Construction employment dipped by 5,000 jobs between December and January even though hourly pay rose at a record pace in the past year, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said future job gains are at risk from several factors that are slowing projects, as detailed in the Construction Inflation Alert that it will post on February 7.

“Contractors are struggling to fill positions as potential workers opt out of the labor market or choose other industries,” said Ken Simonson, the association’s chief economist. “In addition, soaring materials costs and unpredictable delivery times are delaying projects and holding back employment gains.”

Simonson noted that average hourly earnings in the construction industry increased 5.1% from January 2021 to last month--the steepest 12-month increase in the 15-year history of the series. The industry average of $33.80 per hour exceeded the private sector average by nearly 7%. However, competition for workers has intensified as other industries have hiked starting pay and offered working conditions that are not possible in construction, such as flexible hours or work from home.

Since January 2021 the industry has added 163,000 employees despite the decline last month. But the number of unemployed jobseekers among former construction workers shrank by 229,000 over that time, indicating workers are leaving the workforce altogether or taking jobs in other sectors, Simonson added.

Construction employment totaled 7,523,000 last month, which was 101,000 jobs or 1.3% less than in pre-pandemic peak month of February 2020. However, the totals mask large differences between residential and nonresidential segments of the industry, Simonson said.

Nonresidential construction firms--general building contractors, specialty trade contractors, and heavy and civil engineering construction firms--lost 9,000 employees in January. Nonresidential employment remains 213,000 below the pre-pandemic peak set in February 2020. In contrast, employment in residential construction--comprising homebuilding and remodeling firms--edged up by 4,400 jobs in January and topped the February 2020 level by 112,000.

Association officials said the Construction Hiring and Business Outlook survey that it released in January showed most contractors expect to add employees in 2022 but overwhelmingly find it difficult to find qualified workers. The association will shortly post an updated Construction Inflation Alert to inform owners, officials, and others about the challenges the industry is experiencing with employment, materials costs, and delays.

“Construction firms are struggling to find workers to hire even as they are being forced to cope with rising materials prices and ongoing supply chain disruptions,” said Stephen E. Sandherr, the association’s chief executive officer. “But instead of addressing those challenges, the Biden administration is adding to these problems with a new executive order that will inflate the cost of construction, discriminate against most workers and undermine the collective bargaining process.”

View the construction employment table. View the association’s Outlook survey.

Related Stories

Apartments | Aug 22, 2023

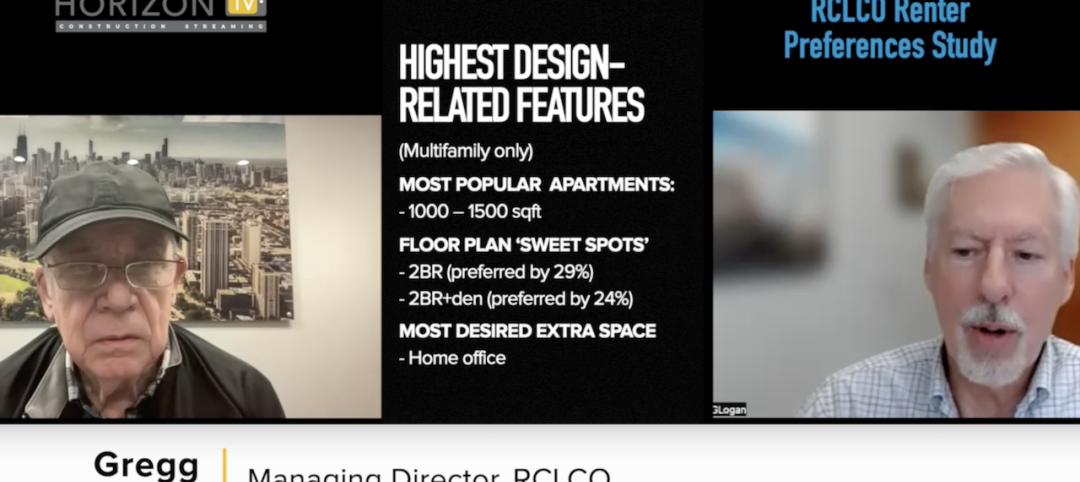

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

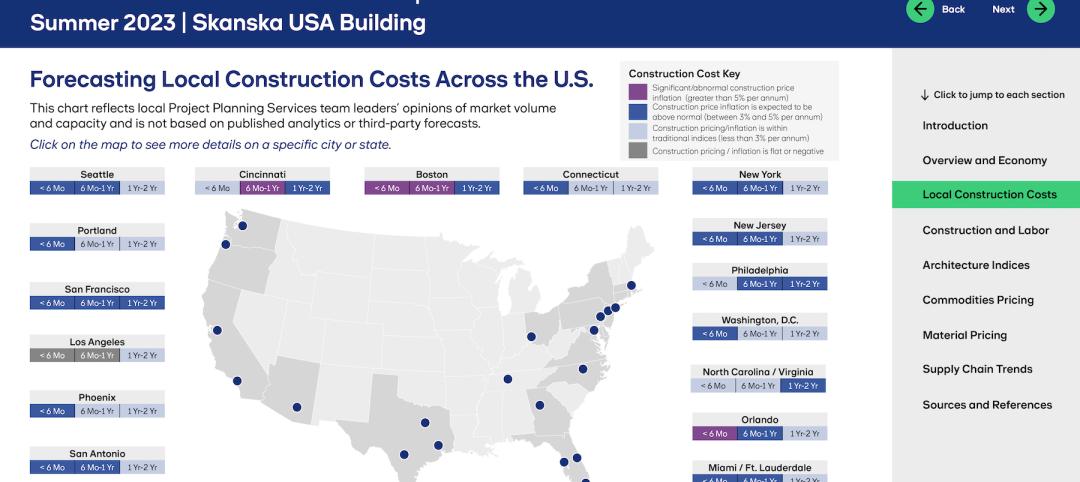

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.