Construction employment increased by 20,000 jobs in December and by 151,000, or 2.0 percent, in all of 2019, according to an analysis of new government data by the Associated General Contractors of America. Association officials noted that its recent survey found three out of four contractors expect to keep adding workers in 2020, but even more respondents found it difficult to fill positions in 2019, and a majority anticipate it will be as hard or harder to do so in 2020. Officials called on the federal government to increase funding for career and technical education and expand employment-based immigration for workers whose skills are in short supply.

“More than four out of five respondents to our survey said they were having a hard time filling salaried or hourly craft positions in 2019,” said Ken Simonson, the association’s chief economist. “Nearly two-thirds of the firms say that hiring will be hard or harder this year. In light of those staffing challenges, costs have been higher than anticipated for 44 percent of respondents and projects took longer than anticipated for 40 percent of them. As a result, 41 percent of respondents have put higher prices into their bids or contracts and 23 percent have put in longer completion times.”

Simonson observed that both the number of unemployed workers with recent construction experience (489,000) and the unemployment rate for such workers (5.0 percent) were the lowest ever for December in the 20-year history of those series. He said these figures support the survey’s finding that experienced construction workers are hard to find.

“Contractors are confident that there will be plenty of projects in 2020,” Simonson added. “Our survey found that for each of 13 project types, more contractors expect an increase in 2020 than a decrease in the dollar value of projects they compete for.”

Association officials said the optimistic outlook for projects depends on having an adequate supply of qualified workers. The officials urged the Trump administration and Congress to double funding for career and technical education over the next five years, pass the JOBS Act to expand opportunities for students seeking alternatives to college, and enable employers who demonstrate an unfilled need for workers to bring them in from outside the U.S.

“Construction can play a major role in sustaining economic growth, but only if the industry has an expanding supply of both qualified workers and new entrants to replace retirees,” said Stephen E. Sandherr, the association’s chief executive officer. “Construction firms are working hard to overcome labor shortages, but federal officials must do their part by adequately funding career and technical education, making it easier for students to qualify for loans for short-term technical education programs and putting in place needed immigration reforms.”

View the 2020 Construction Outlook Survey.

Related Stories

Apartments | Aug 22, 2023

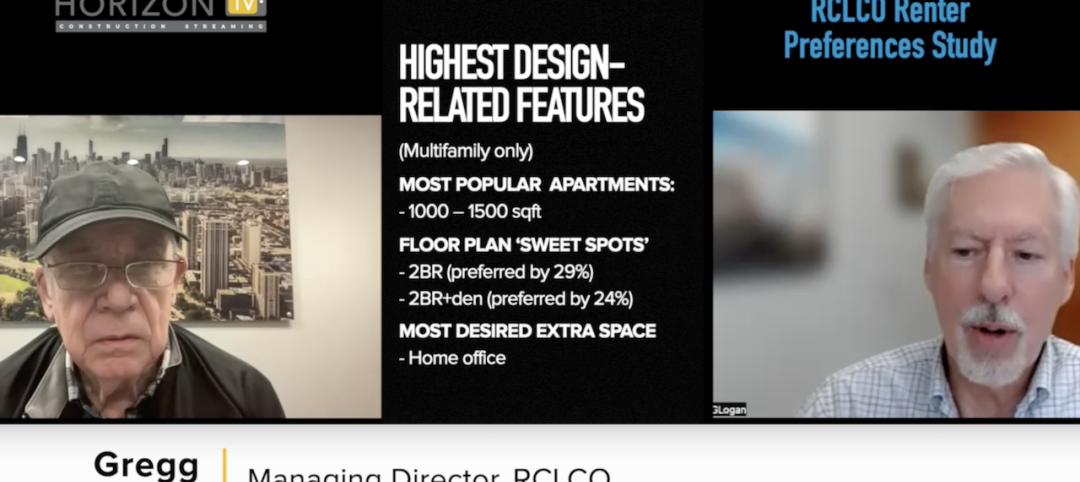

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

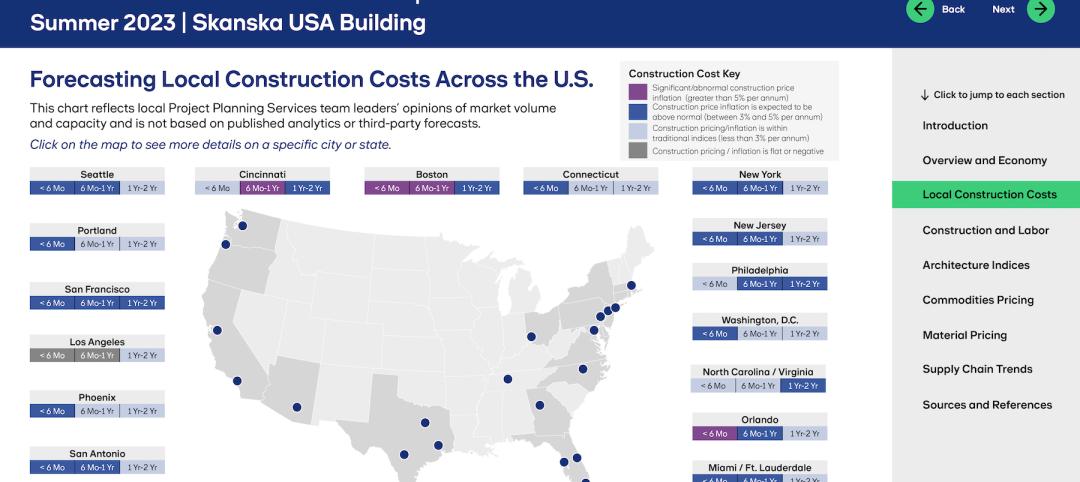

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.