Construction employment in February remained below pre-pandemic levels in all but six states, according to an analysis by the Associated General Contractors of America of government employment data released today, while soaring materials costs and supply-chain problems threaten future employment. The association issued a Construction Inflation Alert detailing the problems and urged a rollback of tariffs and other supply impediments.

“Today’s figures show most states are still far from recovering the construction jobs lost a year ago,” said Ken Simonson, the association’s chief economist. “The overall economy is recovering, but huge price spikes and ever-lengthening delivery times threaten to set construction back further.”

The association’s new inflation alert documents a wide variety of materials undergoing steep and frequent price increases and delivery delays, Simonson noted. This combination threatens to hold up the start or completion of numerous projects and add to the downward pressure on construction employment, the economist warned.

Seasonally adjusted construction employment in February 2021 was lower than in February 2020—the last month before the pandemic forced many contractors to suspend work—in 44 states and the District of Columbia. Texas lost the most construction jobs over the period (-56,400 jobs or -7.2%), followed by New York (-41,100 jobs, -10.1%), California (-35,000 jobs, -3.8%), Louisiana (-20,400 jobs, -14.9%), and New Jersey (-18,200 jobs, -11.1%). Louisiana experienced the largest percentage loss, followed by Wyoming (-14.0%, -3,200 jobs), New Jersey, New York, and West Virginia (-9.3%, -3,100 jobs).

Only six states added construction jobs from February 2020 to February 2021. Utah added the most jobs (6,700 jobs, 5.9%), trailed by Idaho (4,500 jobs, 8.2%) and Arkansas (900 jobs, 1.7%). Idaho added the highest percentage, followed by Utah and Arkansas.

From January to February, 35 states lost construction jobs, 11 states added jobs, and there was no change in D.C., Idaho, Oregon, Rhode Island, and Vermont. New York had the largest loss of construction jobs for the month (-15,600 jobs or -4.1%), followed by Indiana (-6,100 jobs, -4.1%), Illinois (-5,600 jobs, -2.6%), and Iowa (-5,500 jobs, -6.9%). Iowa had the largest percentage decline, followed by Kansas (-4.9%, -3,100 jobs), New York, and Indiana. Utah added the most construction jobs and the highest percentage over the month (3,000 jobs, 2.5%), followed by South Carolina (2,200 jobs, 2.1%).

Association officials called on the Biden administration to roll back tariffs on a range of key construction materials, including lumber and steel, that are contributing to the price spikes. They also urged the administration and Congress to work together to find ways to ease shipping delays that are undermining established supply chains. This could include providing temporary hours-of-service relief and looking at ways to expand port capacity.

“The coronavirus has wreaked havoc on many supply chains, but some of the price increases are the result of misguided policy decisions, including tariffs,” said Stephen E. Sandherr, the association’s chief executive officer. “Cutting tariffs and addressing shipping delays will give a needed boost to many firms struggling to get back to pre-pandemic business and employment levels.”

View state February 2020-February 2021 data and rankings and January-February rankings. View AGC’s Inflation Alert.

