Construction employment decreased from March 2020 to March 2021 in 203, or 57%, of the nation’s metro areas, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said that the industry’s broader recovery in many parts of the country is being hampered by rising materials prices, supply chain disruptions and project cancellations.

“Nearly twice as many metros have lost construction jobs as gained them in the past 12 months, even though homebuilding has recovered strongly and the overall economy is in much better shape than it was a year ago,” said Ken Simonson, the association’s chief economist. “Nonresidential construction is still at risk of further declines in much of the country.”

Houston-The Woodlands-Sugar Land, Texas lost the largest number of construction jobs over the 12-month period (-31,000 jobs, -13%), followed by New York City (-24,000 jobs, -15%); Midland, Texas (-10,000 jobs, -26%); Odessa, Texas (-8,000 jobs, -39%); and Nassau County-Suffolk County, N.Y. ( 7,900 jobs, -10%). Odessa had the largest percentage decline, followed by Lake Charles, La. (-35%, -6,800 jobs); Midland; Longview, Texas (-24%, -3,600 jobs) and Greeley, Colo. (-21%, -4,100 jobs).

Only 104, or 29%, out of 358 metro areas added construction jobs during the past 12 months, while construction employment was stagnant in 51 metro areas. Seattle-Bellevue-Everett, Wash. added the most construction jobs over 12 months (5,300 jobs, 5%), followed by Indianapolis-Carmel-Anderson, Ind. (4,300 jobs, 8%); Austin-Round-Rock, Texas (4,000 jobs, 6%); Sacramento--Roseville--Arden-

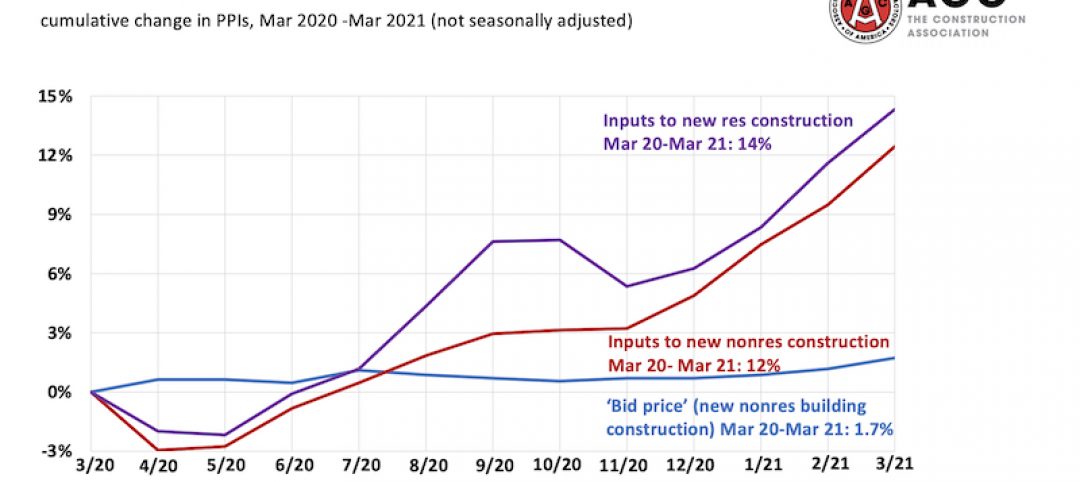

Association officials said that construction firms were being squeezed by rapidly rising materials prices while they are unable to charge more for construction projects amid broader market uncertainties caused by the pandemic. They urged federal officials to ease tariffs on key construction materials – including steel and lumber – to address materials prices and to boost investments in infrastructure to boost demand.

“Construction employment is not going to rebound in many parts of the country while firms are struggling to afford the materials they need to complete existing projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Once federal officials take immediate and effective steps to address both spiking prices and lagging demand, employment levels should rebound in more of the country.”

View the metro employment 12-month data, rankings, top 10, multi-division metros, and map.

Related Stories

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

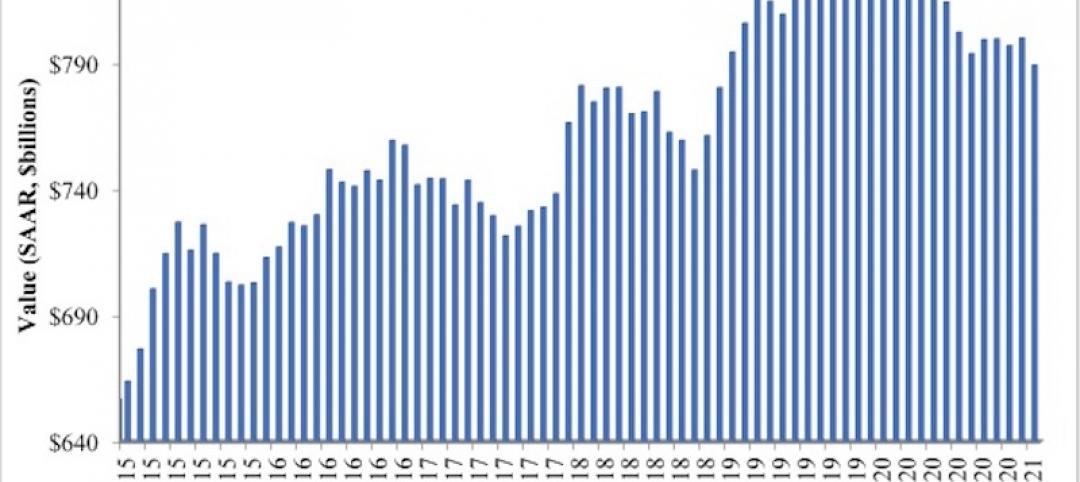

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.