Construction employment increased in 245 out of 358 metro areas between March 2017 and March 2018, declined in 67 and stagnated in 46, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that the new figures come amid questions about how a possible trade war and long-term infrastructure funding shortfalls will impact the construction sector.

"While firms in many parts of the country continue to expand, there is a growing number of threats that could undermine future employment growth in the sector," said Stephen E. Sandherr, the association's chief executive officer. "Among the top threats to future construction growth are the risk of a trade war and long-term infrastructure funding challenges."

Houston-The Woodlands-Sugar Land, Texas added the most construction jobs during the past year (10,700 jobs, 5%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,500 jobs, 9%); Dallas-Plano-Irving, Texas (7,800 jobs, 6%) and Riverside-San Bernardino-Ontario, Calif. (7,200 jobs, 8%). The largest percentage gains occurred in the Weirton-Steubenville, W.Va.-Ohio metro area (29%, 400 jobs), followed by Merced, Calif. (26%, 600 jobs); Wenatchee, Wash. (26%, 600 jobs) and Midland, Texas (23%, 6,000 jobs).

The largest job losses from March 2017 to March 2018 were in Baton Rouge, La. (-3,200 jobs, -6%), followed by Columbia, S.C. (-2,200 jobs, -11%); Minneapolis-St. Paul-Bloomington, Minn.-Wisc. (-1,700 jobs, -2%); Newark, N.J.-Pa. (-1,700 jobs, -4%) and Montgomery County-Bucks County-Chester County, Pa. (-1,600 jobs, -3%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-34%, -1,300 jobs), followed by Monroe, Mich. (-17%, -400 jobs); Portland-South Portland, Maine (-11%, -1,000 jobs) and Columbia, S.C. (-11%, -2,200 jobs).

Association officials said that trade disputes that could arise from the President's newly-imposed tariffs and long-term infrastructure funding shortfalls could threaten future construction employment growth. They noted that many construction firms have already experienced significant increases in what they pay for steel products. Meanwhile, long-term funding shortfalls for infrastructure improvements could undermine demand for many firms' services.

"The biggest threats to future construction growth are man-made: trade wars and funding shortfalls," said Stephen E. Sandherr, the association's chief executive officer. "Fortunately, Washington officials can help ensure future economic growth by avoiding a trade war and enacting long-term infrastructure funding."

View the metro employment data by rank and state. View metro employment map.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

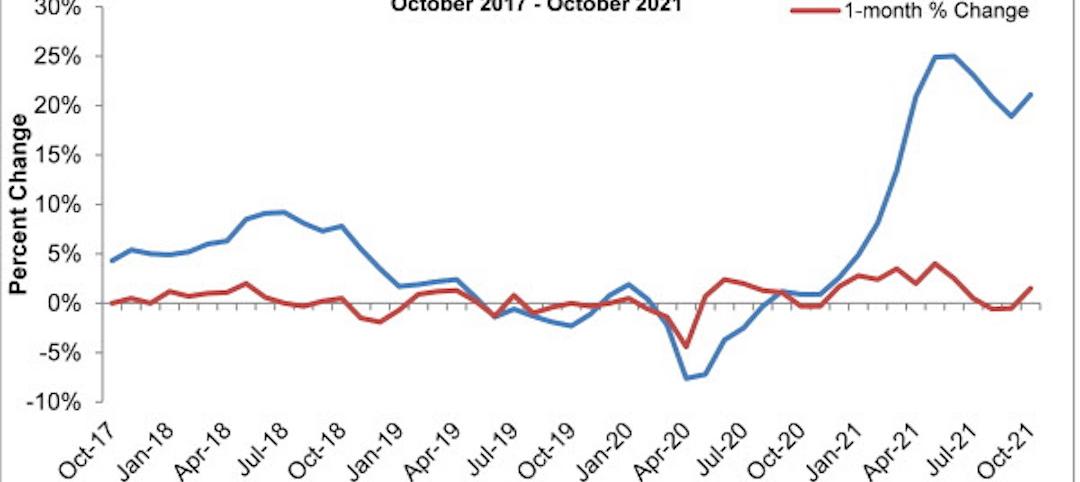

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

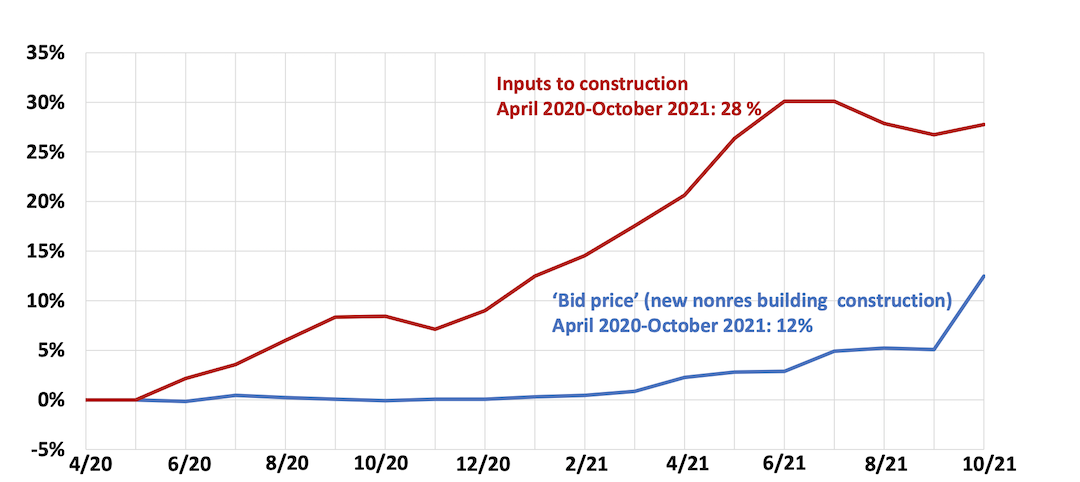

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.