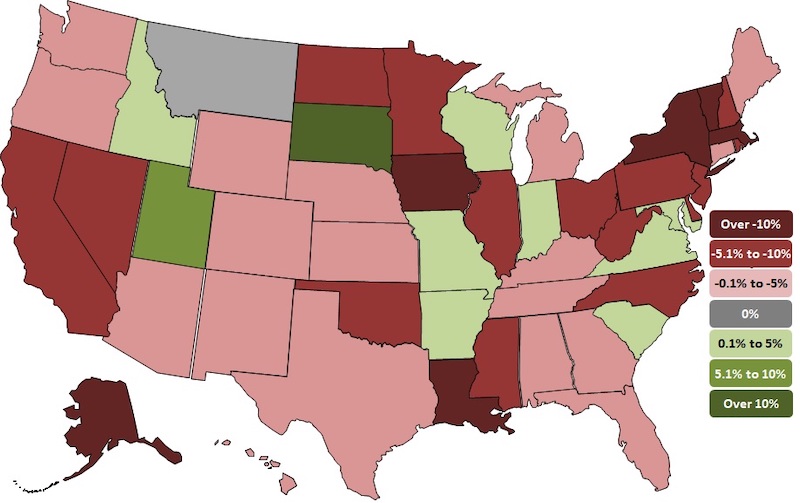

Thirty-nine states lost construction jobs between August 2019 and August 2020 while 31 states and the District of Columbia added construction jobs between July and August according to a new analysis of Labor Department data released today by the Associated General Contractors of America. The new annual figures detail how the coronavirus pandemic has undermined demand for construction projects after a strong start to the year.

“The ongoing pandemic is prompting ever more private owners, developers, and public agencies to delay and cancel projects,” said Ken Simonson, the association’s chief economist, citing the association’s mid-June survey and a more recent survey it produced in August. “The share of contractors that reported postponed or canceled projects nearly doubled while the share who reported winning new or expanded work dropped nearly in half.”

California lost the most construction jobs (-52,000, -5.8%) between August 2019 and August 2020, followed by New York (-46,000, -11.3%); Texas (-39,300 jobs, -5.0%); Massachusetts (-20,200 jobs, -12.4%) and Illinois (-17,200 jobs, -7.5%). Vermont lost the highest percent of construction jobs for the year (-29.6%, -4,500 jobs), followed by Massachusetts; Iowa (-11.8%, -9,300 jobs); Louisiana (-11.4%, -15,700 jobs) and New York.

Ten states and the District of Columbia added construction jobs between August 2019 and August 2020 while construction employment was unchanged in Montana. Utah added the most new construction jobs (8,800 jobs, 8.0%), followed by Virginia (4,400 jobs, 2.2%); Maryland (3,800 jobs, 2.3%); Indiana (3,100 jobs, 2.1%) and Missouri (2,700 jobs, 2.1%). South Dakota added the highest percent (10.9%, 2,600 jobs), followed by Utah; Idaho (2.4%, 1,300 jobs); Maryland and Virginia.

California added the most new construction jobs (6,700 jobs, 0.8%) between July and August, followed by New York (5,200 jobs, 1.5%); Pennsylvania (4,100 jobs, 1.7%); Texas (3,300 jobs, 0.4%) and Oregon (3,200 jobs, 3.1%). New Mexico added the highest percentage (6.7%, 3,100) of jobs for the month, followed by Mississippi (3.4%, 1,400 jobs); Oregon and Kentucky (2.0%, 1,600 jobs).

Nineteen states lost construction jobs for the month with Nevada losing the most (-2,600 jobs, -2.8%). Other states losing a high number of construction jobs for the month include Florida (-2,200 jobs, -0.4%); Nebraska (-1,800 jobs, -3.3%) and North Carolina (-1,800 jobs, -0.8%). Hawaii lost the highest percentage (-3.5%, -1,300 jobs) of construction jobs for the month, followed by West Virginia (-3.3%, -1,100 jobs); Nebraska and Nevada.

Association officials said the best thing Washington leaders can do to boost demand for construction and employment in the sector is to increase investments in infrastructure and provide liability protections for firms taking steps to protect workers from the coronavirus. They added that extending the current surface transportation bill for one-year – which appears likely to occur – will provide needed short-term certainty for the transportation construction market.

“The best way to create jobs and boost economic activity is to rebuild aging infrastructure, provide market certainty and protect firms from needless suits,” said Stephen E. Sandherr, the association’s chief executive officer.

View state employment data, 12-mo, 1-mo rankings, map and high and lows. View the workforce survey results.

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.