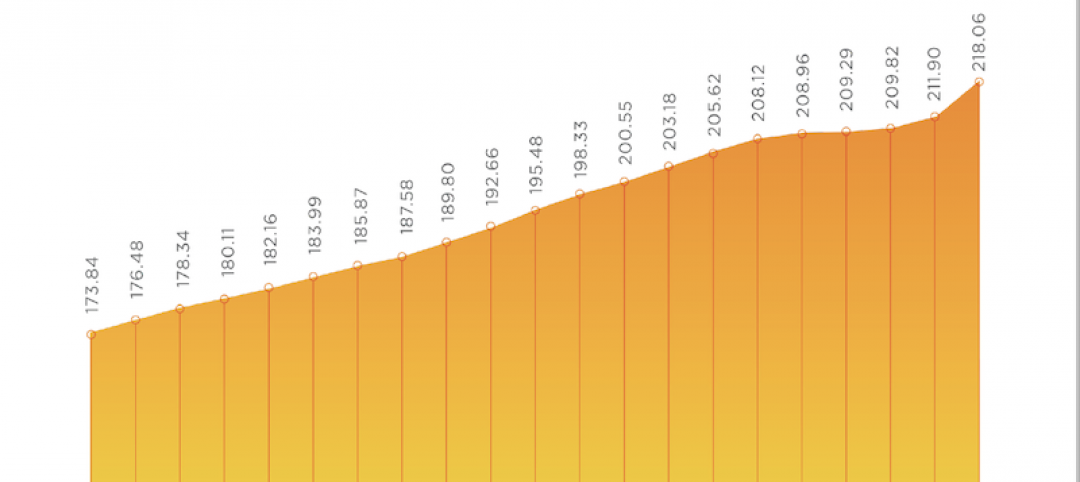

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

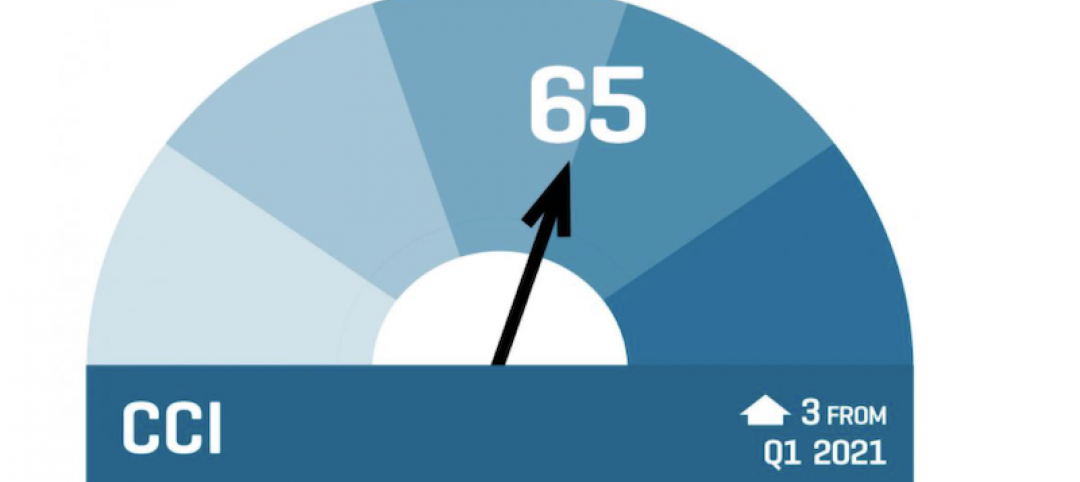

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.