Construction employment increased in 245 out of 358 metro areas between March 2017 and March 2018, declined in 67 and stagnated in 46, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that the new figures come amid questions about how a possible trade war and long-term infrastructure funding shortfalls will impact the construction sector.

"While firms in many parts of the country continue to expand, there is a growing number of threats that could undermine future employment growth in the sector," said Stephen E. Sandherr, the association's chief executive officer. "Among the top threats to future construction growth are the risk of a trade war and long-term infrastructure funding challenges."

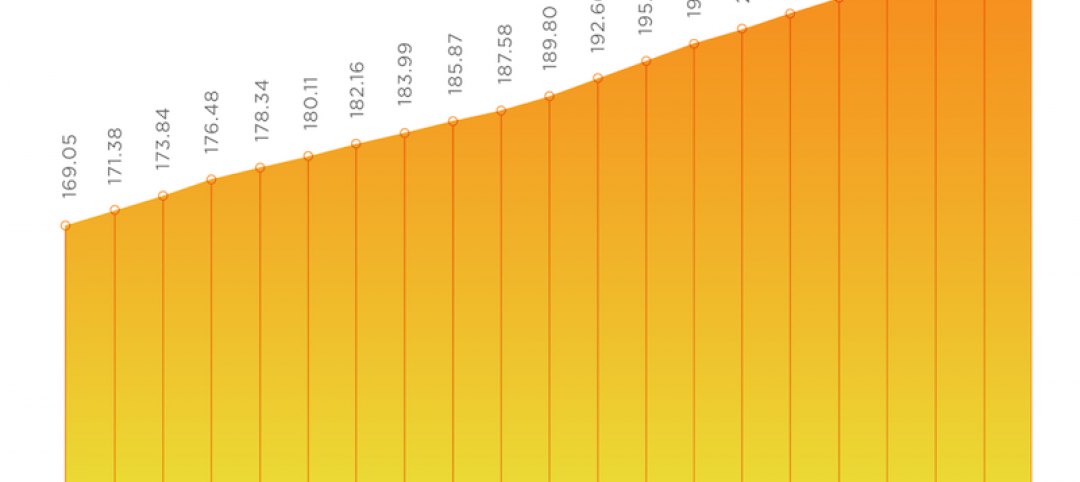

Houston-The Woodlands-Sugar Land, Texas added the most construction jobs during the past year (10,700 jobs, 5%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,500 jobs, 9%); Dallas-Plano-Irving, Texas (7,800 jobs, 6%) and Riverside-San Bernardino-Ontario, Calif. (7,200 jobs, 8%). The largest percentage gains occurred in the Weirton-Steubenville, W.Va.-Ohio metro area (29%, 400 jobs), followed by Merced, Calif. (26%, 600 jobs); Wenatchee, Wash. (26%, 600 jobs) and Midland, Texas (23%, 6,000 jobs).

The largest job losses from March 2017 to March 2018 were in Baton Rouge, La. (-3,200 jobs, -6%), followed by Columbia, S.C. (-2,200 jobs, -11%); Minneapolis-St. Paul-Bloomington, Minn.-Wisc. (-1,700 jobs, -2%); Newark, N.J.-Pa. (-1,700 jobs, -4%) and Montgomery County-Bucks County-Chester County, Pa. (-1,600 jobs, -3%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-34%, -1,300 jobs), followed by Monroe, Mich. (-17%, -400 jobs); Portland-South Portland, Maine (-11%, -1,000 jobs) and Columbia, S.C. (-11%, -2,200 jobs).

Association officials said that trade disputes that could arise from the President's newly-imposed tariffs and long-term infrastructure funding shortfalls could threaten future construction employment growth. They noted that many construction firms have already experienced significant increases in what they pay for steel products. Meanwhile, long-term funding shortfalls for infrastructure improvements could undermine demand for many firms' services.

"The biggest threats to future construction growth are man-made: trade wars and funding shortfalls," said Stephen E. Sandherr, the association's chief executive officer. "Fortunately, Washington officials can help ensure future economic growth by avoiding a trade war and enacting long-term infrastructure funding."

View the metro employment data by rank and state. View metro employment map.

Related Stories

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.