Related Stories

Market Data | Apr 11, 2023

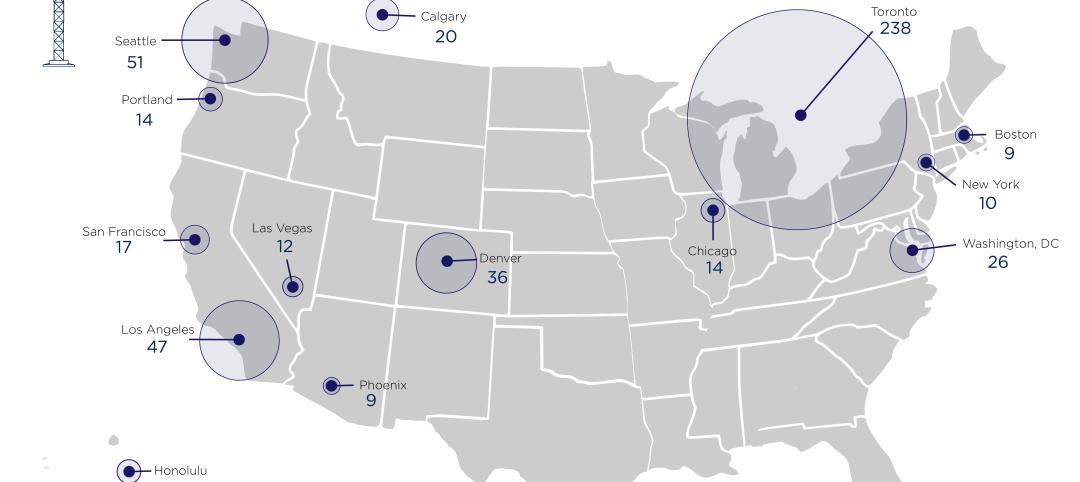

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

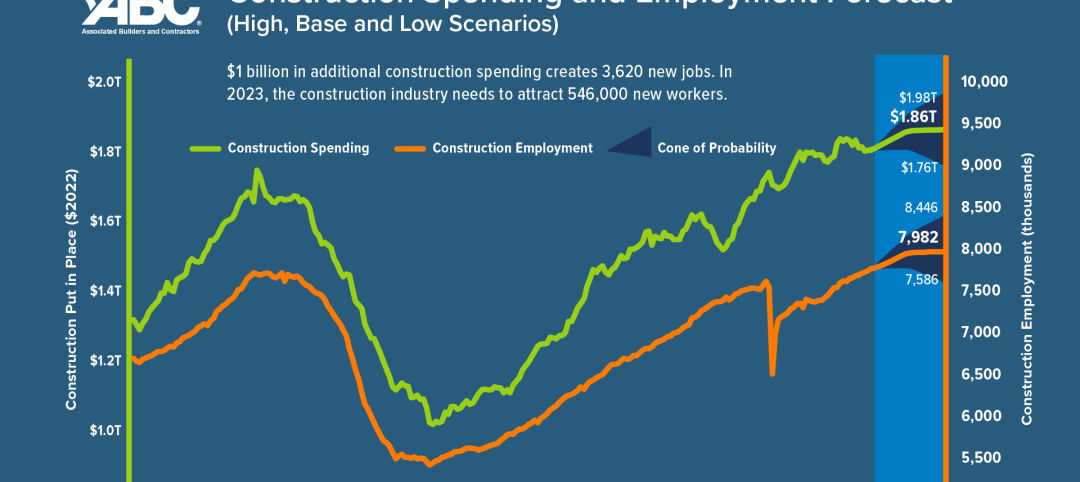

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

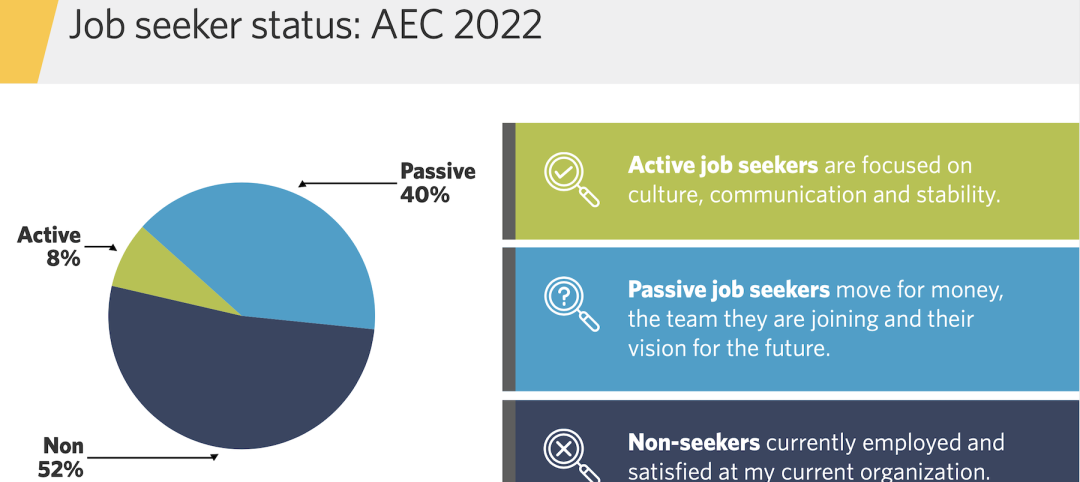

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.