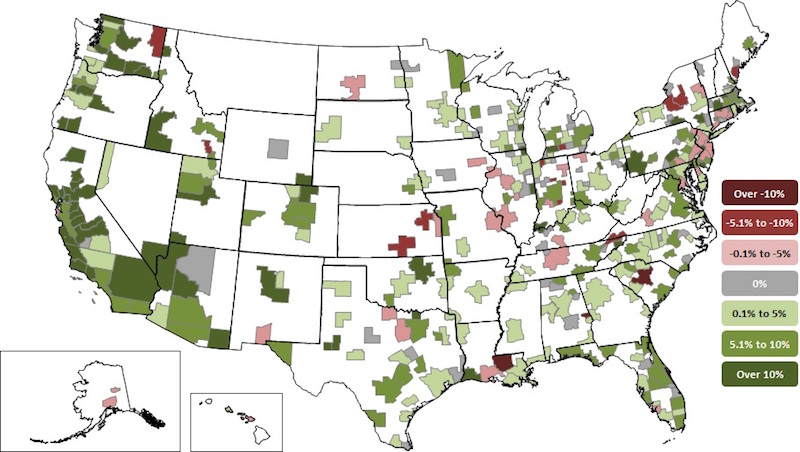

Construction employment increased in 257 out of 358 metro areas between February 2017 and February 2018, declined in 50 and stagnated in 51, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials said that the employment gains are occurring as construction firms in many parts of the country are having a hard time finding enough qualified workers to keep pace with demand.

"Growing private-sector demand for construction services is prompting construction firms to hire more people to complete projects," said Ken Simonson, the association's chief economist. "Yet tight labor markets, particularly for qualified construction workers, is making it increasingly difficult for firms to find people to bring on board."

Riverside-San Bernardino-Ontario, Calif. added the most construction jobs during the past year (12,000 jobs, 13%), followed by Phoenix-Mesa-Scottsdale, Ariz. (9,900 jobs, 9%); Dallas-Plano-Irving, Texas (9,700 jobs, 7%); Houston-The Woodlands-Sugar Land, Texas (9,300 jobs, 4%) and Los Angeles-Long Beach-Glendale, Calif. (7,700 jobs, 6%). The largest percentage gains occurred in the Merced, Calif. metro area (33%, 700 jobs) followed by Midland, Texas (22%, 5,400 jobs); Lake Charles, La. (21%, 4,700 jobs) and Weirton-Steubenville, W.V.-Ohio (21%, 300 jobs).

The largest job losses from February 2017 to February 2018 were in Baton Rouge, La. (-6,500 jobs, -12%), followed by St. Louis, Mo.-Ill. (-2,500 jobs, -4%); Columbia, S.C. (-2,200 jobs, -11%); Fort Worth-Arlington, Texas (-2,000 jobs, -3%) and Middlesex-Monmouth-Ocean, N.J. (-1,700 jobs, -5%). The largest percentage decreases for the year were in Auburn-Opelika, Ala. (-38%, -1,500 jobs) followed by Baton Rouge, Columbia, S.C. and Kokomo, Ind. (-9%, -100 jobs).

Association officials said that growing private sector demand in February is prompting many firms to add more staff as they work to complete projects. They added that the recently-enacted federal spending measure includes up to $10 billion in additional infrastructure funding for this year, meaning firms that perform public-sector work are likely to begin expanding as well amid tight labor market conditions.

"As demand for construction continues to expand, it will only get harder for many firms to find qualified workers to hire," said Stephen E. Sandherr, the association's chief executive officer. "Congress and the administration should work together to expand career and technical education opportunities so more high school students will opt for good-paying careers in construction."

View the metro employment data by rank and state. View metro employment map.

Related Stories

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

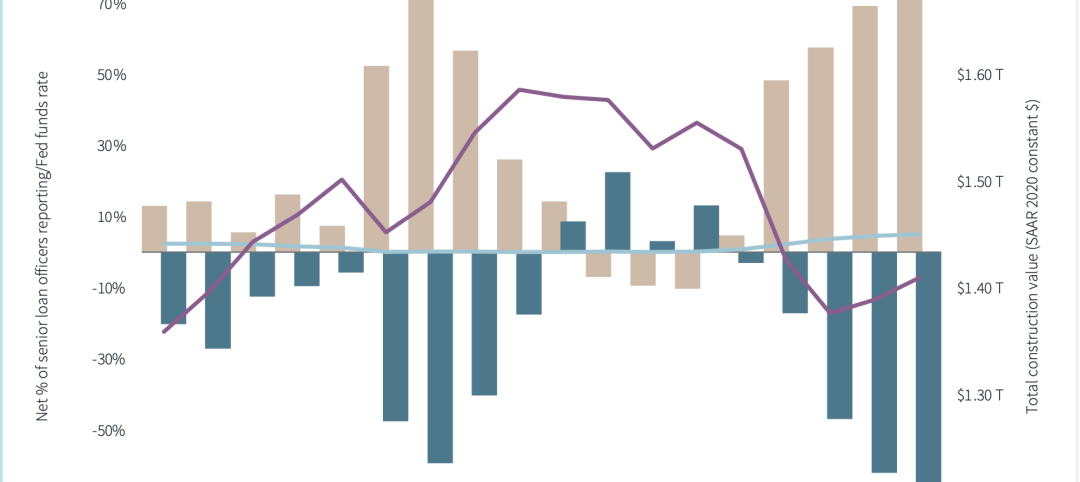

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.