Construction employment grew in 211, or 59%, out of 358 metro areas between December 2018 and December 2019, declined in 73 and was unchanged in 74, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that many firms report they are having a hard time finding enough qualified workers to hire, which likely undermined employment gains in some parts of the country.

“There are not enough qualified workers in many parts of the country for firms to be able to keep pace with strong demand for work,” said Ken Simonson, the association’s chief economist. “Construction workforce shortages appear to be holding back further job gains in many parts of the country.”

The Dallas-Plano-Irving, Texas metro area added the most construction jobs in 2019 (16,700 jobs, 11%). Other metro areas adding a large amount of construction jobs during the past 12 months include Los Angeles-Long Beach-Glendale, Calif. (12,300 jobs, 8%); Las Vegas-Henderson-Paradise, Nev. (9,400 jobs, 14%); Houston-The Woodlands-Sugar Land, Texas (9,300 jobs, 4%) and San Diego-Carlsbad, Calif. (8,600 jobs, 10%). The largest percentage gain occurred in Kansas City, Mo. (17%, 4,800 jobs), followed by Omaha-Council Bluffs, Neb.-Iowa (16%, 4,500 jobs); Auburn-Opelika, Ala. (15 percent, 400 jobs) and Rochester, N.Y. (15 percent, 3,000 jobs). Construction employment reached a new December high in 71 metro areas and a new December low in four areas.

The largest job losses between December 2018 and December 2019 occurred in New York City (-4,500 jobs, -3%), followed by Northern Virginia (-2,900 jobs, -4%); Riverside-San Bernardino-Ontario, Calif. (-2,600 jobs -3%) and Cincinnati, Ohio-Ky. (-2,400 jobs, -5%). The largest percentage decrease took place in Fairbanks, Alaska (-12%, -300 jobs), followed by Longview, Texas (-10%, -1,400 jobs); Wichita Falls, Texas (-10%, -300 jobs); Victoria, Texas (-9%, -400 jobs) and Huntington-Ashland, W.Va.-Ky.-Ohio (-9%, -700 jobs).

Association officials said workforce shortages were undermining strong employment gains in many parts of the country and urged federal officials to take steps to encourage more people to pursue high-paying construction careers. These steps include doubling federal investments in career and technical education to expose more students to construction career opportunities. And they called on Washington officials to establish a temporary work visa program to allow people with construction skills to work in markets impacted by labor shortages.

“Given the current state of demand for their services, many construction firms would be hiring more workers if only they could find them,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of convincing young adults to go into debt to pay for college, Congress and the administration should expose them to other options, including high-paying construction careers.”

View the metro employment data, rankings, top 10, history and map.

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

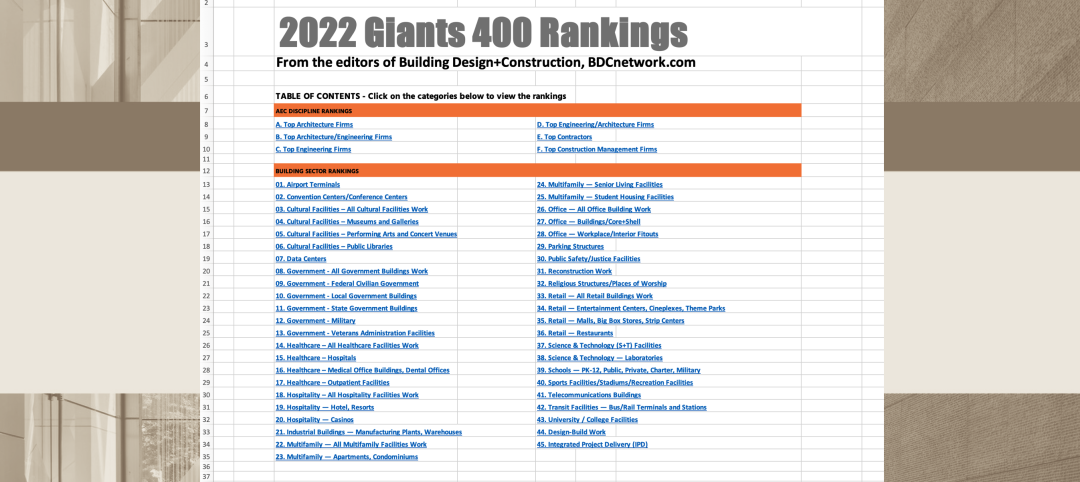

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.