Construction employment declined in 99 out of 358 metro areas from March 2019 to last month as the coronavirus pandemic triggered the first shutdown orders and project cancellations, according to an analysis released by the Associated General Contractors of America today. Association officials urged federal and state officials to boost investments in infrastructure to help put more people to work amid rising unemployment levels.

“These new figures foreshadow even larger declines in construction employment throughout the country as the pandemic’s economic damage grows more severe,” said Ken Simonson, the association’s chief economist. “Unfortunately, the data for April and later months are sure to be much worse. In our latest survey, more than one-third of firms report they had furloughed or terminated workers—a direct result of growing cancellations.”

The largest percentage decline in construction employment between March 2019 and last month occurred in Laredo, Texas, which lost 19% or 800 jobs, followed by Lake Charles, La., which lost 18% (4,600 construction jobs). Lake Charles had the largest numerical decrease, followed by New York City, which lost 3,500 construction jobs (2%).

Construction employment increased over the year in 205 metro areas and was flat in 54. The largest percentage increases in construction employment occurred in Lewiston, Idaho-Wash. (23%, 300 jobs), followed by Walla Walla, Wash. (22%, 22 jobs). The largest numerical gain occurred in Dallas-Plano-Irving, Texas (10,200 jobs, 7%).

Association officials noted that new infrastructure investments would help offset some of the sudden and dramatic declines to demand for construction that have taken place since the start of the coronavirus pandemic. They noted, for example, that 68% of construction firms report in the association’s April 20-23 survey that they have had projects cancelled or delayed during the past two months.

“New infrastructure funding will put more people back to work in high-paying construction jobs in communities throughout the nation,” said Stephen E. Sandherr, the association’s chief executive officer. “New infrastructure funding will also give a needed boost to manufacturing and service sector firms that supply construction employers, all of which have been hard-hit by the coronavirus and the related economic shutdowns.”

View AGC’s coronavirus resources and survey. View comparative data here. View the metro employment data, rankings, highs and lows and top 10.

Related Stories

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

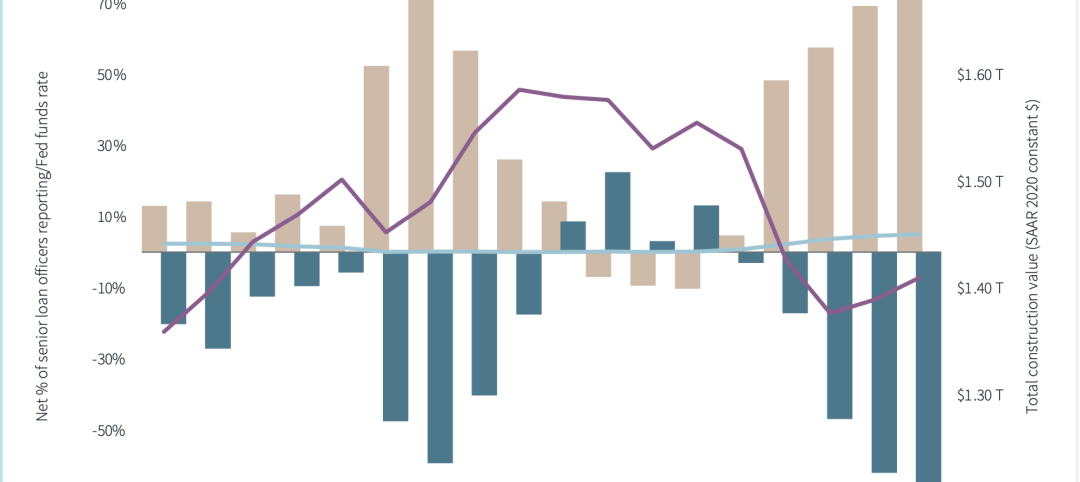

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.